Since the beginning of the year, equity as well as debt-related markets have been on an upswing. The concession given by the Fed on rate increases, the truce on trade disputes with China, the stabilization of earnings expectations, and the encouraging news on employment have all contributed to the upswing. It is obvious that the Fed is not concerned at this stage about an overheating economy, especially if we take into account the fact (as shown below) that business costs are coming down.

As the landing of earnings expectations takes place, we would like to caution that well-known companies such as 3M expect growth in earnings not to exceed 6.5% during the year, and that might be indicative that the growth rate of earnings could stay within single digits. Earlier this year we wrote that the support levels around the world may be turning out to be resistance levels (Domestic & International Developments: Market Reaction and Assessment). Therefore, our caution relates to the fact that even if momentum trading advances equities beyond those resistance levels, equities may reverse course when earnings potential is fully realized. Upside surprises on earnings have been smaller than usual, and that might be indicative of single-digit growth.

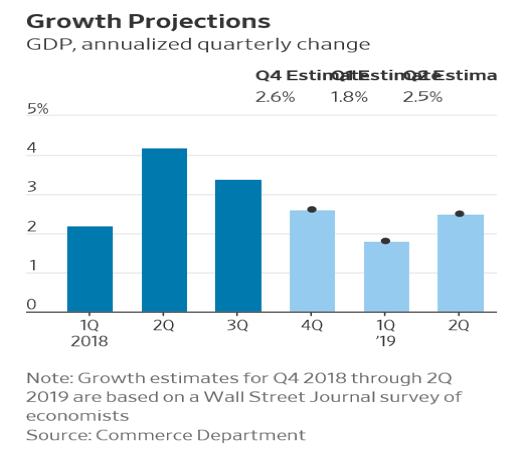

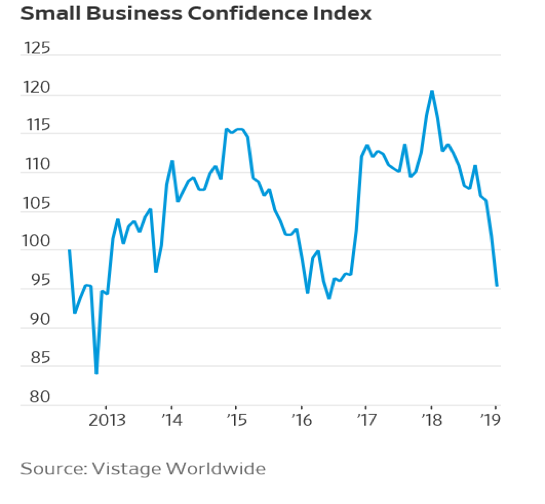

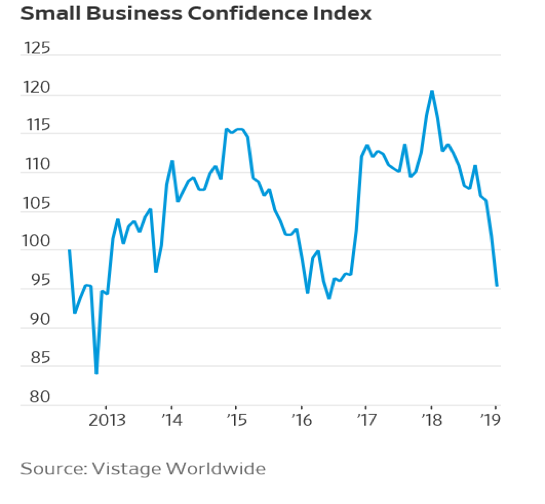

Given that valuations are not especially stretched, we should not expect an earnings recession this year (first-quarter earnings are expected to be dismal, but earnings should improve in subsequent quarters), and given rates suppression, equities are still poised to do better than last year. However, the economic slowdown (see graph below) also raises a question of adding defensive stocks in a portfolio, especially if we take into account that small business confidence index has been falling, as it is also shown below.

