Confused perspectives in the last quarter of 2018 created havoc in markets. However, since the beginning of this year the pause in interest rates hiking along with reduced tensions in the trade warfare have eased pressures and are creating an upswing wave and a new narrative.

The “imminent recession” narrative of late 2018, supported by lower oil prices, exacerbated the fears and created an environment where explanations were sought that best fitted the data. Once again, the fact that fundamentals were neglected for the sake of a narrative created agony and turmoil. Since mid-November we have explained that 2019 was shaping up to be better than 2018. As the first graph below shows we, are back at the levels seen in early October and, per our previous commentaries, those levels may become a resistance ceiling.

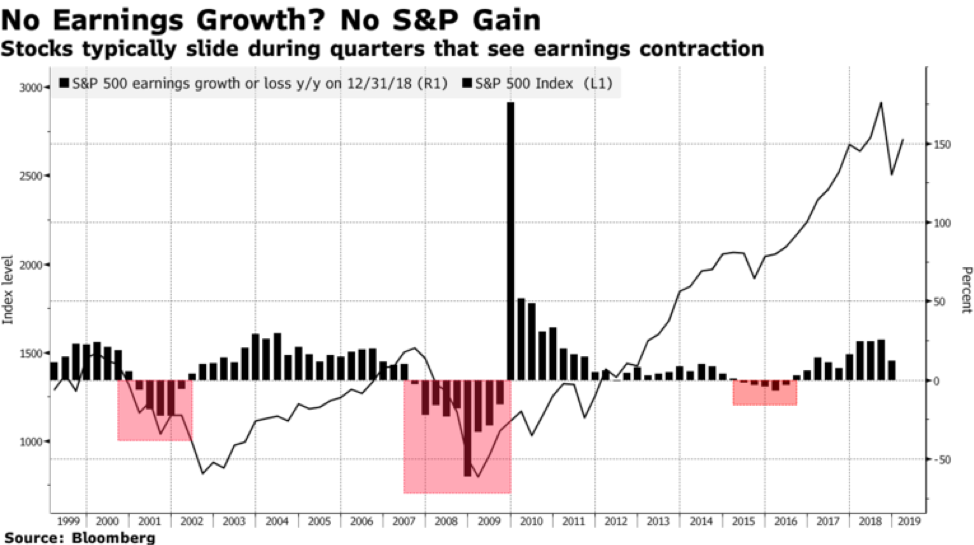

As we are approaching the end of February, our focus turns on earnings. Given the expectations for low earnings in the first quarter, the valuation of stocks (based on 2019 average per share forward earnings will be approaching 17) may start sending signals of being overbought. An earnings contraction (not an earnings recession) will prompt questions about minuscule growth potential in subsequent quarters. The graph below reflects those possible concerns.

