Yesterday the Nasdaq index touched correction territory by dropping more than 10% since its recent highs. Should we be expecting a correction or even a bear market for the rest of the indexes as well?

Our opinion is that the equities are going through a repricing mode. Earnings expectations due to strong sales, a solid US economy, and the fiscal/tax cut of 2017, were uplifted and experienced growth rates between 18-22%. These levels are not sustainable, especially when we are in the midst of trade disputes and global changes. Therefore, the market is adjusting the earnings expectations downwards, and hence the downward trend of the last few weeks.

Market gyrations like these could be considered opportunities to add good names to a portfolio, assuming that macro fundamentals and the company fundamentals remain strong and healthy. Therefore, in times such as these a patient investor seeks to identify solid names to add to the portfolio of holdings. In a similar manner, income-oriented investors could identify names of funds that pay good yields when rates are rising and thus their prices drop.

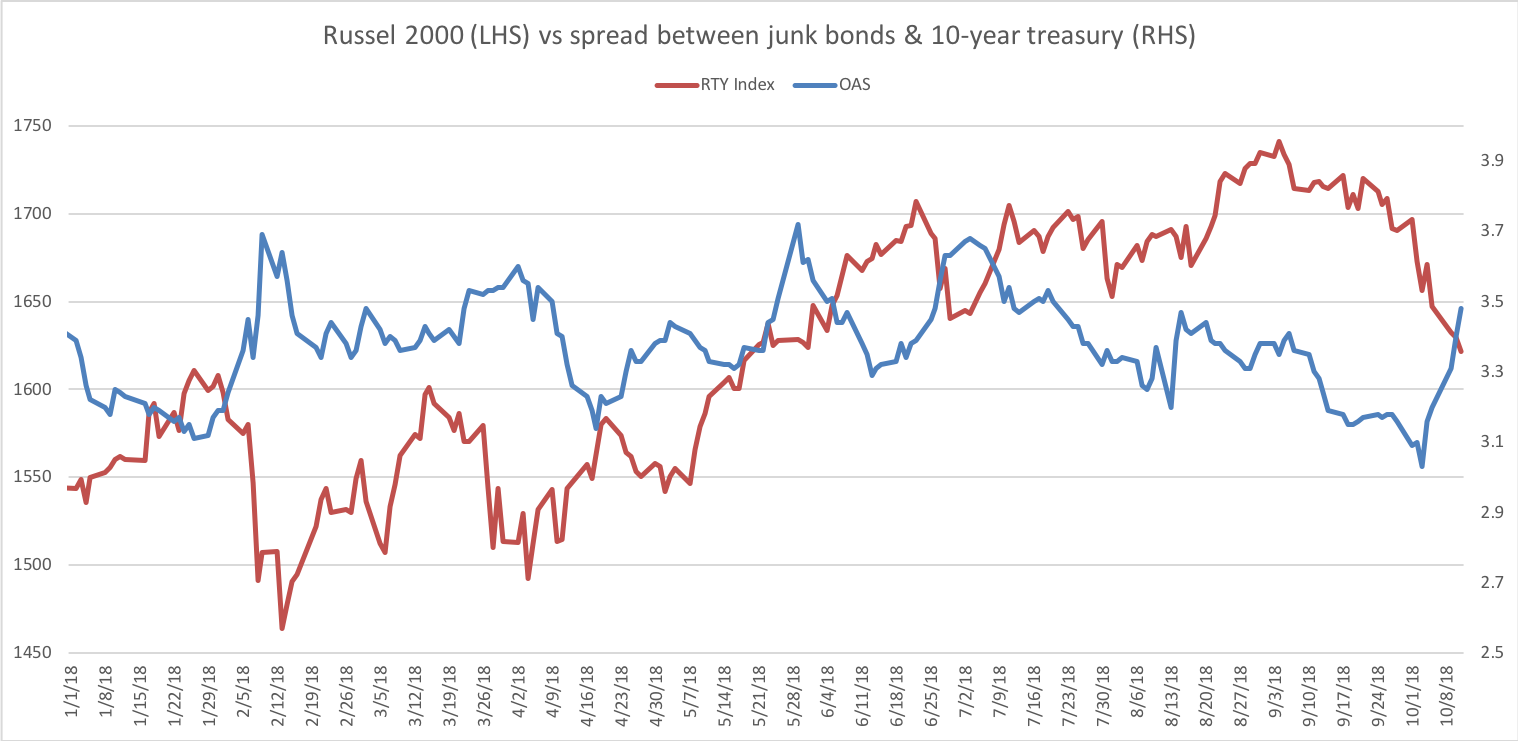

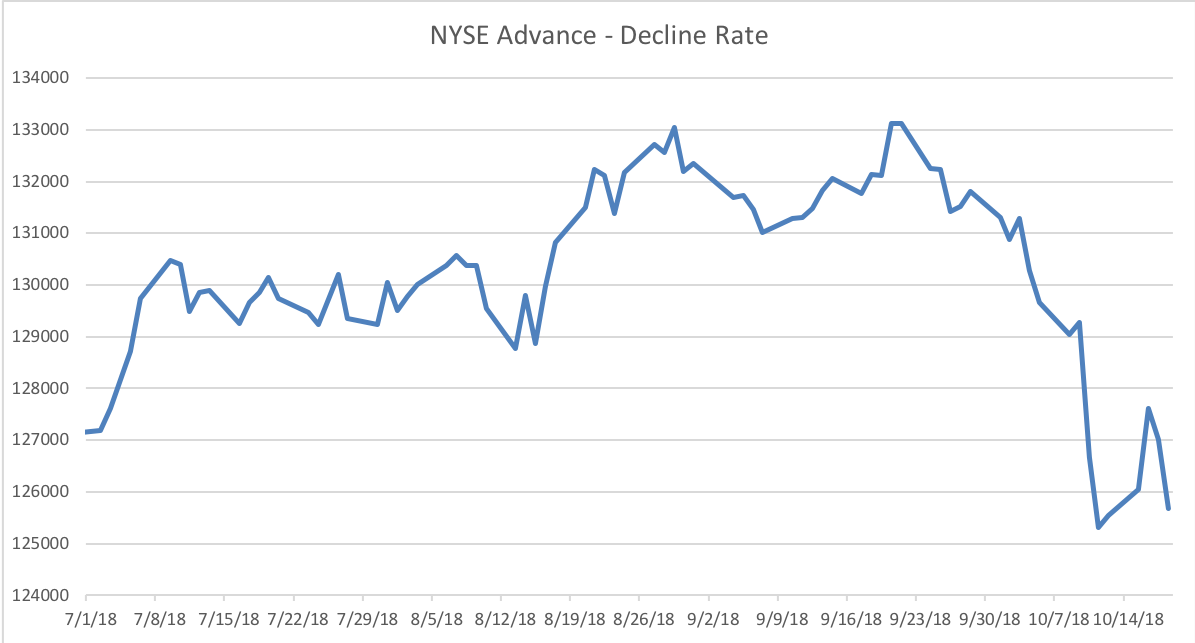

As our Weekly Market Update indicated last Saturday, we are paying close attention (among other indicators) to three indexes, namely: The Russell 2000, the spread between high yield bonds and the ten-year Treasury, and the market breadth defined as number of stocks advancing minus those declining (in order to see the direction of momentum).

The fact is that the Russell 2000 is in negative territory since July (red line in the first graph above) and the spread is rising (blue line in the first graph) while market momentum (second graph) seems to be turning to the negative. Therefore, at this stage we have to say that a reconciliation is needed between risk appetite/risk tolerance and emerging opportunities in a downturn.

