It’s a fact: Alarm clocks destroy dreams. Let’s destroy the alarm clocks. They wake us up from our dreams; interrupt our narcissistic visions of high flying markets and rosy paths of a prosperity bought on credit and paper assets.

As we are drafting this, announcements came in that retail sales are entering bear territory. Yesterday, the Fed was bearish in its outlook for the recovery. They see that things are softening. As belts are tightening around the globe due to austerity programs, prognosticators pronounce the need for greater monetary easing, invoking even Milton Friedman in their calls for more printing of the fiat currencies. Let us just reiterate that we will not cease on our argument that we cannot print our way out of the mess we have put the global economy in by over-extending credit based on questionable(in the best case) or worthless(in the worst case) paper collateral.

Bubble TV channels are hosting guests who are asking for a second round of quantitative easing. They say that Europe is not out of the woods yet. Banks are hurting. Investors (institutional and individual) are seeking safe havens and are flying to quality. Guess what? A bubble is forming in the bond markets and when it bursts (just imagine a scenario where the Chinese start selling bonds) the alarm clock will start buzzing, but it might be too late.

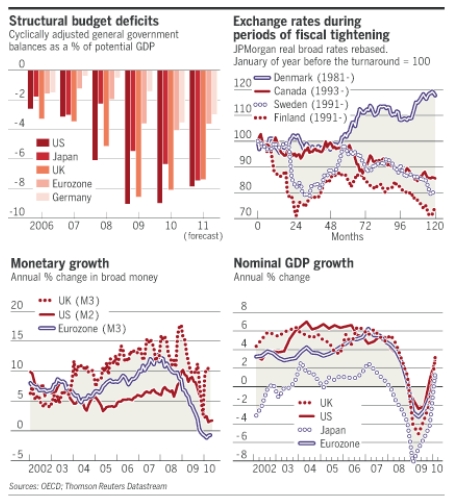

In recent readings we discovered the following graphs. What is wrong with these? Let’s start with the first one: It’s a distorted picture of the real deficits. The keywords there are “cyclically adjusted” and “potential GDP”. The first one portrays what the deficit would have been if there was no recession. The second phrase portrays the deficit as a fraction of what it would have been if the economy was operating at full capacity. Guess what? If my grandma had had wheels, she would have been a bus! Recession is a reality, as is the fact that the economy is not at full capacity.

The numbers are coming in, and show underutilized capacity, high unemployment, and deflationary pressures. Some countries are trying or will try to devalue their way out of the incoming double dip. Analysts look at the second graph below and say that Sweden, Finland, and Canada solved their problems by letting their currencies lose ground in the 1990s. Guess what? The macro environment was different back then. The problem back then was contained within a few small economies (at least much smaller than the US). Now, we are dealing with a crisis that has hit the US and the EU at the same time. Back then interest rates were high. Now, they are almost at zero. Back then China was not a major player. Now, through its mercantilistic strategy it undermines the prospects of current account adjustments. Back then the banking sector was much healthier than it is nowadays. Back then cases of over-leveraged and over-indebtedness were not as extensive as they are now. Back then global demand was rising. Now, global demand is weakening.

You may ask: What is then wrong with the third graph above? Why is monetary growth in negative territory? Haven’t the central banks expanded money supply? Certainly they have increased the monetary base. That’s why reserves – as we have pointed out in monthly newsletters posted in our website – have exploded in the banking system. However, those reserves have not found their way in to the real economy. That’s part of the exit strategy that central banks are looking for. The danger of course is that if they are released, inflationary pressures will surface. At the same time, in order to be released, you need to find credit-worthy customers. Guess what? The latter become fewer and fewer. Thus, if you do not have credit-worthy customers you may have reserves, but money supply drops, as it did in the 1930s and as it does now.

What is wrong with the fourth graph then? The reported growth is driven by government spending. The austerity and belt-tightening measures will put the brakes on such artificial growth, while our anticipation is that central banks will cease being the customers of last resort for the business of securitization, as our next commentary will explain. Sorry, if we sound the alarm clock, and destroy a dream. Are we on the bus yet?

Please enjoy the ride!