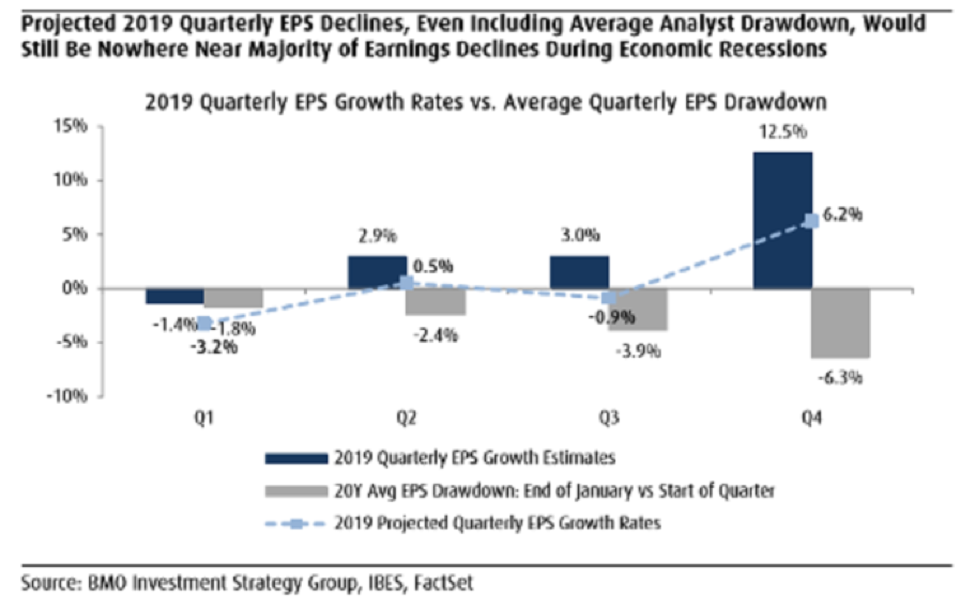

The projected profit slowdown (due to slower demand growth and some rising costs) could deteriorate the equities’ outlook and reduce the appetite for large institutional investors, especially if they start trusting the expected growth rate of earnings as reported in some surveys (negative for Q1, around 0.5% for Q2, negative for Q3, and about 6% for Q4). If those expectations come close to materializing, then we may not exactly experience an earnings recession, as the following graph shows.

Studies related to stock pricing behavior show that in 15 earnings cycles in the last 70 years, stocks tend to rise even after a profit recession lands in the field of corporate earnings, which may be reiterated during the current earnings cycle.

However, our concerns about the earnings cycle are elevated when we take into account emerging markets renewed fears (accelerated Argentinian inflation rate, South African rand’s troubles, Indian tremors, Nigerian institutional weakness on top of the Chinese slowdown, to name just a few) along with EU troubles and especially German business climate/expectations pessimism as shown below.

If on top of this we add rising political fever in the US, we may be prompted to ask ourselves: “Where is safety?” In market circumstances like the ones we described above, we opt for a more conservative approach (maintain cash equivalents of at least 10-12% depending on the risk tolerance level of the portfolio holder) but we also opt for a dollar-cost-average approach in adding to our gold holdings. Anchoring portfolios, after all, produces alpha during turbulent times.

Projected Q1 Earnings Contraction: Valuations, Momentum, and Resistance Levels

Author : John E. Charalambakis

Date : February 21, 2019

Confused perspectives in the last quarter of 2018 created havoc in markets. However, since the beginning of this year the pause in interest rates hiking along with reduced tensions in the trade warfare have eased pressures and are creating an upswing wave and a new narrative.

The “imminent recession” narrative of late 2018, supported by lower oil prices, exacerbated the fears and created an environment where explanations were sought that best fitted the data. Once again, the fact that fundamentals were neglected for the sake of a narrative created agony and turmoil. Since mid-November we have explained that 2019 was shaping up to be better than 2018. As the first graph below shows we, are back at the levels seen in early October and, per our previous commentaries, those levels may become a resistance ceiling.

As we are approaching the end of February, our focus turns on earnings. Given the expectations for low earnings in the first quarter, the valuation of stocks (based on 2019 average per share forward earnings will be approaching 17) may start sending signals of being overbought. An earnings contraction (not an earnings recession) will prompt questions about minuscule growth potential in subsequent quarters. The graph below reflects those possible concerns.

The projected profit slowdown (due to slower demand growth and some rising costs) could deteriorate the equities’ outlook and reduce the appetite for large institutional investors, especially if they start trusting the expected growth rate of earnings as reported in some surveys (negative for Q1, around 0.5% for Q2, negative for Q3, and about 6% for Q4). If those expectations come close to materializing, then we may not exactly experience an earnings recession, as the following graph shows.

Studies related to stock pricing behavior show that in 15 earnings cycles in the last 70 years, stocks tend to rise even after a profit recession lands in the field of corporate earnings, which may be reiterated during the current earnings cycle.

However, our concerns about the earnings cycle are elevated when we take into account emerging markets renewed fears (accelerated Argentinian inflation rate, South African rand’s troubles, Indian tremors, Nigerian institutional weakness on top of the Chinese slowdown, to name just a few) along with EU troubles and especially German business climate/expectations pessimism as shown below.

If on top of this we add rising political fever in the US, we may be prompted to ask ourselves: “Where is safety?” In market circumstances like the ones we described above, we opt for a more conservative approach (maintain cash equivalents of at least 10-12% depending on the risk tolerance level of the portfolio holder) but we also opt for a dollar-cost-average approach in adding to our gold holdings. Anchoring portfolios, after all, produces alpha during turbulent times.