We are coming to a juncture in the markets where we need to decide if the means of illusions used can produce any real lasting effects. The truth of the matter is that in a world fascinated with superficial results, few are those those who argue for fundamental substance. In last week’s commentary I argued that unless productivity rises (through growth and not just cost cutting measures), the foundations of the global economy will become weaker. In a similar manner, unless employment increases, profits rise, and savings are set on a healthy trajectory, we will keep amusing ourselves to death by means of illusions. Money things (such as monetary measures) affect money things (prices of goods and assets). Real things (such as higher productivity rates) affect real things (such as production and employment levels).

There are three events that have been underlying financial developments in the last few weeks: First, turmoil in the emerging markets. The Brazilian stock market is down 19% for the year. The market in the Philippines lost 9% for the week. Emerging countries’ currencies are losing ground against major currencies (the Indian rupee seems to be reaching record lows against the USD). A Chinese bond offering failed, signifying liquidity issues in China. Turkey is going through a political turmoil which may affect its economic prospects since it signifies fragility in its system. This turmoil in emerging markets may continue for a few months which may result in capital outflows whose mirror image will be inflows into developed markets and a boost in those pertinent markets.

The second phenomenon that has been underlying the markets in the past several days is increased volatility. The uncertainty about quantitative easing programs in the US and elsewhere in the developed markets (which highlights the illusionary mentality), has inflicted nervousness in the markets which have been accustomed to care about illusions of growth rather than the real things that matter and affect long term economic progress. The graph below shows what the gains would have been is someone had invested in the proxy of that volatility in the last month.

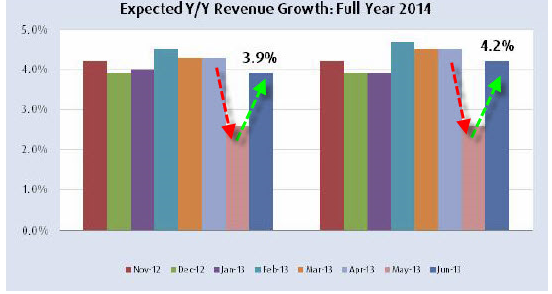

The third phenomenon that has been impacting the markets is the uncertainty about further support to the system through monetary measures. The bonfire of illusions demands more fuel, without comprehending that in the absence of proper collateral those monetary accommodations undermine the foundations of the economy itself. Any tapering of the monetary measures will be balanced by capital inflows and while the illusion of interest rate normalization takes place (given the fact that the developed countries cannot afford higher interest rates), the markets may perceive it as a sign of strength. If that turns to be the case, then another illusion will be enforcing the notion of higher profitability which in turns will become a self-fulfilling prophesy. Maybe this is already happening, if we take into account the following graph of corporate revenue growth expectations in 2014 (on the left side the graph shows all corporations while on the right side it excludes financial institutions).

My fear is that the markets for the foreseeable future will be experiencing the volatility cycles of what Aristotle called prodigality and illiberality. The former gives (monetary accommodations) without discernment, while the latter takes (the monetary accommodations) and bundles up the wounds instead of operating on the patient.

As the markets go through those cycles of prodigality and illiberality opportunities will arise to acquire real hard assets which have real intrinsic values, while also gaining from ephemeral swings.