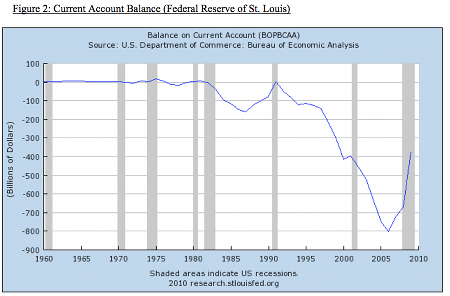

The following is a series of thoughts about the threat of deflation knocking at the door of the U.S. economy. The U.S. economic growth is most dependent on the consuming culture of its citizens as it comprises 70% of our GDP. Yet the last decade saw the trend of tapping credit lines to keep our consumptive habits alive. As Figure 1 below demonstrates, the real disposable income has seen a downward trend. This pattern helped feed the explosion of the current account deficit (which includes the trade imbalances) portrayed in Figure 2.

International liberalization of trade and finance helped relocate the production of industrial goods in areas of the lowest labor costs, a tenant of comparative advantage. This shift in production contributed to the downward pressure in wages seen above and lowered prices on a variety of goods and services, especially with the admittance of China into the World Trade Organization. With the recycling of trade surpluses in Asia, as well as elsewhere, into dollar denominated assets, the United States saw a period of lower prices and higher growth, typically two diverging phenomena, not to mention low interest rates; it pays to be the international reserve currency doesn’t it?

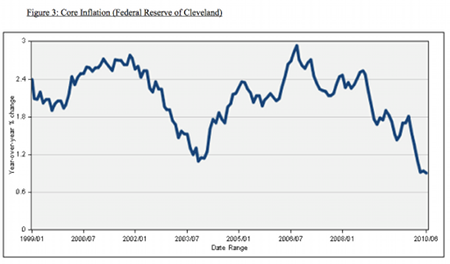

With inflation not a threat (Figure 3) the Federal Reserve was justified in lowering interest rates, and just to be on the safe side the banking sector would develop new, convoluted instruments that were supposed to safeguard it from risk; we know how the latter turned out.

The creation of credit lines, reserve assets, and rising asset prices were explained by growing demand and the diversification of risk in the financial system during the boom of the mid 2000s. With nothing going wrong, the financial sector saw no reason to not continue pumping credit, believing that demand would continue to rise. Yet with wages in decline, credit and supply were bound to become excessive at some point in the future as the public would not be able to afford assets which were rising in value while incomes were in decline; the bubble was destined to burst.

And then it happened. Now the air is being let out.

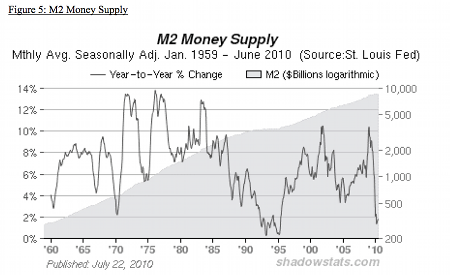

Losses spread throughout the banking sector thanks to counter-party risk. Corporations and households were shut out of the credit markets leading to layoffs, losses, defaults and drastically falling prices since 2008 (as demonstrated in Figure 3), and a vast amount of excess capacity (Figure 4). This glut of excess capacity will continue to persist as long as both the securitization and credit markets remain frozen, meaning employment has a ways to go before recovering, wages will continue to experience downward pressure, deleveraging will continue, corporate profitability will suffer, the money supply will contract (M2 has contracted, see figure 5 below) as Irving Fisher-the generator of the debt-deflation theory- predicted and asset prices will continue to drop.

With excess capacity still entrenched, deleveraging rising, consumption dropping, and employment opportunities nowhere to be seen, escaping the current downfall is not in the foreseeable future for the U.S. economy regardless of what happens in the stock market.

Deflationary pressure is a complicated dilemma, especially given the current stage of the U.S. economy. Once deflation has actually kicked in it can ravage borrowers, as every dollar has become more scarce and thus more valuable, meaning that paying back debts is very costly, opposite of inflation. The normal diagnosis is aggressive monetary and fiscal stimulus so as to reflate the economy but with interest rates already near zero and political will absent, both tools seem useless, unless the Fed goes into another more aggressive round of quantitative easing a.k.a. as the printing press, where – as St. Louis Fed Preside Dr. Bullard suggested last Thursday – the Fed will start expanding again its balance sheet by purchasing paper from market participants which will be credited to its balance sheet as “assets”. Moreover, credited reserves are not making their way into the real economy to roll over debts since the banking system is fearful of counterparty risk. The question of course is what will happen to the hundreds of billions of debt that will require refinancing over the next two years? With deflation knocking at the door, wage and incomes will fall, unemployment could worsen, excess capacity will increase, productive industrial investments will decline, defaults will increase, recessions will become more frequent (see what happened to Japan between 1990-2009), and instability will thrive.

It seems that we are on a ride heading for a global shake up.