European Markets

Corporate and Business News

- Eurozone investor morale improved significantly in March, with the Sentix index rising to -2.9 from -12.7 in February, exceeding expectations of -8.4.

- European markets closed lower on Friday led by declines in the travel sector which was down 1.6% after the closure of Heathrow airport following a fire at a nearby electrical substation that wiped out power at the airport.

- German premium carmakers like Audi and Mercedes-Benz are exploring various strategies to handle the impact of U.S. import tariffs. These strategies include raising prices, lowering output, and shifting production.

- Audi is considering passing on some of the tariff costs to customers through price increases and is also looking at localizing production in North America.

- BMW anticipates $1.09 billion in tariff-related costs this year, while European officials warn that a U.S.-led trade war would primarily harm the U.S. economy.

- German exports declined by 2.5% in January compared to the previous month.

- The Swiss government lowered its 2025 economic growth forecast from 1.5% to 1.4%, citing global trade tensions but maintaining confidence in avoiding a recession.

- The French Central Bank cut its growth outlook from 1.1% to 0.7%, citing trade tensions.

Debt and Monetary Policy News

- The ECB cut rates for the sixth time amid economic uncertainty, lowering the deposit rate by 25 bps to 2.5%, a level it considers “meaningfully less restrictive” as inflation nears its 2% target.

- ECB policymakers see a growing chance of pausing their easing cycle at the next meeting, awaiting greater clarity on trade and fiscal policy before further cuts.

- Eurozone banks must adjust to relying more on central bank funding as excess liquidity in the banking system continues to decline.

- BNP Paribas predicts German 10-year borrowing costs could rise to 4%—their highest since 2008—as the country ramps up defense and infrastructure spending.

- Fitch Ratings warns that Germany’s AAA credit rating could come under long-term pressure if large-scale spending is not offset by fiscal consolidation or fails to drive sustainable growth.

Asian Markets

Corporate and Business News

- Recycled metal products maker Radius Recycling has entered into a definitive merger agreement with Toyota Tsusho America, the U.S. subsidiary of Japan’s Toyota Tsusho Corp.

- Japan’s Trial Holdings will acquire supermarket chain Seiyu from KKR for $2.55 billion.

- China’s Xiaomi raised its full-year electric vehicle delivery target to 350,000, up from the 300,000 target for 2025 set earlier this year, founder Lei Jun announced on Weibo.

- China’s car sales rose 1.3% in the first two months of 2025.

- Safra Sarasin Group will acquire a majority stake in Saxo Bank. This acquisition is part of a broader trend of consolidation in the financial sector.

- China’s exports grew just 2.3% year-on-year in the January-February period, while imports unexpectedly fell 8.4%, according to customs data.

- Nam Ou Power, a unit of China’s state-owned Power Construction Corp, has sued Laos utility Electricité du Laos in Singapore for $555 million in unpaid dues from a hydropower project.

- China has lifted a two-year ban on poultry imports from Argentina, reopening a key supply channel amid ongoing trade tensions with the U.S., which has led to steep tariffs on American poultry.

- Foreign investors added nearly $16 billion to emerging market portfolios in February, increasing exposure to Chinese stocks and debt across developing economies.

- Goldman Sachs raised its target for emerging market stocks, citing an AI-driven rally in Chinese equities that could lift other markets. The brokerage increased its 12-month target for the MSCI Emerging Markets Index by 3% to 1,220 from 1,190, projecting an 11% potential upside.

Debt and Monetary Policy News

- The Bank of Japan kept interest rates steady, warning of risks from Trump-era tariffs, while wholesale inflation reached 4%.

- Investors purchased a net $23.44 billion in overseas bonds last month, the highest monthly total since August 2024, while selling 346.4 billion yen in foreign equities, according to Japan’s Ministry of Finance.

- Sri Lanka and Japan signed agreements on Friday to restructure $2.5 billion in debt, concluding two years of negotiations to help Sri Lanka recover from a severe financial crisis.

- China’s finance ministry announced plans to issue up to $829 million in yuan-denominated sovereign green bonds in London, marking its first overseas issuance of such bonds.

- Chinese banks extended 1.01 trillion yuan ($139.66 billion) in new loans in February, falling short of analysts’ expectations, according to data from the People’s Bank of China.

- China rolled over a $2 billion loan to Pakistan, according to Pakistan’s finance ministry adviser. Pakistan is working to stabilize its finances after securing a $7 billion IMF bailout in September 2024. The first loan installment is under review, with a potential additional $1 billion disbursement if approved.

Latin American Markets

Corporate and Business News

- U.S.-based fintech Tala, which provides small loans to clients in emerging markets, has secured a $150 million debt facility to expand its business in Mexico, the company announced Wednesday.

- China is delaying approval for BYD to build a plant in Mexico over concerns that the electric vehicle maker’s technology could leak to the U.S.

- Brazilian power firm Eletrobras reported a nearly 25% increase in fourth-quarter net profit from a year earlier, reaching $191.4 million.

- Brazilian egg exports, including fresh and processed products, surged 57.5% in February, driven by stronger U.S. demand.

