Welcome to our monthly newsletter which covers key developments in non-US markets. With this newsletter, we highlight corporate, debt, and monetary policy news in European, Asian, and Latin American markets. We end this piece with a spotlight on commodities.

European Markets

Corporate and Business News

- Ryze, a European digital tech firm, unveiled a major rebrand of its AI platform Pixis, aiming to redefine AI-driven advertising strategies.

- Siemens (SIEG.DE) reports limited impact from tariffs, with profits exceeding forecasts. Revenue increased 7% to €19.8 billion, while orders climbed 10% to €21.6 billion.

- European hedge funds expressed a positive outlook despite global economic uncertainty, citing opportunities in volatile markets and shifting monetary policies.

- ArcelorMittal and STMicroelectronics announced significant job cuts, contributing to a drop in French consumer confidence. STMicroelectronics plans to cut up to 3,000 jobs across France and Italy, with 1,000 jobs in France alone, while ArcelorMittal will cut 600 jobs in northern France.

- French consumer confidence unexpectedly dropped to a five-month low in May due to fears about job security and global trade tensions. The household confidence index fell to 88, down from 91 in April. This was a surprise, as economists had expected an increase to 93.

- The Czech arms sector is rapidly growing, potentially overtaking automotive manufacturing as the country’s economic engine. Arms production has surged due to Increased global demand, especially from countries supporting Ukraine, empty military stockpiles across Europe, and a shift in geopolitical priorities toward defense and security.

- Germany built 14% fewer apartments in 2024, falling short of government housing targets. Germany’s property sector has faced difficulties starting in 2022 as higher interest rates made borrowing more expensive, leading to falling prices and insolvencies among some property firms.

Debt and Monetary Policy News

- The ECB aims to reach a political agreement on the digital euro by early 2026, marking a key milestone in its multi-year project to introduce a central bank digital currency (CBDC) for the eurozone.

- Britain’s economy grew more strongly than expected in early 2025, expanding 0.7% between January and March—significantly higher than the 0.1% growth seen in Q4 2024 and surpassing the consensus forecast of 0.6%.

- The Bundesbank reports the German economy is stalling, with U.S. tariffs curbing exports. Global trade tensions are exacerbating longstanding challenges in Germany, including high energy costs and an industrial sector struggling to compete internationally—even in traditionally strong areas like automotive manufacturing.

- The French Central Bank projects only slight economic growth in Q2, with outlooks dampened by multiple public holidays in May and ongoing international trade tensions.

- ECB Vice President Luis de Guindos identified three main risks facing the eurozone economy: a global trade war, financial market volatility, and high debt levels. French ECB policymaker François Villeroy de Galhau expects there is room for another ECB rate cut by this summer.

- Finnish central bank chief Olli Rehn said the eurozone’s fight to reduce inflation to the 2% target is on track, but the growth environment is worsening, with the global trade war posing a significant risk to the outlook.

Asian Markets

Corporate and Business News

- Chinese shipments of foreign-branded cellphones (primarily led by Apple’s iPhone) dropped 49.6% year-on-year in March. Huawei and other local brands have resurged amidst trade tensions with the U.S.

- China’s Contemporary Amperex Technology Co. Limited (CATL), the world’s largest electric vehicle battery maker, has launched a major Hong Kong listing aimed at raising at least $4 billion, marking one of the largest equity offerings globally in 2025.

- Japanese exports rose 2% in April year-on-year, but shipments to the U.S. fell 1.8%, according to Ministry of Finance data.

- Japan’s largest banking group, Mitsubishi UFJ Financial Group (MUFG), posted a record annual net profit despite a 41% drop in fourth-quarter profits. MUFG recorded a net profit of 114 billion yen in Q1 compared to 192.8 billion yen a year earlier.

- Japan’s SoftBank Group reported its first annual profit in four years. Contributing to the bank’s turnaround is its investments in AI, including its commitment of $100 billion to the Stargate project, a massive AI-focused data center initiative led by OpenAI, Oracle, and MGX.

- Nissan Motor will cut more than 10,000 jobs globally, bringing total layoffs to about 20,000, or 15% of its workforce, including previously announced reductions.

- Panasonic plans to cut 10,000 jobs and expects $900 million in restructuring costs. The restructuring comes amid sliding profitability in Panasonic’s traditional consumer electronics business.

