As of yesterday (July 4th), it seems that the European debt crisis is entering into a new phase, with the expected new downgrades of Greek paper by the major rating agencies, which warned that “selective default” is at hand, due to the terms of the rescue package proposed by the EU leaders.

It has long been our position that no country or firm became wealthy due to its consumption patterns and debt accumulation (packaged as “bailouts”) habits. Unless the bottom is identified, lenders cannot be assured of what to expect. A form of a Brady Bonds plan, as proposed by the Center of Financial Stability might work if accompanied by interest rate caps, a form of Eurobonds that would serve as the collateral base/anchors and prospects for growth. We still believe that a storm is forming that will challenge conventional wisdom and practices and will demystify valuations of different asset classes.

Recent monetary developments – including the extensions of the swap lines between the major central banks – accommodate currency distortions and misalignments while they also magnify mispricing of asset classes and hence contribute to global imbalances in terms of trade accounts. The graph below shows that the correlation of the Euro and the price of oil is breaking down and this is but a minor example of what we believe could be a period where similar relationships will be challenged; all at a time when the EU’s cohesiveness is at doubt, US debt ceiling debates distract and distort attention away from the real issues and Chinese growth is slowing down (see second figure) at a time where loans they made during the crisis are coming due at their local banks.

The recent agreements signed between China and Russia last month point to the a rising tide of currencies’ debasements and misalignments given the inflationary pressures in Russia as shown below, especially when we take into account the ECB’s position with the more than $2 trillion of potential questionable paper it has accumulated and the Fed’s leverage ratio of more than 40:1.

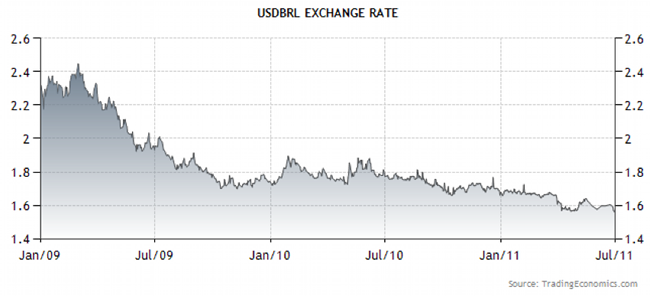

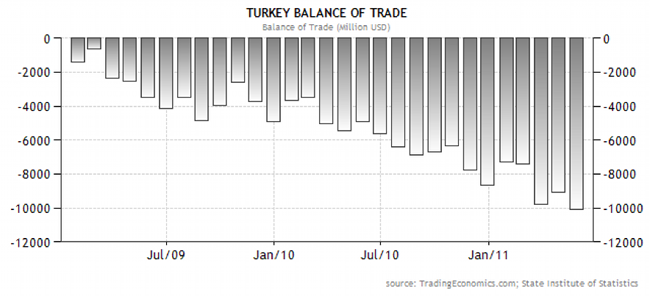

We are also of the opinion that two other leading developing countries, Brazil and Turkey (whose GDP growth recently exceeded that of China’s) are facing significant issues in terms of currency pressures (Brazilian currency has been appreciating rapidly as the following figure shows), while Turkey’s current account deficits point to possible currency depreciation in the foreseeable future).

The gathering storm around the world calls for a crisis management summit similar to the one that took place more than 25 years ago known as the Plaza Accord. Fortunately, back then Chairman Volcker had an official role. Maybe it’s time he is given a new real official role before we start singing

Sic transit gloria mundi…