Welcome to our new bi-weekly newsletter which covers key developments in non-US markets. With this newsletter, we highlight corporate, debt, and monetary policy news in European, Asian, and Latin American markets. We end our newsletter with a spotlight on commodities.

European Markets

Corporate and Business News

- Job cuts and political turmoil caused France’s index of sentiment (a measure of consumer confidence) to slide to 90 in November from 93 in October, marking the lowest point since June. It is widely expected to continue falling in December amid the collapse of Barnier’s government.

- EU ends probes on Amazon, Starbucks, and Fiat after courts ruled that the bloc was wrong to charge the Netherlands and Luxembourg with giving companies unfair advantages through tax breaks.

- Eurozone business confidence edges up despite tariff threats from incoming US president, Donald Trump. However, business confidence remains behind its long-term average, indicating that confidence remains weak.

- German businesses continue to flounder as geopolitical pressures mount, leading to sooner-than-expected ECB cut rates.

- Spain’s October industrial output rose 1.9% year-over-year (y/y), exceeding the +0.3% y/y consensus.

- Chip stocks sparked a rally in Europe following mixed trading in Asian markets during the US Thanksgiving holiday.

- Rheinmetall forecasts 20 billion EUR in sales by 2027 amid higher defense spending in Western markets.

- Ford cut around 14% of its European workforce on weak EV demand and competition from subsidized Chinese rivals.

- Gazprom’s 2025 plan assumes no more transit via Ukraine to Europe, decreasing $1 billion per year in transit fees for Kyiv.

Debt and Monetary Policy News

- British inflation jumped more than expected last month by 2.3% y/y, rising back above the BOE’s 2% target. Underlying price growth gathered speed too, showing why the Bank of England is moving cautiously on interest rate cuts.

- The Swiss National Bank Chief indicated the central bank will introduce negative rates if needed, sending the Swiss franc to a two-and-a-half-month low against the dollar.

- ECB’s intervention via Transmission Protection Instrument (TPI) to stabilize France’s yields seems unlikely since several key criteria (ie budget deficit, debt level) are not met. The gap between French and German yields – a gauge of the premium investors demand to hold France’s debt – hit 90 bps, its widest since 2012.

- The EU Commission said France’s draft 2025 budget and medium-term plan to bring down public debt are in line with EU rules while spending plans of the normally frugal Netherlands are too high.

Asian Markets

Corporate and Business News

- Tesla’s China-made EV sales dropped 4.3% y/y in November. The drop in sales comes amid fierce competition from Chinese rival BYD, which reported a 67.2% y/y increase in passenger vehicle sales.

- GM will take more than $5 billion in charges related to its China operations. The charges are primarily due to increased competition, rising costs, and a challenging market environment in China.

- Netflix surpassed 10 million subscribers in Japan, with Japanese-language shows garnering attention.

- Uber launched a boat-hailing service on Kashmir’s scenic Dal Lake. This service allows tourists to book rides on traditional wooden Shikara boats through the Uber app.

- ASML and its semiconductor manufacturing peers climbed on hopes for less severe US curbs on China chips.

- Indonesia’s Investment Minister, Rosan Roeslani, announced that Apple has committed to a $1 billion investment in the country.

- China Mobile offers to buy Hong Kong’s HKBN in a $882 million deal.

- Taiwan has raised its economic growth forecast for 2024, now expecting GDP to expand by 4.27%, up from the previous estimate of 3.9%. This optimistic outlook is driven by the AI boom, which has boosted demand for tech products.

Debt and Monetary Policy News

- The Bank of Korea unexpectedly cut its benchmark interest rate by 25 basis points to 3%. This marks the second consecutive rate cut, as the bank aims to support the slowing economy amid growing uncertainties, including the potential impact of new US trade policies. The bank also lowered its growth forecast for 2024 to 2.2% from 2.4% and for 2025 to 1.9% from 2.1%.

- Australia’s Q3 GDP growth disappointed, and now markets are looking to April for the beginning of rate cuts. On an annual basis, growth slowed to 0.8%, the slowest pace since late 2020. Meanwhile, New Zealand cuts rates by 50 bps and indicated further easing.

- China’s relentless bond rally pushes 10-year yield below 2%, a record low. This drop is driven by investor expectations that Beijing will further ease its monetary policies to support the slowing economy.

Latin American Markets

Corporate and Business News

- Citi completes split of Mexico business ahead of Banamex IPO. Citigroup is now preparing for the initial public offering (IPO) of Banamex, which is expected to take place in 2025.

- Mexico announces 12% boost to the minimum wage to combat poverty. The new daily minimum wage will be 278.80 pesos ($13.75) in most of the country and 419.88 pesos ($20.70) in the northern border zone.

