European Markets

Corporate and Business News

- Business activity in the eurozone continues to weaken as uncertainty around domestic politics and global trade looms in the new year.

- Germany’s central bank has drastically reduced its economic growth forecast for next year, revising it down to +0.2% from the previous +1.1%. The central bank also warned of heightened uncertainty, including the potential rise of trade protectionism.

- Novo Nordisk received European approval to proceed with its planned acquisition of US-based drug manufacturer Catalent, a key producer of its popular obesity drug Wegovy.

- Volkswagen reached a significant agreement with its labor unions to keep its car plants operational in Germany. This deal ensures that all 10 of Volkswagen’s plants in Germany will remain open, and it guarantees job security for workers until 2030.

- Consumer prices in France rose by 1.7% year-on-year in November, aligning with market forecasts.

- German wholesale prices fell by 0.6% month-on-month in November, while the outlook for German consumer sentiment remains modest after a slight improvement.

- In Britain, the economy contracted for the second consecutive month in October ahead of the government’s first budget. This marks the first back-to-back decline in output since the onset of the COVID-19 pandemic.

- Job vacancies in the UK have decreased more sharply over the past year than in other comparable countries, adding to signs of a slowdown in the British economy during the second half of the year.

Debt and Monetary Policy News

- The ECB lowered interest rates by 25 basis points, aiming to stabilize an economy strained by debt concerns in France and vulnerabilities to trade tariffs threatened by US President-elect Donald Trump.

- The Bank of England maintained its benchmark rate, diverging from the ECB and the Federal Reserve, which opted for rate cuts this week.

- The Swiss National Bank cut interest rates by 50 basis points, marking its largest reduction in nearly a decade. However, a return to negative rates is unlikely, according to the SNB Chairman.

- The British public’s five-year inflation expectations rose to 3.4%, the highest level since mid-2022.

- Italian bonds are poised for gains in 2025, potentially at the expense of German and French bonds.

Asian Markets

Corporate and Business News

- The Adani Group, facing allegations of bribery, is under pressure from Bangladesh to renegotiate its power deal, adding to the challenges for India’s corporate giant amid ongoing investigations.

- Japan’s Honda and Nissan are in talks to establish a holding company, signaling deeper collaboration to counter increasing competition from Chinese electric vehicle manufacturers. The potential merger would also include Mitsubishi Motors, which is controlled by Nissan.

- Indian fintech MobiKwik experienced a remarkable market debut, surging 86% to reach a valuation of $474 million, highlighting strong investor appetite for fintech growth in Asia.

- Chinese regulators indicated a more accommodative stance toward the tech sector, boosting investor confidence as major firms like Alibaba and Tencent show signs of recovery.

- India’s Reliance is pursuing a multi-billion-dollar loan to refinance its debt and fund expansion, reflecting its aggressive growth strategy across diverse sectors.

- Japan’s Sony is set to become the largest shareholder in Kadokawa, strengthening its media and entertainment portfolio.

- Japanese retail giant Seven & i Holdings plans to open 500 new stores across the US and Canada by 2027, capitalizing on its global brand strength.

Debt and Monetary Policy News

- The Bank of Japan kept interest rates unchanged, with debates now shifting to the extent of potential hikes as inflation remains persistent. Japan’s inflation in November exceeded expectations, driven by a weak yen and rising energy costs, fueling speculation of future rate hikes.

- The Indian rupee continues to depreciate, weighed down by a widening trade deficit, central bank transitions, and global monetary tightening.

- Beijing introduced targeted credit easing measures for its struggling property sector, aiming to stabilize growth and address liquidity crises. The Chinese yuan stabilized after government-backed measures were introduced to support exports and combat capital outflows.

- India’s central bank held rates steady but injected liquidity into the financial system to mitigate global economic headwinds.

- While Indian bond yields dipped, Japan’s long-term yields edged higher, reflecting contrasting monetary policies in the region

- Both India and China reported recoveries in foreign exchange reserves, signaling improved external stability amid global volatility.

Latin American Markets

Corporate and Business News

Brazil’s currency fell to a record low as markets scrutinized the government’s spending plans and large budget deficit.

