During 2018, almost all major asset classes experienced declines. As previously commented, many sectors have dropped more than 20% since last September and while safe havens have made some gains during the last quarter, they still have not experienced yet the gains that they could normally have enjoyed in a significant downturn like the one we experienced in the last quarter. Could that be an indication that the equities market went through a normal correction and they have at least another round of an upswing?

We retain cautious optimism for the markets in 2019, but we also question if the highs previously reached in 2018 could be reached again. The trend that is being formed is made up of earnings and growth repricing, geopolitical and trade tensions, and uncertainties related to Brexit and the EU endeavor. (We are not that concerned about the Fed’s moves, as we believe that no more than two rate increases will be taking place this year).

The bond market and especially the 14 trillion 10-year US Treasuries market signifies the concerns about earnings and growth. As the graph below shows, the partial flight to safety in the month of December drove down the yield in a substantial way. Reports released yesterday regarding Chinese and European growth will probably add to those concerns as will do Apple’s warning (following yesterday’s market closing) about revenue growth mainly due to possible declining sales overseas.

The majority of the analysts expect a reversal of the yields trend in 2019. We humbly disagree. If that reversal were to take place, then the implication for the risk assets (such as stocks) is that they should experience a rally to the north of 12%, which is not that likely given the earnings and economic growth slowdown. Furthermore, such a risk-on approach and flight away from bonds would imply strengthening of the dollar and continuous troubles for emerging markets.

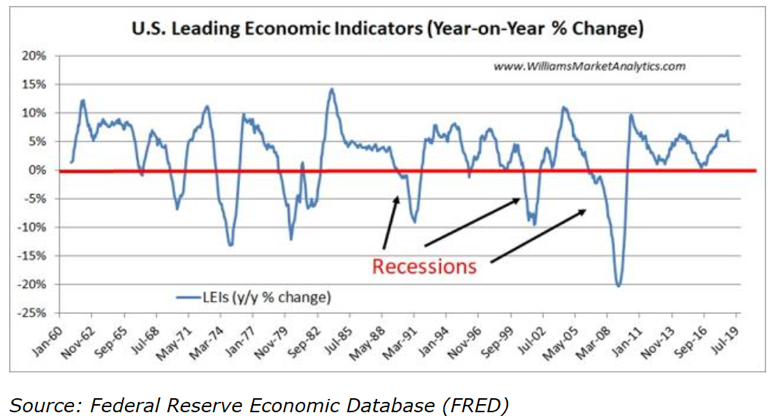

On the contrary, we believe that the forces that shape up the trajectory of the dollar signal a weakness, assuming that a disastrous fallout does not occur in Europe due to Brexit and the Eurozone dysfunctionalities. (Let’s not forget also that EU-wide elections for the EU parliament are set for May and populists could gain a significant number of seats.) Therefore, we do not expect the 10-year Treasury to reach 3.5% as analysts proclaim, but we would not be surprised if it reaches 3.10%. At the same time, we expect selective emerging markets – and especially China – to recover. Furthermore, we do not expect an inversion of the yield curve to become a feature of the debt markets in 2019 (temporary inversions might happen), and we do not expect a recession in 2019 because both the manufacturing and the non-manufacturing PMIs still signify expansion (without excluding though the possibility that recessionary signs may make their appearance by the end of 2019) while also the LEIs (Leading Economic Indicators which are made up of ten forward-looking variables) still show growth prospects, as shown below .

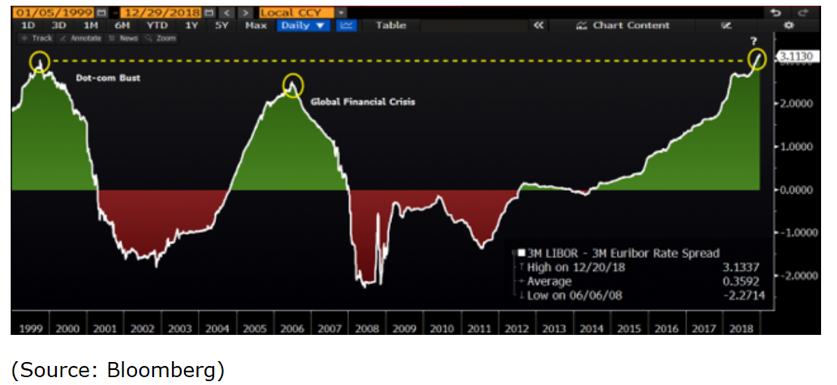

The economic and financial ecosystem (a topic we will be visiting throughout this year) is undergoing a metamorphosis. A transformation in the system takes place when a factor such as technological evolution occurs. A metamorphosis of the ecosystem takes place when technological revolutions occur at the same time of political, social, and geopolitical transformations, and we believe that we have entered into such a period. Therefore, as the changes are intertwined, we cannot just say that the change of the credit cycle may be revising Minsky’s financial instability hypothesis, because the tipping point may not be the credit cycle as the metamorphosis unfolds.

The metamorphosis may coincide with the widening difference/spread between the Libor and the Euribor, as shown below (previous peaks coincided with global events that metamorphosized the way we think and do business).

Therefore, as we proceed with cautious optimism in the New Year, we think that investment strategies should be further anchored with assets that do not represent third parties’ liabilities or just paper wealth, hedged in the sense of uncorrelated asset classes and options tactics, seek value opportunities in recognizable names that have strong fundamentals, but also leave room – depending on the risk tolerance of each investor – for the evolving technologies and platforms that are changing our lives.