- German automaker BMW has informed U.S. dealers that it will absorb the added costs of new tariffs on imports from Mexico, at least for the next several weeks.

- Industrial production in Brazil remained flat in January compared to December, missing market forecasts as economic indicators continue to signal a slowdown.

- Theft of truckloads of green coffee beans is surging in the U.S., the world’s largest importer of the commodity, as prices hit all-time highs over the past year, according to transportation companies.

- Brazilian state-run oil firm Petrobras said its board has approved an agreement to settle a U.S. court dispute with EIG Energy Fund XIV, including a $283 million payment by Petrobras.

Debt and Monetary Policy News

- Brazil’s government maintained its economic growth forecast at 2.3% for this year while slightly raising its inflation estimate due to “marginal changes” in its base case scenario.

- The Brazilian central bank announced plans to offer up to $4 billion through dollar auctions with repurchase agreements.

- Argentina’s economy likely posted year-on-year growth in the fourth quarter of 2024, ending six consecutive quarters of contraction and further pulling the country out of recession.

- Argentina’s monthly inflation rate accelerated to 2.4% in February, aligning with analyst expectations.

- Brazil’s government has requested congressional approval for a nearly $6.9 billion budget reallocation, increasing pension spending while cutting funds for the Bolsa Família cash transfer program.

- Argentine analysts kept their inflation forecasts nearly unchanged, with the central bank’s market expectations survey predicting year-end inflation at 23.3%.

- Brazil’s economy grew 3.4% in 2024, its strongest expansion since the post-pandemic rebound. However, momentum slowed more than expected in the fourth quarter as restrictive monetary policy weighed on activity, increasing bets on an earlier rate cut.

- Panama’s government secured a $1.29 billion loan with a two-year maturity from a Bank of America subsidiary, the Economy Ministry announced.

Commodities Spotlight

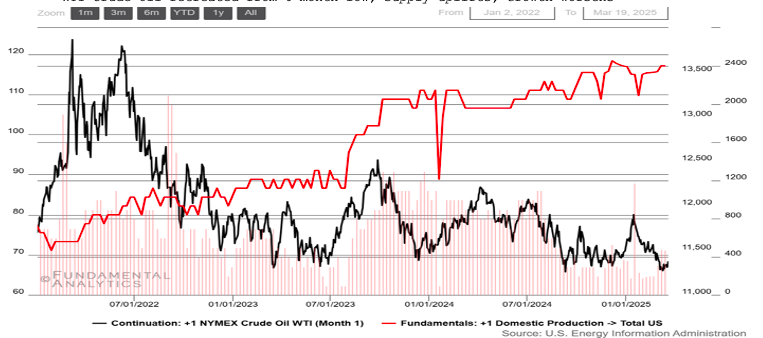

WTI Crude Oil Retreated from 6-month Low, Supply Uplifts, Growth Worsens

Source: Fundamental Analytics

WTI crude futures traded around $68 per barrel, heading for its best week since early January, as new US sanctions on Iran and OPEC+ plans of output cuts fueled supply concerns. Nevertheless, prospects of increased Russian supply could limit upward movement while US production continues to soar. Also, OPEC and its allies are set to increase production by 138k barrels per day, the first rise since 2022, adding to an expected surplus. Additional downside risks stem from shifting global trade, which could dampen growth and weaken consumption. Signs of slowing demand emerged after industry data showed a larger-than-expected build in crude stocks last week. However, heightened violence in the Middle East, threatening supply disruptions from key oil-producing regions, helped cushion some losses.

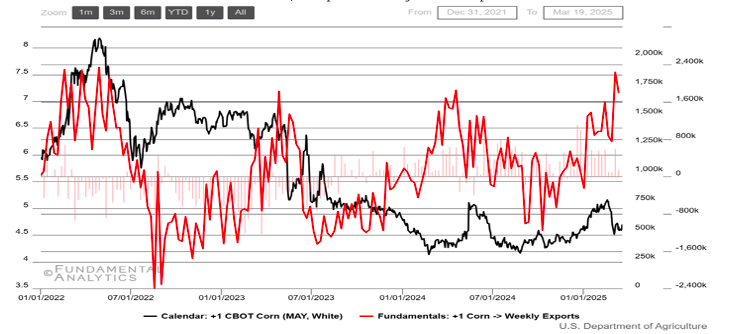

Corn Prices Rebound Despite Strengthened Exports

Source: Fundamental Analytics

Corn futures dropped back below $4.60 per bushel, moving further away from a two-week high of $4.78, amid concerns that trade conflicts could disrupt agricultural trade flows, especially after data revealed a sharp decline in corn purchases by China. While global production is forecast higher due to gains in India, Russia, and Ukraine, output in South Africa and Mexico is set to decline. Furthermore, private exporters reported sales of 100k metric tons of corn to Mexico for the 2023/24 marketing year, while the USDA’s latest weekly report showed over 50 million bushels of U.S. corn were shipped. Additionally, top supplier Argentina revised its 2024/25 corn production forecast down to 44.5 million metric tons (mmt), from 46.0 mmt last month, and below the USDA’s projection of 50.0 mmt.