- Nippon Steel and Sojitz acquired a 49% stake in Champion Iron’s Canadian project.

- Brazilian digital lender Nubank invested $150 million in South African fintech Tyme Group, signaling its intent to expand.

- Brazilian lawmakers approved key regulations necessary for implementing tax reform.

- Mexico’s lower house unanimously passed labor reform legislation for app-based drivers and delivery workers.

- Chevron’s CEO stated that there have been no discussions with US President-elect Trump regarding Venezuela policies.

- Brazil’s new stock exchange in Rio, Base, is set to begin testing operations in early 2025.

- Argentina’s economy grew by 3.9% in the third quarter of 2024, marking the first quarter-on-quarter expansion since the country entered a technical recession at the end of 2023. However, on a year-on-year basis, the economy contracted by 2.1%.

Debt and Monetary Policy News

- Brazil’s central bank raised interest rates more than expected and signaled the possibility of further tightening.

- Argentina’s central bank slashed its benchmark interest rate to 32% from 35%.

- Skepticism surrounds Brazil’s fiscal package, as a poll revealed that most Brazilians doubt the government’s measures will effectively reduce the deficit.

- In its latest report, the Bank of Mexico reported financial stability, even amid persistent economic challenges.

- Colombia’s congress voted against a proposed $2.24 billion fiscal reform plan.

Commodities Spotlight

Commercial Crude Oil Inventory Falls for 4th Consecutive Week, Futures Rise

WTI crude oil futures, which remain above $70 per barrel, found some support after EIA data showed that US crude oil stocks fell by nearly 1 million barrels in the second week of December, extending the 1.4-million-barrel draw from the previous week. Additionally, Kazakhstan plans to comply with OPEC+’s extended oil cuts next year, reversing earlier plans to raise output to 190 thousand barrels per day, joining the UAE in supporting the extension. Still, expectations of ample output from non-OPEC+ members, including the US, Canada, and Brazil, dampen optimism.

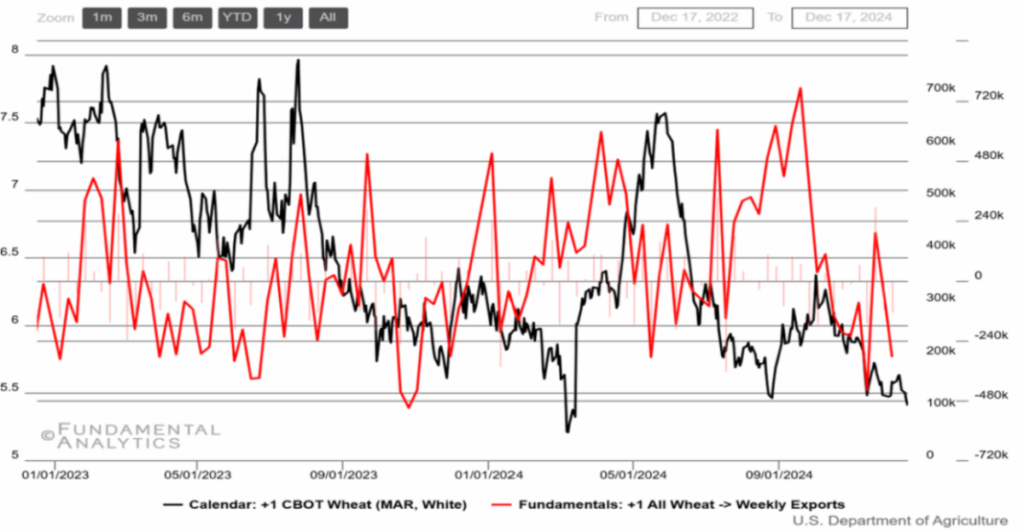

March Futures Weakened with Favorable Weather Expectations for ex-US Competitors

Wheat futures traded just below $5.50 per bushel, marking their lowest level in over a week. The decline was driven by forecasts of rain in parts of the US winter wheat regions and favorable dry weather in Europe, which has supported winter wheat planting. France’s agricultural sector forecasted a significant rebound in wheat planting for the 2025 harvest, aided by drier November conditions that prevented a repeat of last year’s rain-disrupted sowing season.