- Japan’s Honda Motor forecast a 59% profit decrease for the current financial year and paused plans to build an EV supply chain in Canada amid uncertainty from U.S. tariffs. Honda expects operating income of 500 billion yen, down from 1.21 trillion yen in the previous year.

Debt and Monetary Policy News

- China cut its benchmark lending rates and lowered deposit rates by 5–25 basis points as the economy struggles, with economists doubting Beijing’s 5% growth target without further stimulus.

- China struggles to lift home prices, with April showing no growth: new home prices down 4% year-on-year, resale prices falling across all city tiers, property investment down 10.3% year-on-year, and sales shrinking 2.8%.

- The Indian rupee is expected to appreciate against the U.S. dollar, supported by the India-Pakistan truce and a rally in the Chinese yuan following the U.S.-China trade agreement.

- Japanese investors purchased foreign stocks for an eighth consecutive week, buoyed by progress in U.S. trade talks and easing fears of a global trade war’s economic impact.

- Yields on long-dated Japanese government bonds rose to new records after a poor auction result raised concerns over upcoming debt sales.

- The Bank of Japan’s deputy governor said interest rates will continue to rise if the economy rebounds from the expected impacts of higher U.S. tariffs, while warning of a highly uncertain outlook. Japan’s core inflation hits a more than two-year high, potentially forcing a Bank of Japan rate hike by year-end.

Latin American Markets

Corporate and Business News

- Argentina’s government approved a $2.5 billion lithium mining project by Anglo-Australian giant Rio Tinto, marking the first mining project under a new investment incentive regime.

- Investments in Latin American startups rose 26% in 2024, surpassing Europe and Southeast Asia, according to the Endeavor/Glisco Partners report.

- Argentina posted a trade surplus of $204 million in April, with exports of $6.66 billion and imports of $6.46 billion.

- Brazilian beef processor Marfrig announced plans to complete its takeover of poultry and pork processor BRF, with intentions to eventually list shares of the combined entity in the United States.

- During Brazilian President Luiz Inácio Lula da Silva’s visit to China in May 2025, a major $1 billion sustainable fuel deal was announced, marking a significant step in Brazil-China energy cooperation.

- Citigroup must face a $1 billion lawsuit claiming it aided fraud by a Mexican oil company.

- Netflix announced a $1 billion investment over the next four years to produce 20 films and series annually in Mexico. The move aims to expand its local content portfolio and strengthen its presence in Latin America.

- Global auto suppliers Katcon (Mexico) and Tata AutoComp (India) launched a joint venture to manufacture components for passenger and commercial vehicles, agricultural tractors, and off-road vehicles.

Debt and Monetary Policy News

- Moody’s warns that Colombia’s public debt puts the country’s sovereign rating at risk, currently at Baa2 with a negative outlook.

- Brazil’s economy grew 1.3% in the first quarter, defying high borrowing costs due to a strong grain harvest and industrial sector growth, according to central bank data.

- Brazil’s Finance Ministry raised its 2025 GDP growth forecast to 2.4% from 2.3% and kept the 2026 forecast at 2.5%. Inflation is now projected at 5.0% for 2025 and 3.6% for 2026, slightly higher than previous estimates.

- The Bank of Mexico cut its benchmark interest rate by 50 basis points for the third consecutive meeting, as inflation remains within target but uncertainty persists due to trade tensions and a weak economy.

- Argentina’s monthly inflation rate slowed more than expected to 2.8% in April, according to INDEC, though rising costs continue to challenge residents.

- Fitch upgraded Argentina’s long-term foreign and local currency issuer default rating from “CCC” to “CCC+,” citing a new IMF program and foreign-exchange market liberalization that improved the country’s external liquidity.

