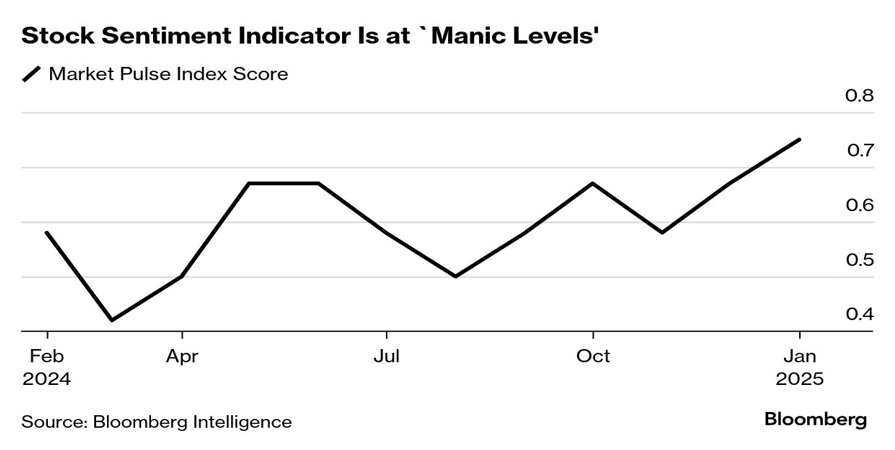

In the commentary we published two weeks ago, we described Mr. Market as an entity that from time-to-time suffers from a manic-depressive syndrome. Yesterday, Bloomberg reported that the stock market sentiment was approaching manic level by late January, as shown below (in the last two weeks of January the bull/bear ratio jumped by almost 30%).

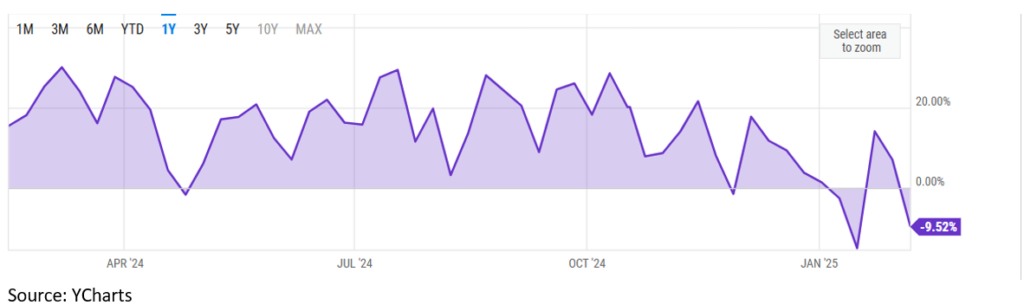

However, that sentiment declined by almost 10% in the last few days, as shown below by the percentage spread between bulls and bears.

Why such a change in investors’ sentiment? Could it be that some fears related to institutional instability are creeping into the market? We better define the economy at this point. The economy is a set of institutions. But what is an institution? An institution is how we do/accomplish things. For example, if we want an academic degree we go to college/university. If we want a loan, we go to a bank. If we want to worship God, we go to a religious institution. If we desire reform, we may pursue changing the institutions on a gradual scale – after carefully and thoughtfully drafting a plan of consequences and alternatives – unless experts determine radical surgery is needed. However, when we attempt to break the institutions without having a viable functional alternative, we can break the economy.

The downturn of investors’ sentiment may just be temporary and as such should not be of concern to us. However, the fear is that in a few months, we might be witnessing the brewing of a significant downturn in investors’ sentiment. Which are the culprits of such fear? Persistent inflationary pressures, concerns about tariffs’ effects, policies that may turn out to be outside the authority of the executive branch of the government, legal battles over policies that could take years to resolve, concerns about major conflicts of interest, the inability of Congress (a co-equal branch to the executive) to be the springboard of checks and balances, concerns about crossing the Republic’s Rubicon (the crossing of the Rubicon by Ceaser in 49 BCE brought a myriad of serious problems, abolished the Roman Republic, and became the cornerstone of Roman instability) while abolishing institutional guardrails, spending and deficit concerns, uneasiness and solicitude about the care required in relation to respecting and obeying the rule of law (if a functional democracy is desired), national security concerns due to the abolition of soft power institutions while abandoning allies, concerns related to the design and execution of reliable and competent strategies, fears for an avalanche of consequences if civil institutions collapse, etc. All those fears are on top of rising concerns related to corporate earnings growth and an overpriced market.

