As noted in two previous commentaries (Assessing the Prospects of 2019: Part II and Headwinds vs. Tailwinds: An Initial Assessment of Undercurrent Trends Affecting the Market Outlook for 2019) we are cautiously optimistic that 2019 will be a better year for the markets than 2018 has been. Having previously explained the reasons for that cautious optimism, we take this opportunity to comment on the latest market swings that have upset the markets and have made some analysts start debating whether these are signs of an impending panic or of a recession.

After the 500+ drop of the Dow Jones Industrial Average on Monday, Tuesday’s headlines could be summarized in the following sentence: “The worst December since the Great Depression.”

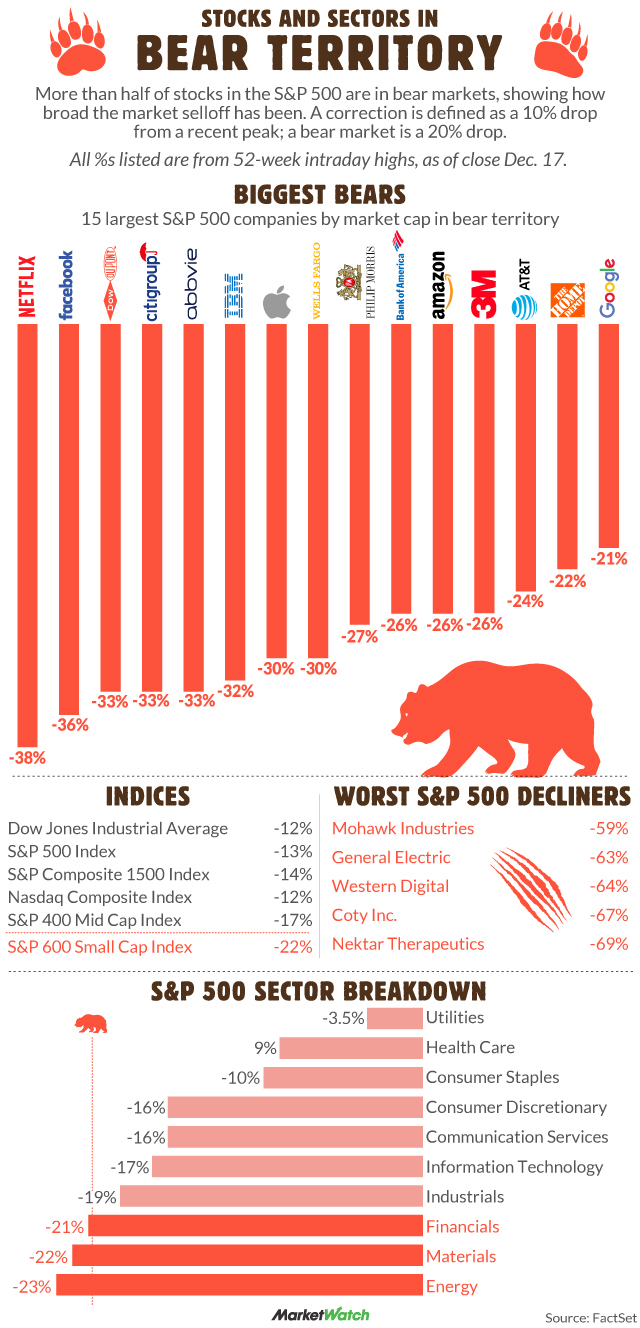

Hold on, this is not Hollywood and the directorship has not been awarded yet to Oliver Stone! We understand that there are concerns. Temporarily the yield curve was inverted, and oil prices keep dropping (due mainly to oversupply, but also due to insufficient cuts by the OPEC and a slowdown in economic growth). We understand that earnings growth may be slowing down, and the Fed may raise rates again today. We also understand that the trade disputes with China may continue, and credit spreads may be rising. We can also understand that the All World Index of stock markets may have dropped close to 9% this year and that several sectors are in bear territory (implying a drop of more than 20% from the highs earlier this year) and as the image below shows, several well-known companies have suffered losses well over 20%.

However, in all these headwind developments we should also consider that the financial stress index does not signify an elevated financial stress level, and the financial conditions index published by the Chicago Fed still shows loose monetary conditions. We understand also that during this month no junk bond sales took place (a record since the Lehman collapse) which by itself could point to tightening credit conditions, but we consider such development a pretty healthy indicator that fund managers refuse to bankroll buyouts that may be questionable or whose valuations surpass acceptable standards.

We also consider the reduced expectations about growth in corporate earnings something that needed to happen because growth to the tune of 20%+ is pretty abnormal. The overall landing of expectations regarding corporate sales and earnings, as well as business expansion and business sentiment may have not been as smooth as we wanted, but the turbulence we have experienced at least can help us to come down to earth regarding valuations, prospects, presuppositions, and assumptions.

The fact also that companies could have borrowed at much higher costs and refused the credit also shows signs of maturity in the demand for credit, which signifies that reason may be prevailing regarding the terms of credit. If this logic is correct, then an equilibrium position may be developing in credit and valuation metrics which is also a healthy sign and the credit overextension (which in most cases is the cause of a crisis) may slow down to healthier levels (especially in the over-leveraged market). We are all for the credit fever to come down.

Moreover, if someone likes particular companies (assuming that s/he has done the homework regarding their fundamentals), then s/he should like them even more at lower valuations. In addition, selling puts on well-grounded companies could turn out to be an income generating tactic that enhances portfolios’ incomes while positioning/acquiring good names. Furthermore, as better opportunities may arise, diversification (geographic and sectoral) could reduce risks and enhance returns.

The December events could be classified as turbulence noise while we are attempting a landing. Once the plane has been serviced and refueled then it could take off again for new destinations, assuming that the political tremors (both in the US but also in the EU) as well as the geopolitical manipulations do not structurally damage it.

In closing, and given the spirit of the days, I am always moved by the vision of ruling from a manger rather than from a palace while also entering a city on a donkey rather than on horse!

Merry Christmas!