More than twenty years ago I read a book by Tom Sine titled “Mustard Seed versus McWorld”.

I had met the author a couple of years earlier when we both served on a panel together, but what made me get that book was its intriguing title and the foreword by Ravi Zacharias, a person whom I admired (and who recently passed away) and who had influenced my worldview. In that foreword, Ravi Zacharias wrote: “Quick-fix solutions have trivialized the serious and reduced reality to sound bites.” In my limited understanding of things, that sentence reflected a rising tide of forces that was changing our world, our way of doing business, our monetary affairs and the way collateralization and securitization was about to change credit creation, planting the seeds of forthcoming crises, while also undermining institutions and corrupting our minds. The result is that nowadays our youth know about Tik Tok but may have never heard about Epictetus. No wonder then that money from a helicopter is a welcomed “solution”.

Forty years ago, the great late Senator Mark Hatfield wrote the foreword in another book by Tom Sine. That book too was about the mustard seed, a tiny spice seed that can truly make a difference. In a world that is becoming the terrain of great power rivalry – as Matthew Kroenig explains in his outstanding latest book of the same title – and at a time of debt explosion, tech revolution, helicopter money, financial repression and when a pandemic is unraveling policies and practices, we tend to formulate an opinion that the pendulum may be swaying from risk to uncertainty. If that premise were to materialize, then our geopolitical and geoeconomic processes need to be enhanced with mustard seeds stamped also with Epictetus’s and Zeno’s logos, but let me revert to that at the end of this commentary after reviewing some evolving facts.

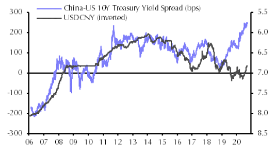

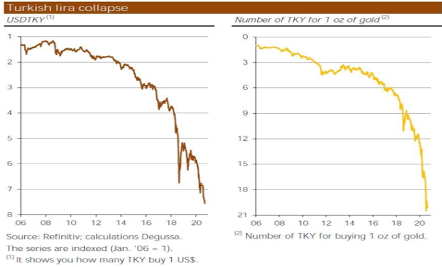

The evolving terrain of great power rivalry will, sooner or later, be reflected in the exchange rates between the US dollar and the Chinese renminbi. Countries that allow the devaluation of their currencies soon lose their destiny and their geopolitical and geoeconomics significance. The facts at this juncture point to an appreciation of the renminbi, as shown below, due primarily to three factors, namely: revitalization of Chinese exports and lower commodity prices both of which enhance net trade position and thus the value of the currency; greater negative economic hit/impact due to the pandemic in the US; and finally interest rate differentials in favor of the Chinese currency (see graph below). We wouldn’t be surprised if the renminbi which currently stands at 6.767 dollars appreciates to the level of 6.25 dollars by mid-2021. The US cannot afford to jeopardize the status of the dollar, even in the smallest iota, and should do anything in its capacity to limit the influence of the renminbi which is a mirror image of an illiberal and oppressive regime that seeks to subjugate the world into its image. A country that loses sight of its currency’s importance and adopts populism has pretty good chances to see its currency follow the Turkish lira trajectory as shown below.

As noted in our last week’s commentary, the figures across the US and the EU portray that the economic recovery may be stalling, which by itself will complicate fiscal and monetary affairs as well as forex dynamics. We show below four additional graphs (on top of the one we discussed last week). The first one shows the slowdown in retail sales in the US, and the second one the slowdown in construction activity in the EU, while the bottom two reflect the manufacturing and overall slowdown. The fact that the recovery in production is still lagging, the spending turnaround that we have observed has been creating pressures on inventories and supply chains, and hence the upward pressure on prices that we have been observing.

Upward price pressures do not support financial markets (debt as well as equities) while enhance the cheapening of currencies. Of course, the value of real hard assets and real money (gold) increases when currencies lose ground. However, a neurotic reality is emerging due to a rising uncertainty regarding the November 3rd elections outcome, which neurotic reality reflects a conflict between false suggestions and true intuitions. The result is that our geopolitical and geoeconomic developments suffer from a repression of conscience which is way beyond Freud’s instinct repression.

The rising uncertainty may possibly only be addressed when we ask some fundamental questions such as “why is a painting worth more than a photograph, a sculpture more than the model, a symphony more than an assemblage of sounds, a book more than a dialectical puzzle of ideas, and a drama more than a dialogue?” The answer, of course, is that they awake unconscious resonances. The spectators in a hall, in a theater or in an arena no longer represent individuals but the collective personality of an undefinable unity that awaits an awakening of its unconscious, symbolic life. On the conscious plane – as Paul Tournier wrote decades ago – there are only arguments and conflicts. One can give structure to a crowd either by mobilizing their instincts (feelings of hatred and fear) or by awakening their sense of advancing what is just, true, virtuous, right, moral, decent, and proper.

Epictetus (a man who began life as a slave, lame and weak in body) exemplifies a person’s ability to transcend external adversities and attain tranquility. Reason and will are to be informed by the transcendent reality of logos. We may indeed be headed into a period of multiple rides on the wild side. An understanding of the undercurrent causes and steadfast devotion to what is right, true, virtuous and fair is fundamental, in order to overcome rising uncertainties, volatile externalities, and govern our affairs informed by the logos rather than by impulses. Mustard seeds do make a difference.