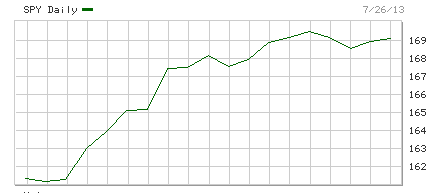

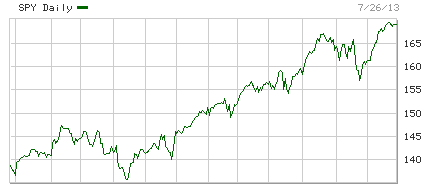

The current market record-setting highs may signify an upward bias carried by momentum and liquidity. The first graph below shows the performance of the S&P 500 over the last month, while the second graph portrays its performance in the last twelve months. Two observations are in order: First, the market keeps reaching new highs in spite of continuous problems and the fact that the fundamental issues (debt, productivity, toxic assets, shaky banks especially in the EU, unfunded liabilities, unemployment, etc.) have not been addressed yet. Second, despite a mini-correction about six-eight weeks ago, the market obtained enough momentum to break new highs.

I am of the opinion that the current trend fueled by the conversion of the monetary base into money supply (new loans) has the ability to break new highs, and thus would not be surprised if we saw the Dow Jones breaking the 16,100 level in the next couple of weeks. However, at that point and given the fact that political instability reigns supreme from the Middle East to the shores of Portugal and the fact that the EU maestro (Germany) faces an election on September 22nd, we should also expect a market retrenchment at that point by at least 4-6%.

In the whole Mediterranean we see geopolitical instability. Let’s review the cases: Tunisia, Libya, Egypt, Syria, Lebanon, Israel, Turkey, Cyprus, Greece, Italy, Spain, and Portugal. At the same time the divergence between the desired path for recovery between the US and Germany becomes wider. The US cannot afford the sclerotic German ideas to reverse the ephemeral progress it has achieved. As things are shaping up at this point, Greece will face a funding gap of over $11 billion between October 2013 and December 2014. The inability to close the gap will force the IMF to withdraw from the Troika. The latter may push Germany and Finland to do the same.

Unless provisions are made in the next two-three months a Euro debt crisis may erupt that has the potential of not only derailing the projected growth path but also of canceling out any progress made. Therefore, it may be better to confront the issues prior to the German elections and that could be the trigger for the market retrenchment.

What then should we say if our horizon expanded until year’s end? Assuming the above, I still hold the opinion that the market has the potential of reaching new highs (beyond the 16,100 mentioned above) given the liquidity, the reduction in the fear premium, and the growth agenda that the US is pushing for.