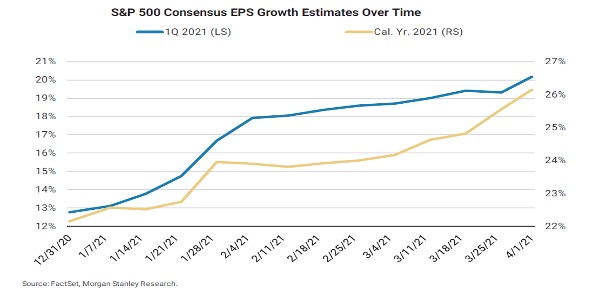

The reflation trade that started in late 2020 and uplifted the fortunes of banks, energy, and small cap stocks might be experiencing a pause lately. However, as shown below, the earnings expectations for the full year are robust and strong. The fact that the leisure, travel, and hospitality sectors have not yet exhibited an impressive V-shaped recovery might be indicative of the underlying concerns related to the reopening and its execution at a time when Europe is still struggling and other nations and continents are also fighting rising infection cases (India, S. America).

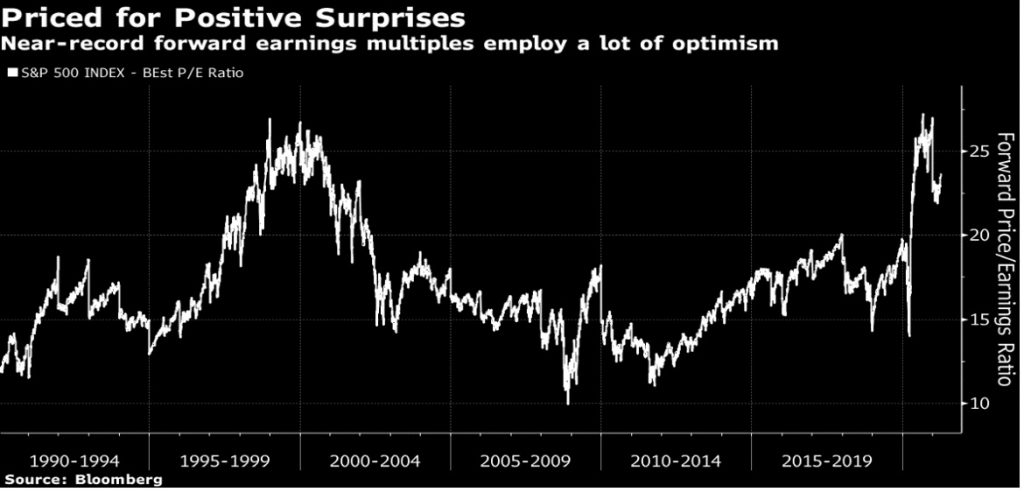

The elevated multiples of forward earnings (see figure below) may signal a combination of two things: First, strong confidence in the forthcoming growth, and second, anticipation of better-than-expected earnings reports in the first two quarters of the year.

If indeed, earnings reports support uplifted expectations, then we may need to incorporate into our investment recovery strategies the following facts:

- The accommodative fiscal and monetary measures

- The declining volatility

- The new wave of innovations

- The forthcoming recovery of areas – such as Europe – that lag behind the equities’ recovery seen in the United States

The amalgam of the elements discussed above may point out a potential – surprisingly lasting – market upswing where the strengthening of fundamentals could sustain elevated expectations and valuations, especially for industrial and value holdings.

In our humble opinion, the unfolding era may resemble the period of the first half of the 19th century that set the stage of structural economic and geopolitical changes, significant growth, and innovations underwritten by technological and energy changes. However, before that era was able to consolidate its gains, autocracy had to be defeated. The period before that consolidation is well-reflected by Puccini’s opera Tosca (and what a treat to listen to Jonas Kaufmann in the leading role of Cavaradossi), where Tosca (like some nations today) falls victim of deception by forces that represent corruption and autocracy.

In a manner similar to that era when, prior to the rejuvenation of the global economy, autocrats – who had no respect for human life or to the idea of freedom, were the oppressors and temporarily seemed to enjoy their “triumphs” – were defeated and the forces of liberty and democracy prevailed, we tend to believe that we may be approaching a watershed moment when again reason, liberty, inclusive institutions, and democracy will defeat the forces of oppression.

As we may be standing on the verge of major innovations in biotechnology, robotics, AI, fintech, and cloud computing (to name a few) that could revolutionize life and productivity, we believe that open systems that embrace transparency and freedom will prevail like they did at the time when Britain was innovating in the first 35 years of the 19th century, where the agricultural revolution was combined with the steam engine, and the ability of capital and labor to move freely arose. The result was the miracle of an Industrial Revolution that uplifted the fortunes of Britain. It is no accident that a few years earlier in France the forces of oppression and deceit had been defeated. Even when Napoleon in his autocratic style tried to prevail over the forces of freedom, openness, inclusiveness, and democratic values, the rest of the European forces defeated him and, through the Concert of Europe, prosperity and peace prevailed. Through that Concert of Europe, the foundations of the second Industrial Revolution were planted along with the seeds of the first era of globalization when mobility increased, costs declined, and standards of living improved for everyone, while the arts and sciences flourished.

The total package of inclusive institutions made debt affordable and Britain the epicenter of capital.

Really, if we lived under a vail of ignorance and we were to be born today would we choose to be born in Russia, China, or the United States?