Early this morning I was listening to the announcement about Deutsche Bank’s (DB) profits, which came in “better than expected” and hence its stock price gained more than 2% for the day. It is always a pleasure to honor and recognize prudential banking professionals, but I am reserved to do so for DB another time, for reasons explained below. However, I do want to give praise and recognize an exceptional banking professional whom I met a few months ago in Greece: Ms. Androniki Boumi.

Ms. Boumi represents the epitome of exceptional professionalism in her career, advancing the corporate interests she has been entrusted with and in the process creating capital and wealth – the cornerstones of growth – for the banks she worked for, and for other parties related to the activities she has been directing.

In just four years (2000-2004), as President of the Hellenic Postal Savings Bank (HPSB), Ms. Boumi transformed a state-operated bank into a jewel that even private banks admired. Assets under management increased, non-performing loans decreased, the profitability of the bank rose significantly, jobs were created, incomes increased, corporate capital was formed, households found a friend, and all these accomplishments were achieved under prudent lending anchors. It is truly admirable to take over a state-owned bank and touch it in such a way that all vested parties say “bravo, a job well done”.

But it is not only the HPSB where Ms. Boumi outperformed her call of duty. In the National Investment Bank for Industrial Development (ETEBA) where Ms. Boumi served from 1974 until 2000, she was able to touch anything and transform it into a productive asset that generated returns for the vested parties. Whether the objective was project finance, merger and acquisition, corporate finance, investment banking, venture capital, an IPO, and a myriad of other bank-related activities, Ms. Boumi was there to advance the interest of the client and to create a win-win situation where real wealth was created.

I was able to witness recently her outstanding and most efficient way of handling business in her latest role of corporate restructuring in one of the most challenging environments in Greece. I admired the professional ethos, the flexibility, the innovative spirit, and the love for a job that can truly be used as a cornerstone for turning around problematic situations.

Professional bankers like Ms. Boumi need to be imitated. If Greece had more professionals like Ms. Boumi, most probably the country would not be in the dire situation it has been facing in the last few years.

In the closing paragraphs of this commentary, I would like to return to DB and its “prudential banking practices”. My fear is that the toxic assets are still there given that in its latest balance sheet it reports derivatives to the tune of $75 trillion! Its deposits are about $720 billion i.e. it has sufficient deposits (in a bail-in scenario where depositors’ funds are used to bail out the bank) to cover one percent (1%) of its liabilities!

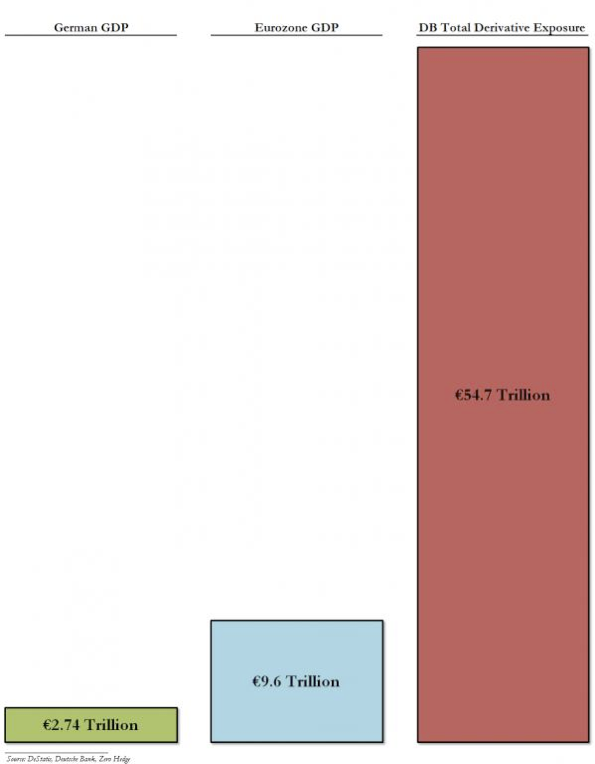

The following graph is indicative of what is happening in the shaky EU-wide banking sector.

As it is evident all of EU’s GDP does not suffice to cover one bank’s exposure to derivatives. In the accounting scheme of things, we are told that through the magic wand of netting the gross and net notional values of derivatives reduces substantially the risk exposure of the banks. However, the problem with such accounting schemes is that when the collateralization chain breaks apart (as it did in 2008) rehypothecation of questionable collateral freezes, and when that takes place, then the gross exposure in liabilities becomes net exposure which stands at $75 trillion.

Under those circumstances, the “no matter what” pledges won’t worth the paper they are printed on (even if they were in writing, let alone when they represent mere words of moral suasion).