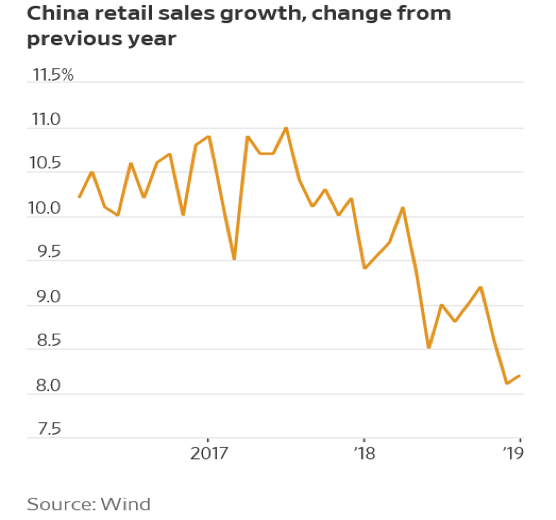

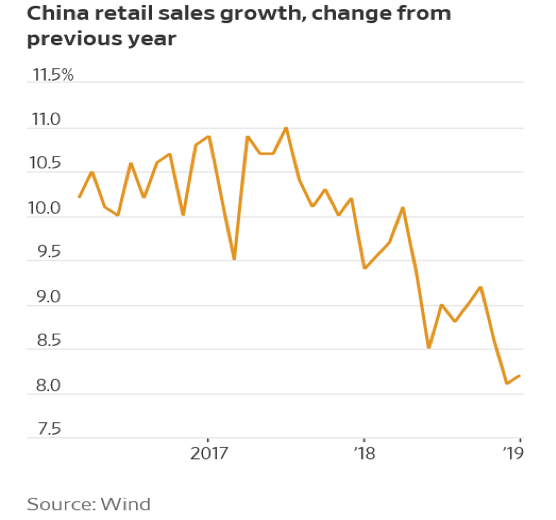

For several weeks now we have been advocating the position that Chinese Internet-related stocks are poised to perform well this year, and indeed they have registered significant gains. However, we cannot overlook the fact that the corporate credit situation in China is very problematic and the 3 trillion of troubled loans is a red flag. The country experiences a credit crunch and the fact that companies which specialize in distressed debts are flocking into China is indicative of the situation, as is the fact that the slowdown in what is known as “total social financing” is dramatic. The situation is expected to improve in the near future due to increased liquidity by the central bank; however, in the medium term the situation could deteriorate significantly. The Chinese slowdown can easily be seen in the following figure.

For several weeks now we have been advocating the position that Chinese Internet-related stocks are poised to perform well this year, and indeed they have registered significant gains. However, we cannot overlook the fact that the corporate credit situation in China is very problematic and the 3 trillion of troubled loans is a red flag. The country experiences a credit crunch and the fact that companies which specialize in distressed debts are flocking into China is indicative of the situation, as is the fact that the slowdown in what is known as “total social financing” is dramatic. The situation is expected to improve in the near future due to increased liquidity by the central bank; however, in the medium term the situation could deteriorate significantly. The Chinese slowdown can easily be seen in the following figure.

Speaking of slowdown, we should also mention that the Eurozone grew at its weakest pace in four years in 2018 and Italy is already in recession. Therefore, the slowdown in both the US, China, and the EU feed the concerns about global expansion and hence of earnings prospects. (Of course, we leave aside for now the concerns about Brexit’s impact on the EU trajectory).

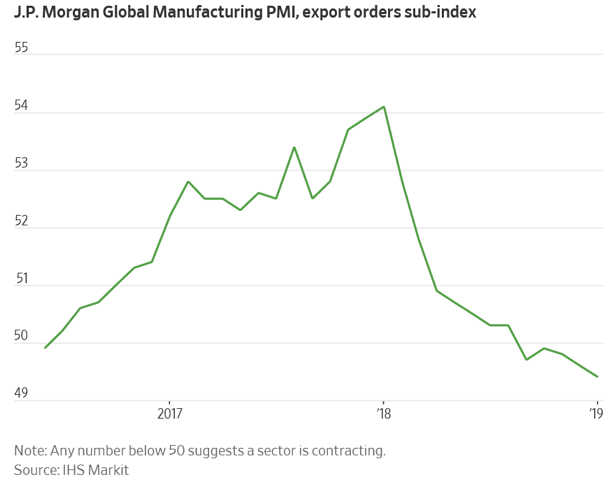

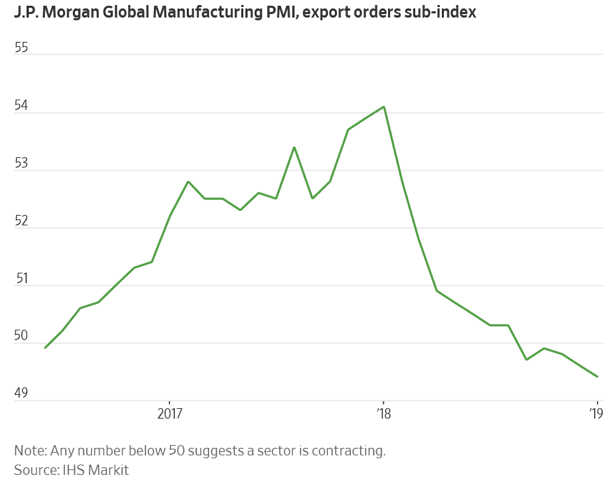

In closing this week’s commentary, allow me to state that the slowdown observed should also be seen with trading lenses.

The graph above exemplifies the slowdown in shipments and manufacturing, but it could also be observed in services too. Our word of caution is that markets may be myopic by the Fed’s pause on interest rates and the pause on the Chinese disputes, but declining shipments caution us to be a bit more defensive.