- Mexico’s economy up 1.1% in the third quarter. This growth was driven by strong performances in the primary sector (agriculture, forestry, fishing, and mining), which saw a 4.9% increase. On an annual basis, the GDP grew by 1.6%.

- Brazil created a net 132,714 formal jobs in October, data from the labor ministry showed on Wednesday, below the 200,000 forecast.

- Peru’s consumer prices rose by 0.09% in November 2024 compared to October.

- JPMorgan upgrades Mexican equities on US growth but downgrades Brazil, citing slower growth in China and potential pressures from President-elect Donald Trump’s tariff policies.

- Mexico’s Elektra shares deepen losses, while Moody’s has flagged reputational risks for Elektra’s financial arm, Banco Azteca, due to governance weaknesses and substantial related-party exposure.

- Soaring legal fees in snarled Citgo auction frustrates companies. The auction, which involves 18 companies seeking up to $21.3 billion for debts related to Venezuela, has faced multiple delays and legal complexities.

Debt and Monetary Policy News

- Brazil’s unemployment rate dropped to 6.2% in the three months through October, which is the lowest level since records began in 2012. While a positive sign for the economy, it has raised inflation concerns. Inflation exceeded forecasts with annual inflation reaching 4.77%.

- After Brazil’s government announced it would Brazil’s freeze $860 million in spending for 2024 to comply with its fiscal rules, the Treasury has forecasted a $3.3 billion deficit for 2024. This primary deficit of 20 billion reais is narrower than the maximum shortfall permitted under Brazil’s fiscal rules.

- The China Development Bank has extended a $690 million loan to Brazil’s National Bank for Economic and Social Development (BNDES). This marks BNDES’s first foreign currency operation and is part of a broader package of agreements aimed at strengthening economic ties between China and Brazil.

- Colombia’s 12-month inflation rate through November 2024 is forecasted to be 5.13%. This is a decrease from the 5.41% rate at the end of October, but still above the central bank’s target of 3%.

Commodities Spotlight

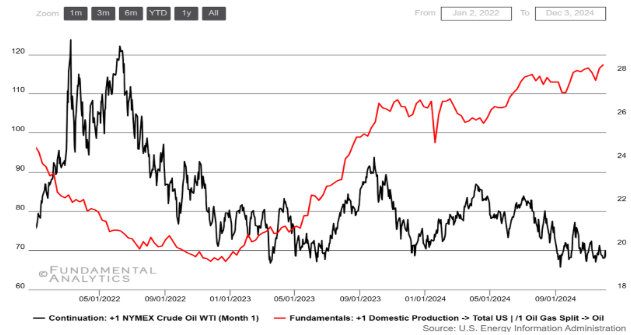

US Crude Stockpiles Fall While Production Reaches Record High

Source: Fundamental Analytics

WTI crude oil futures fluctuated around the $68 per barrel level on Thursday as OPEC+ decided to maintain current oil production levels for the first quarter of 2025. The group plans to gradually increase output starting in the second quarter and continue doing so until September 2026. This decision aligns with market expectations, as the group seeks to balance falling global demand and rising output from non-OPEC+ countries. Meanwhile, US data painted a mixed picture, with crude stockpiles falling by over 5 million barrels—the largest weekly drop since August—but production reaching a record high, emphasizing robust supply outside OPEC+.

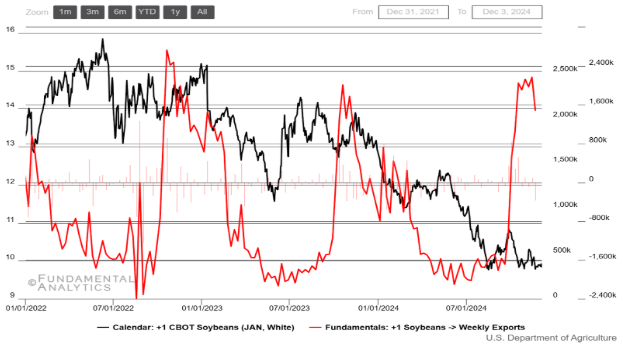

Soybean Futures Stabilize On Strong Production Outlook

Source: Fundamental Analytics

Soybean January futures stabilized just below $10 per bushel, underpinned by strong production outlooks in Brazil and improved weather in Argentina. Brazilian soybean output for the 2024/25 season is forecast to hit record levels, with Celeres estimating 170.8 million metric tons, nearly 1 million tons higher than previous projections, and StoneX forecasting 166.2 million tons. Despite increased US export sales, soybeans remain locked in a narrow range due to ample global supplies and lingering concerns over potential trade tensions with China, the world’s top soybean importer, under the incoming Trump administration.