The war of words was in high gear this past week. German officials demanded participation of the private sector in a new Greek bailout package that is estimated to be around $130 billion, i.e. about 40% of the Greek GDP. If that happens, then Greece will have borrowed – in a form of a bailout – close to 80% of its GDP in just two years! We cannot help it but ask: CUI BONO?

We will answer shortly the question of who benefits, but first a few words about the evolving EU situation. Germany wants the private holders of Greek bonds to accept a rollover and exchange maturing bonds with ones that mature 5-8 years later. The rating agencies proclaimed that this would be considered a “selective default” that may initiate a credit event, where holders of bonds’ insurance policies a.k.a. CDSs could cash in. The European Central Bank (ECB) along with France considers such an option a non-starter because they fear that the markets will immediately think that the same thing will happen to Ireland, Portugal, Spain and possibly other EU countries. Moreover, they are afraid of the effect that such a solution will have on the balance sheets of banks throughout the EU and consequently of the effects on its own balance sheet (see our last two commentaries).

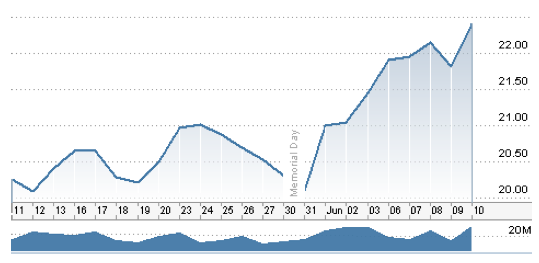

In our US markets risks are building up to the point that we would not be surprised if shorting the market could turn out to be financially rewarding, as the following graph shows.

Pro Shares Ultra Short S&P 500

The EU markets suffer from a worse predicament, also reflected in the performance of EU stocks, as the next graph demonstrates. Specifically, we can see from the graph below the performance of the S&P 500 (green line) along with the Euro Stoxx 600 Index (orange line).

The co-movement and co-determination is obvious. The Euro Stoxx 600 fall is steeper, reflecting the greater EU uncertainties.

The EU uncertainties are coupled with lower US expectations about profitability, sales, and the possibility of an economic slowdown on both sides of the Atlantic. In addition, signs of a significant Chinese slowdown and an end to that housing bubble (real estate prices actually declined in China in the last few months), add to the mixture of uncertainty, inflation, stubbornly high unemployment, political turmoil and international upheaval. We live in historic days, maybe as historic as a combination of the early 1990s (geopolitical changes in the eastern block), the late 1930s (trying to get out of the depression), and the late 19th century (industrial revolution).

We would not be surprised if a QE3 takes place, without an official title. In view of a potential major storm, we have decided to integrate some art in our writings, and try to draw lessons from that. Hence, and given Chancellor Merkel’s visit to the White House last week, we offer our readers what is known as GERMANIA FLORESCENS (‘Prosperous Germany’), as it can be seen below. In the center of the picture is Athena the Greek goddess of wisdom and prudence. (Isn’t it an oxymoron these days that the Germans’ concern is about Greek debt?) Next to her are Demeter and Dionysus, who represent the abundance of food and drink. In the foreground we can see the two famous German river-gods: Danube on the right, and the Rhine on the left. The presence of water – our next newsletter’s topic – symbolizes its importance for all human activities. On the right side we see scenes of trade and shipping, the arts (painting), and the sciences (astronomy). To the left are additional scenes of economic activity (mining, hunting and warfare). Victory is seen riding on an eagle, while the figures of Prudence, Religion, and Understanding reflect peace. Germany rises victorious and rules with magnanimous harmony. In the center Constancy and Faith are topped by Justice which in turn is crowned by Fame. It is truly an amazing piece of art which signifies the concept of co-determination that is exacerbated by the forces of globalization. Simply put: We are all in it together.

What a contrast then with the infighting that we observe among high EU, ECB and national officials. The elements of a major financial storm are getting stronger and the markets shake, while speculators rejoice. If we look at the S&P 500 index above in the last six weeks, we can clearly see the symptoms of the formation of that storm.

Markets’ normalcy cannot be restored unless debt issues are addressed on a global scale. Austerity measures seem to make the problems worse. They exacerbate recessionary pressures, lower spending power, depress tax collection, increase unemployment, and downgrade business prospects. Bank lobbyists push more loans as the answer! Governments seem incapable of understanding that the fat in their economies is the debt they have accumulated. Who benefits from all the interests, the fees and the penalties? The accumulation of debts may be postponing the day of reckoning, but makes its effects much worse. When governments undertake to bailout holders of bonds, eventually they mortgage the future of generations to come, and endanger their national sovereignty while undermining their own democracies.

Debt creation destroys wealth, competitive advantages, and degrades the asset base of an economy. It forces a fire-sale of major assets, while it leaves its people with an internal devaluation of their purchasing power via a debt deflation process where wages decrease and businesses go bankrupt while debts increase. Thus, the real economy that produces goods and real services shrinks while the financial sector enjoys the magic of compound interest. It seems that the lesson of co-determination has been lost and forgotten. Financial mechanisms of credit creation using the camouflage of toxic paper as collateral have distorted the basic lesson taught by a prudent policy that proclaims the ability to pay as a guiding principle of harmonious economic relationships. It is an abomination to the principle of co-determination to channel productivity gains just to the financial sector. Such a practice has backfired and created havoc in the real economies throughout economic history, as Edward Chancellor and Charles Kindleberger have demonstrated in their books, Devil Take the Hindmost and Manias, Panics, and Crashes.

The mentality and practice of debt servitude endangers rebellion and a populist movement. On the contrary, when the principle of co-determination (curiously enough implied by Adam Smith) is applied and guided by the other equally important principle that when interest is paid out of surplus in the real economy, growth springs out and waters the flowers of business activities. It is absurd to try to measure an economy’s wealth by the magnitude of its debts. The latter are claims on the real economy, and thus by definition they shrink it, rather than expand it. Debt creation misallocates capital, distorts prices, inflates values, creates bubbles, and ultimately destroys the spirit of capitalism. Therefore, debt service does not allow the formation of capital and eventually reduces incomes and prospects for nations and households.

Is it time to proclaim ode to a Jubilee?