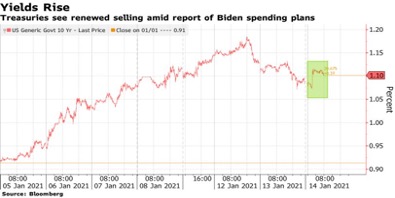

Last Thursday (January 14th), the team of the President-Elect proposed a new stimulus package close to $2 trillion. Within a few minutes, the markets reversed gains and ended the day down. The bond markets also sold off and the yields – while they were dropping in the previous two days – started rising again, as shown below. The market downturn continued on Friday.

We find positive and negative signs in the proposed package. However, this commentary does not intend to address this particular package, but mainly the forthcoming package(s) that would aim to advance growth in a new and much-needed direction. In our humble opinion, the litmus test (if there is such a thing in similar packages) is the ultimate impact the package(s) will have on the growth rate of productivity and in positioning the US to contain China and other illiberal states (along with their minions) in an effective way. We understand that the natural question might be, “what does Chinese containment have to do with the package(s)?”, but in our assessment an economic policy separated from geopolitical priorities which aim to advance national security as well as the allies’ interest is not just monolithic but could also be counter-productive (more on this at the end of this commentary).

What are the positive signs then of this proposed package? We could certainly say that there are millions who need financial assistance and the package achieves that. The stimulus will help those in need and also the economy at-large, as it will sustain spending, and thus, incomes and jobs.

What are the possible negative effects then? It raises the debt and consequently the long-term rates. Moreover, if it discourages employment then it may inflict short and medium-term pain. Finally, if the real interest rate differentials prove to be insufficient, then it could push the dollar down, and cheapening one’s currency may self-inflict wounds down the road, especially in an environment that is becoming ripe for inflationary pressures. If additional debt loads do not become a force of productivity growth, then they could inflict long-term pain into the economy.

Where do we stand then and what are the possible net effects of this and forthcoming stimuli packages? The main goals (in addition to the assistance) of the forthcoming packages (as far as we know) will be to advance clean energy and infrastructure spending. Assuming that the proper targets are set in terms of infrastructure and clean energy spending, then we are of the opinion that the forthcoming package(s) will have a positive long-term effect on the economy, because it will increase the prospects of growth in productivity growth rate which is the most important macroeconomic variable that makes or breaks nations, in addition to the rule of law which is supposed to be the foundational basis.

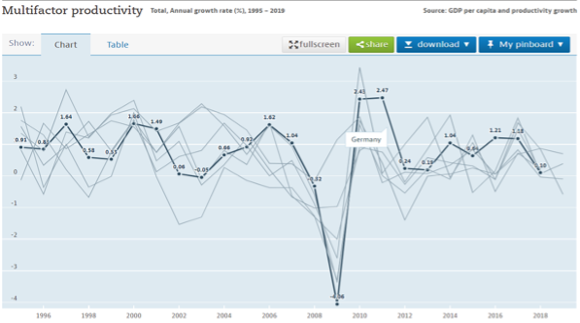

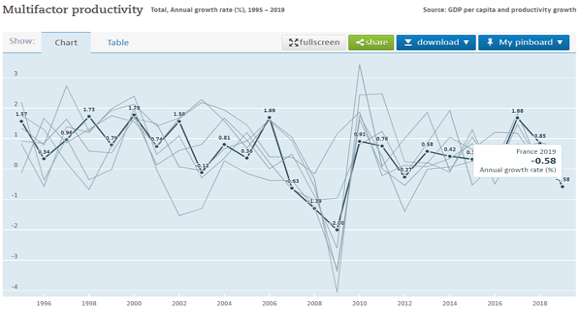

There is little doubt (based on the historical record) that pandemics are followed by slower productivity growth rates. The latter is defined as output per unit of input (e.g. output per labor hour), and signifies efficient allocation of resources. A boom in productivity in the mid/late 1990s and the beginning of the 2000s generated millions of new jobs, reduced poverty, and advanced incomes and standards of living worldwide. Declines in the productivity growth rates are associated with rising misery (like in the 1970s).

The next three graphs show the productivity growth rate for the G7, and the cases of the US, Germany and France (with negative growth rate) are highlighted, in order to show the dismal performance following the financial crisis.

Even emerging economies’ productivity growth rates have declined significantly in the last ten years. Pessimists point out that despite the technological innovations and disruptions we have experienced, productivity growth rate remains dismal. In this commentary we choose to be cheerful and we claim that properly targeting stimuli towards the dissemination of technological advancements (robotics, cloud computing, clean energy, AI, biotechnology) will bring in an era of much higher productivity growth rates which may even include a period of roaring adoptions that will uplift standards of living, incomes, jobs, trade, and portfolios for many years to come.

We are of the opinion that properly targeting the stimuli in advancing and disseminating the framework of infrastructures (legal, physical, social in terms of educational and health standards, technological, financial, energy, trade) will result in flourishing productivity growth rates as demand and supply constraints are being unlocked.

Tangible and intangible capital transitions, when properly boosted and supported by research, will also make debt more affordable as incomes rise, and production expansion along cutting-edge technologies improves manufacturing, logistics, and inventory management, while opening new horizons in international trade.

An economic policy made up of stimuli that target the transition of the seven critical infrastructures discussed above cannot be separated from the framework of moral sentiments that respect the personal liberties of individuals and which in turn free them up from the artificial constraints imposed on them by tyrannical forces of oppression that seek to advance the interests of few while suppressing opposition, the truth, and human dignity. Therefore, such an economic policy should also seek to advance the interests of allies (we want the house of our neighbors to appreciate in value) and together design policies that constrain the impact of illiberal regimes (Russia, China) worldwide.

The world has suffered enough from periods of unmitigated horrors by such regimes whose mobs killed hundreds of millions of people, tortured even more, ransacked homes, and destroyed cultural and religious sites. The reality is that former members of the Red Guards have thrived in the post-Mao era and their dreams of subjugating the rest of the world to their vision of structuring political realities is a pure threat to the values that uphold the moral sentiments of capitalism without which capitalism cannot exist. Therefore, containment of those who wish to purge the liberties that make us free to pursue justice and happiness, is a necessary condition for growth.