The job report last Friday was dismal. Payrolls fell for the first time this year, indicating that the private sector feels uncertain about the depth of this recovery. We remember that it was in early April when Larry Summers (head of National Economic Council) was talking about the recovery approaching “escape velocity”. Obviously, something has gone wrong.

At the same time a deeper look at the employment report indicates that the average hourly wages fell also, as did average weekly hours. Even more troubling is the fact that more than 650,000 workers dropped from the labor force, indicating that their discouragement will be defusing spending expectations.

The cycle called replenishing inventories is ending, and the risks both for the US and EU is that the recession will be knocking at the door by year’s end. Moreover, HSBC survey of purchasing managers in China shows that production there is slowing down due to declining global demand.

From a technical standpoint, we observed “death crosses” appearing in Japan, Europe, and the U.S. Historically, when death crosses appear, recession is approaching. (A “death cross” is defined as the moment when an index’s 50-day moving average falls below its 200-day moving average). When “death crosses” are combined with the latest data from the ISM (Institute of Supply Management) that show slowing manufacturing activity, then we could say that the declining global markets of the last few weeks indicate the discounting that comes prior to the actual event.

Pending home sales tumbled by almost 30%, suggesting that the real estate sector crisis is far from over. If we take into account that the commercial sector has not counted yet its losses, then the slowdown in construction will advance the chances of the double dip.

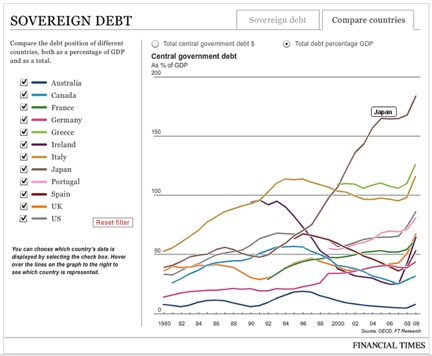

The following figure shows central governments’ debt as a fraction of their GDP. The fact that stimulus programs are running out of steam – per austerity dictates – should be considered as additional ammunition that the manufactured recovery has short legs.

We consider it imperative that individual and institutional investors prepare contingency plans for a dip that will shake markets and unravel painful lessons. The recent drop in prices of metals reflects buying opportunities. We remain upbeat on our main call of the last ten years, that we are in for an unprecedented rise in the price of hard metals and especially gold. Hard assets have proven to be one of the very few asset classes that have shown significant gains over the course of the last decade.