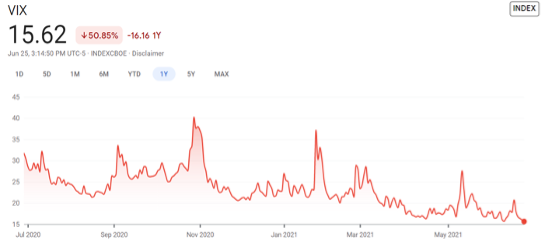

A survey conducted by Bank of America among over 200 fund managers revealed that the grand majority of them significantly trimmed their bond holdings. The reasoning behind such trimming is the expectation that the Fed will itself trim its program of bond purchases. In addition, bond yields are very low, so potential capital gains are restricted. At the same time of course, we observe that market volatility stands at very low levels, as shown below, a level that may signal investors’ complacency.

Market frothiness is a condition with high correlation to market complacency. Fundamental measures of intrinsic values are ignored in favor of emotional momentum that chooses to ignore the objective worth of an asset. As we wrote last week, valuation and market metrics make us skeptical of the continuous market momentum. Moreover, there seems to be a new cult of market hagiography where subjectivism and sentiment carry the day, boosted by central banks’ extraordinary measures of support.

Our skepticism is further boosted if we take into account that earnings’ growth, in both the US and the EU, is expected to drop from 35 and 48 percent respectively to 12 and 14 percent in 2022. Thus, the market may start discounting the growth prospects, in the near future. Having said that, we wouldn’t be surprised if equities register additional gains if the earnings reports from the second quarter are better than expected.

At the same time, when this market hagiography is taking place, geoeconomic and geopolitical changes are taking place that amplify an environment and an ecosystem (to use a contemporaneous term) where truth is no longer relevant. We would reiterate here our claim of a few weeks ago: comprehending the evolving geostrategic environment is necessary for generating sustainable portfolio returns.

This past week, Germany led a failed attempt where the EU would have taken initiatives to warm up to Vladimir Putin. Germany may have wanted to remind us how it twisted the arm of Vladimir Lenin on March 3, 1918, in the infamous Treaty of Brest-Litovsk where the Central Powers (led by Germany) persuaded Lenin and the Bolsheviks to stop fighting them during World War I so that they could advance and concentrate their forces against the Allies. However, when virtue disappears in the absence of true paideia, kleptocratic opportunists crown themselves in an environment of conciliation and collude with anyone, as long as their ulterior objectives can undermine the forces of truth and justice. After all, we should always remember the vital economic importance of Russia as shown in the next graph.

Fundamentally speaking, we cannot let “deals” silence virtue and condemn the world to obey vested interests (such as Nord Stream 2) that defy just and righteous international relations.

The emerging market hagiography that ignores the moral sentiments of capitalism has allowed dictators, like Xi, to celebrate a convoluted and immoral market authoritarianism as the crown jewel of growth. This Thursday (July 1st), the Chinese Communist party (CCP) will celebrate the 100th anniversary of its founding. Will it really celebrate the death of over 80 million people that died because of its Great Leap Forward or the Cultural Revolution? Will it really celebrate the silencing of freedom and the suppression of liberty throughout the land over the course of the last 72 years? Will it celebrate the Tiananmen Square massacre? How about its violation of the Hong Kong transfer Treaty? Sorry, I am mistaken: Xi will certainly apologize for the criminal behavior against ethnic minorities. Apologies again. I am certain that Xi will be praising Zhao Ziyang on Thursday celebrations and will be reversing the reversal of Deng’s reforms that he institutionalized since taken over.

So, where do all these leave us regarding capital deployment for the medium term? Look for virtue in quality: Strong balance sheets, strong and rising free cash flow, and steady dividend growth companies.