In the last two commentaries we focused on asset allocation in times of change and on particular sectors that may benefit from forthcoming policy changes. In this commentary we would like to focus on an emerging convergence and suggest that a value-oriented approach to capital deployment might meet both some defensive measures while also taking advantage of a potential market upswing.

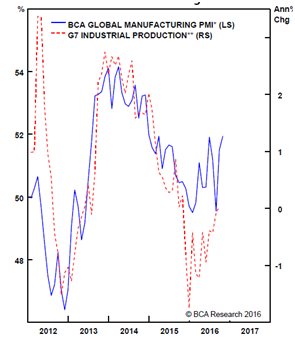

The first graph below shows an encouraging trend regarding global and G7 manufacturing. The figure shows that both trends have reversed from their downturn which indicate that global manufacturing is getting out of its recession. There are at least four positive effects from this trend: First, positive employment effects; second, greater trade effects; third, positive income/spending effects; and finally positive effects on earnings as a result of all of the previous effects.

Space does not allow us to show the European PMIs (Purchasing Managers’ Index) which also start moving higher, indicating a possible growth of around 1.4% for Europe in 2017, which would be very good news (assuming of course that the Italian, Austrian, and the Dutch elections do not create a political/identity crisis in the EU). On top of this, reliable recession signals such as the LEI Index (Leading Economic Indicators) in the US show an economy which is still in an expansion mode and not under an immediate threat for a recession. Furthermore, global employment indicators (the expanded version which includes discouraged workers and those who work part-time but desire full time work) also send encouraging signals, indicating a stronger base of spending and economic confidence.

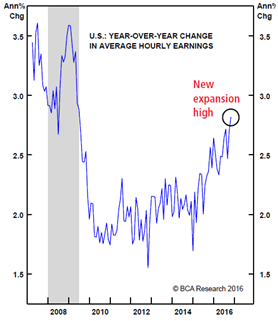

We could argue that even more encouraging and more significant for markets – which are led by US levels and trends – is the fact that the average hourly earnings continue rising, as it is shown below.

The obvious implication of this trend is that spending will increase which should enhance earnings and potentially protect them against an opposite trend due to a rising dollar. Speaking of earnings, we should not overlook the fact that they rose approximately 11% against their watermark (Q3 in 2014). The projections and trend is that they should remain healthy (despite a rising dollar and rising wages), and thus it should sustain an upward market trend.

The obvious implication of this trend is that spending will increase which should enhance earnings and potentially protect them against an opposite trend due to a rising dollar. Speaking of earnings, we should not overlook the fact that they rose approximately 11% against their watermark (Q3 in 2014). The projections and trend is that they should remain healthy (despite a rising dollar and rising wages), and thus it should sustain an upward market trend.

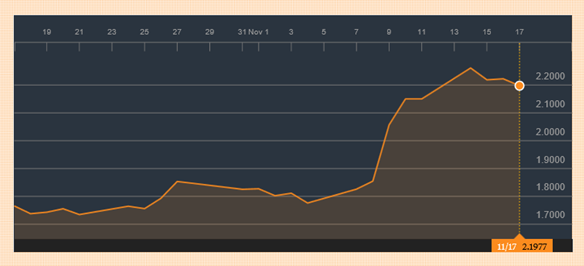

We understand that some concerns and red flags have been raised due to the significant increase in the yield of ten-year Treasuries over the course of the last month, as shown below.

We are a bit contrarian, and we believe that this is good news that leads to rates normalization and a normal deflation from the bond bubble. We would have applauded a 50 bps increase in the rates when the Fed meets in December, even if it s clear that it will raise rates by only 25 bps, which leads us to our preferred investment strategy for the next few months, namely a value-oriented approach.

Assuming then a 25 bps increase in short term rates, we would like to conclude that in our opinion the forthcoming policy changes and the sectors that will affect, the global merging of trends, and the fact that the US markets lead global markets, all point out to an investment approach that identifies entities whose long-term fundamentals have not been fully reflected in their current market price. Therefore, we rather opt for entities whose intrinsic value is not fully reflected in market valuation, so that the margin of safety would support potential pitfalls.