In this week’s commentary we will briefly show how the buffer zones created by the world’s central banks are expected to result in above (recent) trend growth due to the fact that liquidity provisions are expected to boost lending ratios primarily in the US and emerging markets. Technically speaking we expect the money multiplier to reverse its downward trend and thus higher lending to result in better growth rates and employment levels. We do not expect inflation to pick up pace this year while we keep a close eye on bond prices which may start exhibiting weaknesses in the second quarter.

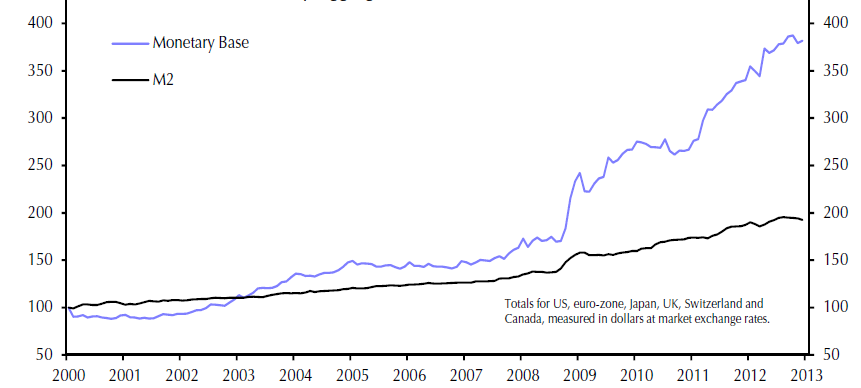

We shall start with the global monetary aggregates, which as shown in the figure below have been constantly rising at a significant pace since late 2008. However, global money supply (as measured by M2) has failed to increase by the same pace signifying that the rise in the monetary aggregates targeted the bailout of banks and their reserve levels.

Our expectation is that loan-to-deposit (LDR) ratios will rise this year for the US and emerging economies, but not necessarily for the EU banking sector which still needs to consolidate and deleverage. We expect further shrinkage in EU banks’ balance sheets but we also expect higher deposit rates in the EU banking sector. Assuming that the latter two things happen (shrinkage of balance sheets and higher deposits) then EU banks may be in a position to start increasing their lending again in 2015.

At the same time we anticipate that emerging markets will become recipients of the higher money supply which will strengthen their lending capacities, boost their growth rate and capital investment spending while it will also strengthen their currencies and hence assisting the US and EU efforts in boosting their sales abroad.

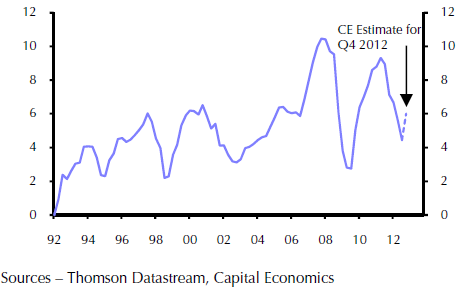

The following figure shows net capital flows to emerging markets as a percentage of GDP over the last twenty years. As we can see such inflows experienced an exponential increase between 2004-’07 and then collapsed due to the financial crisis. Projections show that they will start rising again this year, which will also boost their local markets, as we wrote a few weeks ago.

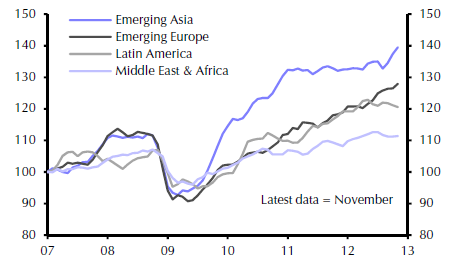

As capital inflows increase in emerging markets their export capacity will increase too which has the possibility of creating a virtuous circle of more capital and higher growth, assuming that the investment climate is conducive to that trend. Speaking of emerging markets exports, the graph below tells us a compelling story that in the midst of the global crisis emerging countries were able to partially overcome pressures through the export route. Therefore, we believe an allocation to emerging markets might be prudent for this cycle.

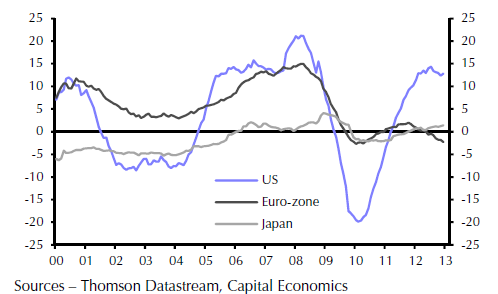

Returning now to the bank lending issue, what we observe below is that lending to non-financial firms has been picking up pace in the US but not in the EU. In Japan has been rising but only marginally. We expect the latter to change pace which will boost Japanese prospects for the rest of the year.

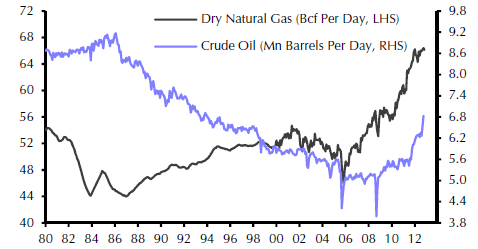

We are cautiously pretty optimistic about US prospects for this and possibly next year too. We believe that US dynamics are changing due to energy dynamics (see our January 2012 newsletter for an elaboration of this issue). The following figure shows the significant increases in domestic energy production. We are of the opinion that this year will prove to be a good year for energy companies and as the US changes the oil and natural gas inputs, it builds additional competitive advantages that will give a boost to its manufacturing sector.

Closing this commentary, we also consider prudent a slow but steady accumulation in natural gas even if its price is anticipated to remain depressed for this year.