On August 9th of last year, we published on this website a commentary on what amounted to be a prelude to our September newsletter, regarding the Chinese bubble.

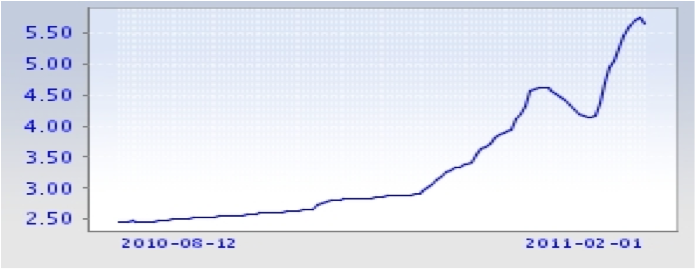

A few months later and in the beginning of the new Chinese Year, we observe some troubling developments in the interbank Chinese market. Specifically, and as the following figures show, the interbank rate in China – known as SHIBOR – has more than double since August 12, 2010.

Three-month SHIBOR rate

One-Year SHIBOR rate

What could that mean? For starters, we would like to offer two explanations: First, the Chinese economy has started feeling the heat from the slush funds, the misallocation of capital, the rising food prices, the non-performing loans (NPLs), the credit overextension, and the natural maturity that comes from high growth rates. Second, the authorities in order to avoid an abrupt bursting of the different bubbles, have been trying for months now to slow things down (hence the increases in the banks’ required reserves and the higher lending rates, among other things).

What could the consequences be and what would such doubling of the SHIBOR mean for the international markets? Again, we will discuss for now two potential effects: First, it may show liquidity drying up in the Chinese market. If Chinese banks hesitate to lend to each other – possibly due to fears of counterparty risks due to NPLs – then liquidity will dry up for the rest of the world. Let’s not forget that in the global credit-scheme of things, it is the promising Chinese market that feeds the credit mechanism with liquidity, unless an alternative is found. If that dries up, the consequences for global markets would be significant in terms of lending, higher interest rates, growth and asset valuations. Second, the maturing bills in the Chinese market and the expectations for more hikes in interest rates impose funding dilemmas for corporations and nations. The People’s Bank of China (PBoC) recently initiated targeted reverse repos after they had suspended them more than two years ago in the midst of the financial crisis. That move alone may indicate inability of the targeted banks to handle liquidity pressures. Given that China is in the beginning stages of its credit tightness program, then we could assume that further tightening will make things worse and will betray inability of some of China’s banks to handle financial stress.

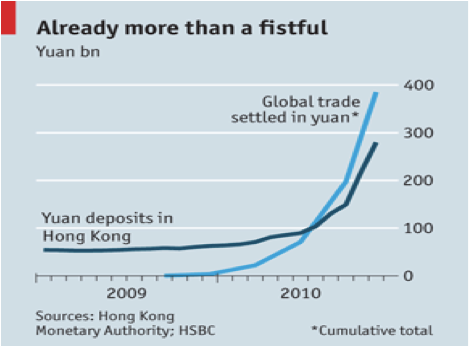

At the same time we observe that China has been trying to promote the yuan (RMB) as a rival to the dollar for reserve currency purposes. Already some trade between China and Brazil, as well as between China and Russia is denominated in their respective currencies. China is afraid that the Fed’s policies have been having significant effects on global financial stability and capital flows. However, without the Fed’s swap lines global liquidity would dry up and another round of recession would materialize almost with certainty. The Chinese efforts to place the yuan on the international scene can be seen in the following graph.

Last year the amount of trade settled in yuan rose substantially. At the same time global deposits in Hong Kong increased at exponential rates. Global corporations and entities such as the World Bank have been issuing “dim sum” bonds in Hong Kong utilizing cash parked in offshore yuan accounts. It seems that China will try to use the offshore yuan to pump liquidity into the mainland in order to uplift the interbank market while at the same time it is acquiring assets abroad.

Liquidity may need to dry up in order to avoid a hard landing scenario in China. However, given that the global economy is not out of the woods yet growth is needed in order for the prospects of employment and stability to materialize. The unrest in the Middle East and the call for prosperity, shared growth, and democracy require the establishment of a middle class there as a prerequisite for such developments. It might turn out that the need for global liquidity – in the midst of the Chinese growth and liquidity haircut – will find an outlet in the Middle East and in that case the New Silk Road will also take advantage of the significant resources and assets there.

Ode to exits via the New Silk Road!