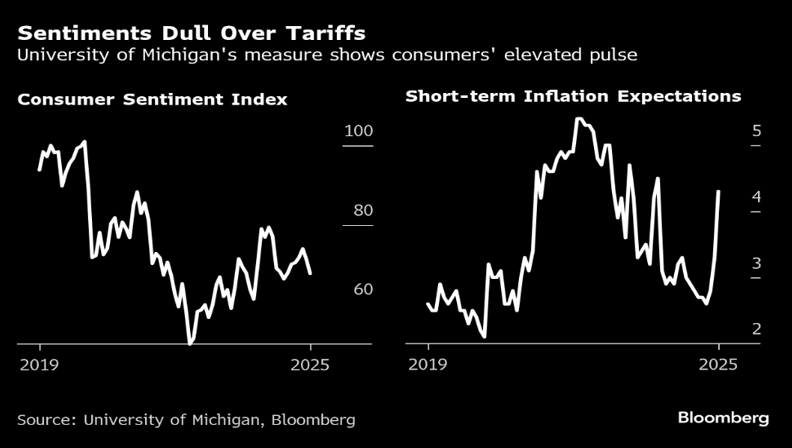

There is little – if any – doubt that the US economy is strong and is expected to remain strong. Reported corporate earnings in the fourth quarter of 2024 were healthy and mostly exceeded expectations. The market gyrations and volatility are mostly due to misfiring regarding expectations and policy uncertainty. Case in point are the rising inflationary expectations as shown below.

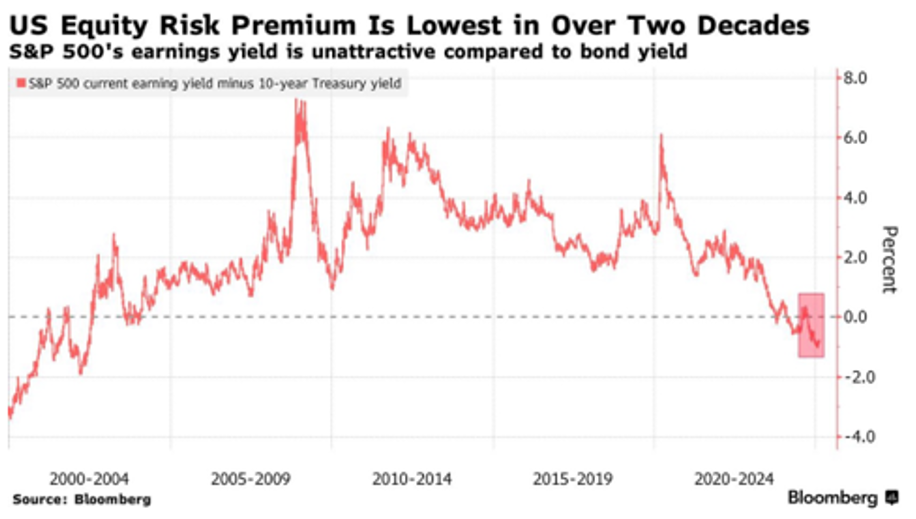

The rising inflationary expectations could impact consumer sentiment as shown above and that could in turn affect sales and earnings. This is a source of fragility in the markets (equity and bond alike), and completely different than the volatility observed in the first Trump administration. Due to the fact that markets are mispriced, rates are significantly higher than 7-8 years ago, deficits may be unsustainable, and a crisis of legitimacy may be brewing. As Tim Hayes, investment strategist at Ned Davis Research, states, this amalgam of concerns points to a defensive portfolio strategy due to a possible worsening macro environment. Under these circumstances, any event can become a catalyst for market turmoil. It is our opinion that the declining (currently in negative territory) equity risk premium (ERP) – see below –signifies below-average future equity returns.

Amid all these developments, we reiterate our position that investors need solid anchors that have intrinsic value and do not represent third parties’ liabilities (like bonds). Gold prices have been reaching record levels (exceeding $2,900/troy ounce) due to rising uncertainty, geopolitical and geoeconomic tensions (like trade war), and central banks’ buying of gold, to name just a few of the reasons for the upswing in gold prices. However, as we have advocated in the past, the US may need to switch from liability to asset management. Current gold reserves are mispriced at $42/troy ounce. The last repricing was more than 50 years ago (from $35 to $42), and that repricing co-underwrote the rising price of gold that took place in the 1970s.

Such repricing of gold reserves will lower the need to issue bonds, and/or underwrite tax cuts (otherwise the expected tax cuts could shake up the fundaments of the debt/bond market), which in turn could lower inflationary expectations, reduce the supply of bonds, and consequently increase bond prices and lower rates. If the US Treasury moves in that direction, then gold prices are expected to increase significantly.

If real money (gold) is repriced upwards, then we should expect fiat money (paper money), including the dollar to become weaker, which could be part of the new economic agenda. A weaker dollar could further boost demand for gold.

No doubt, we live in interesting times!