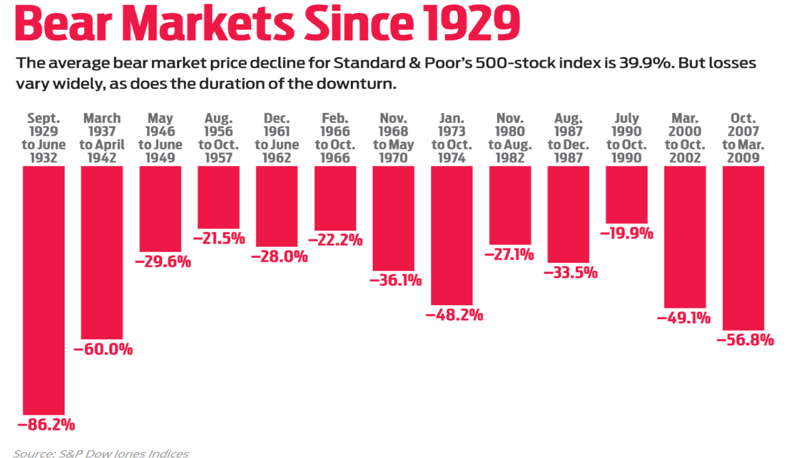

As the graph below shows, the average bear market loss since 1929 is about 25%. However, defensive portfolios have lost on average about 10% during bear markets while safe havens such as gold and Treasuries gained given the alpha they can produce during turbulent times. The rebalancing of portfolios and the reconciliation is a necessary exercise even if the chances of a bear market – given today’s fundamentals – are not that significant.

Here are some facts as investors think about rebalancing and reconciliation:

– Emerging markets in general and China in particular have experienced significant declines and are in bear territory.

– Rising rates make debt denominated in USD more expensive.

– Deleveraging and tariffs will continue to impact China; however, state support (including monetary measures) should be expected, and particular names are starting to become attractive.

– Growth in developed economies will slow down, and assuming we are at the latter stage of an economic expansion, then alternative asset classes that historically do well in such economic reversal could add cushion and enhance returns in the portfolios.

In conclusion, we would say that as the market works out some excesses and reprices earnings expectations, portfolio rebalancing – in terms of asset allocation and hedging with asset classes that could gain in a possible rotation, while seeking opportunities in names/sectors that have dropped significantly – seems to be a viable strategy for the time being.