Inflows to emerging markets dropped by over 65% between July and August of this year. A strengthening American economy and the growing trade tensions have created a rout in emerging markets which is contributing to currency misalignments in Asia and South America. Investors are shifting their money to the US and we would not be surprised if Chinese authorities choose the devaluation route if tremors continue in Chinese markets.

At the same time, two developments might be underway: The first development (widely expected) is for the Fed to raise rates at the end of the month which should strengthen the dollar further. The second development might have more serious consequences since it involves China and Russia and their plans to reduce the use of the greenback in their trades. The policy response to both of these developments could be a pause in the hiking of rates in the US.

Asian countries such as Indonesia and India have seen their currencies lose 9.2% and more than 12% respectively since the beginning of the year. Of course, on top of this we should recall that the Turkish lira has lost 30% of its value while the Argentinian peso has suffered more than 50% loss since January. Countries that have large trade deficits are susceptible to currency depreciation while current account surpluses cushion currencies (case in point the Thai baht which has actually gained ground given its current account surplus of about 9% as a fraction of its GDP).

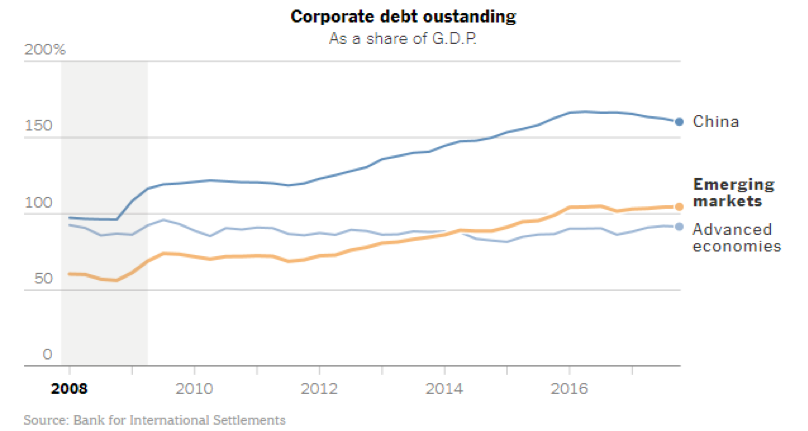

As the flow of funds reverses course and seeks the safe haven of economies such as the US, countries with large current account deficits become susceptible to shocks (case in point: Argentina and Turkey). The high debt levels in China and other emerging markets could also trigger a currency devaluation which could spark a crisis as the following graph shows.

When countries are forced to spend their international reserves in order to support their currencies, a negative feedback loop mechanism could be triggered in which foreign reserves could be depleted in a matter of weeks (if not days). At the same time, if those countries keep raising their interest rates, recessionary forces are triggered that could actually make the situation worse. When we add inflationary pressures into the mix (as is the case in Argentina and Turkey), then we may be dealing with a situation that could bring havoc in the local markets. Under these scenarios the financial system of the country becomes shaky as non-performing loans increase, business activity declines, and capital cushions are eroded.

Dollar shortages at a time of raising US rates and especially at a time of deteriorating macroeconomic conditions (due to trade tensions) could undermine growth prospects worldwide, and hence we would not be surprised if developments in the next couple of months prevent the Fed from raising rates in December, which in turn will imply dollar weakness in the foreseeable future.

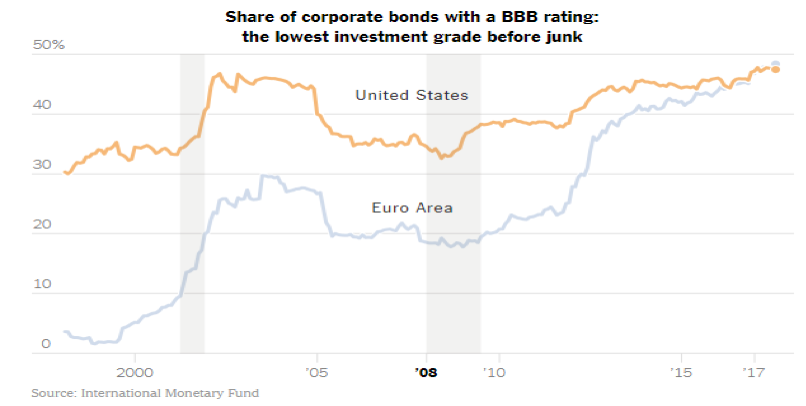

If the Fed takes into account the rising debt levels in the US and especially the rise in low-quality debt (see figure below) and also the fact that we cannot afford to pay exorbitant amounts in interest due to rising deficits, then the Fed may pause the hiking of interest rates starting in December.

If such development materializes, then we could see a reversal in the fortunes of commodities (which move countercyclically to dollar’s trajectory) as well as in the emerging markets’ prospects. Under such scenario, synchronized global growth may be reignited and emerging markets as well as commodities could be the place to invest (while equity markets will continue their upward trend).