Commodities Spotlight

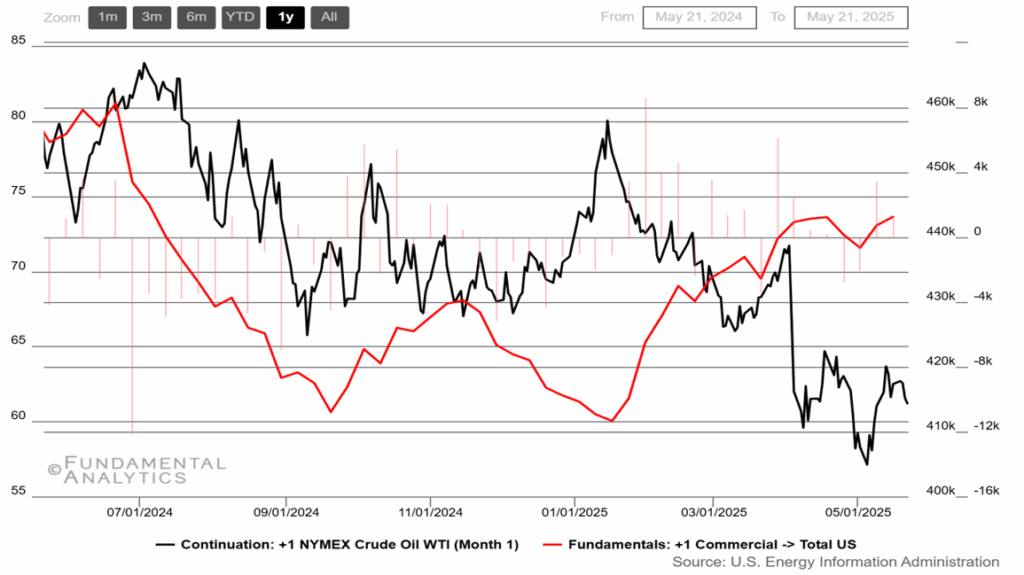

WTI Futures Under Pressure Amid Oversupply Concerns in Oil Markets

Source: Fundamental Analytics

WTI crude oil futures reversed earlier gains to trade just above $61 per barrel after a surprise build in US crude inventories. The EIA reported a 1.328 million barrel increase in crude stocks, defying expectations for a 1.85 million barrel draw. Gasoline and distillate inventories also rose, against forecasts for declines. Extra pressure was added amid growing expectations that OPEC+ will continue ramping up production. The group is expected to agree next week to raise output by another 411k barrels per day in July, with plans to fully phase out the 2.2 million barrels per day voluntary cuts by October.

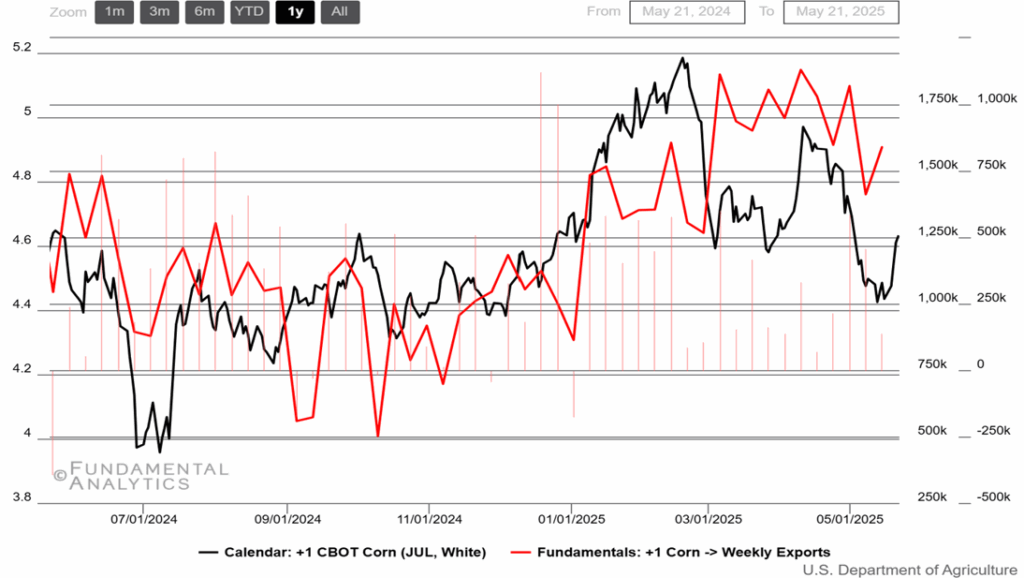

Corn Prices Jump as Buyers Act Quickly to Beat Tariffs Starting in July

Source: Fundamental Analytics

Corn futures climbed back above $4.60 per bushel, recovering from a two-month low of $4.39 on May 8th, as demand-side resilience and emerging supply risks outweighed the bearish pressure from abundant acreage and record yield forecasts. While the USDA’s May 12th WASDE report raised planted acreage to 95.3 million and projected a bumper crop of 15.82 billion bushels on yields of 181 bu/acre—pushing new-crop ending stocks toward 1.8 billion bushels—demand strengthened notably in mid-May. Weekly export sales and shipments surged by over 30%, as buyers rushed to secure supplies ahead of potential US tariffs set to take effect on July 1st.