Whether President’s Trump’s threat of imposing additional tariffs on $200 billion worth of Chinese imports is a negotiation tool or a real threat remains to be seen. What/who also remains to be seen is Treasury Secretary Steven Mnuchin, who declared just a few weeks ago that there will be no trade war.

What is clear so far is that the Chinese have not chosen the higher ground, but on the contrary, they too issued threats for similar measures. Just that hint/threat has had serious negative effects on companies such as Caterpillar and certainly on US farmers. Needless to say, the equity market’s reaction last Monday was loud and clear, signifying the ultimate fear of an expanded trade war which will undermine growth and earnings prospects, and which could act as a prelude to further troubles down the road.

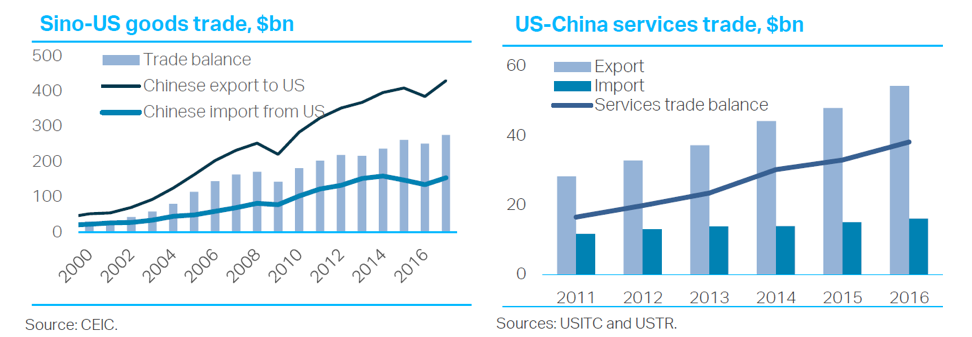

Here are some hard figures (see also graphs below): The US imports approximately $435 billion worth of Chinese imports and exports approximately $155 billion worth of goods (hence the trade deficit). However, the US enjoys a significant surplus with China in services and in goods sourced domestically or through third countries. Of course, if a trade war with China materializes that trade surplus, and the US companies that benefit from it, will suffer.

We are of the opinion that the issue at stake is the Chinese intention to become the #1 player in technology by using tactics of state-sponsored/ subsidized enterprises. This was pretty clear in the White House report published on Tuesday.

Besides the additional (but limited) retaliatory tariffs that China could impose, we anticipate that they will play hardball with issues related to North Korea, Syria, Iran, Russia and their expansionary vision regarding the South China Sea. In addition, they will create burdens for US companies doing or seeking business in China, and they may be tempted to play with the renminbi or even with US bonds that they hold (creating problems in the bond and currency markets).

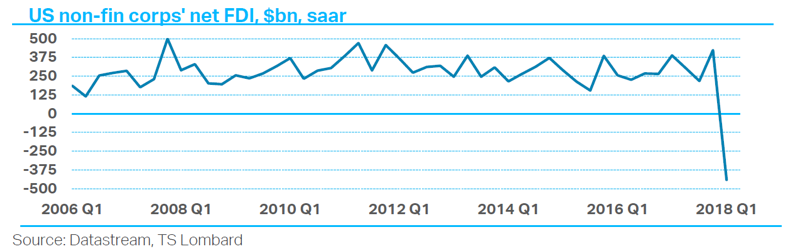

Speaking of currencies, the negative market mood (due to escalating trade disputes) may be counter-balanced – to some extent – by the net inflow of billions of dollars to the US. It seems that corporations are repatriating their overseas deposits to the tune of $200 billion per quarter, as shown below.

What we can clearly see in the graph above is that a net foreign direct investment outflow of $250-300 billion (since 2006), has suddenly been transformed into a net inflow averaging about $200 billion per quarter. This is a remarkable swing that can be exclaimed by the tax legislation that incentivized cash repatriation.

Such inflows could have four major possible effects:

- Strengthen the dollar, weaken the Euro (where the funds are coming from), and act as a limited cushion to possible downward pressures in equities

- The Euro weakness may uplift EU growth prospects

- EU banks will be experiencing dollar drainage

- The US can finance its trade deficit (for the short term) even if a trade war erupts

The times they are a-changing, as Bob Dylan used to say, and this whole upheaval reminds me of Kafka and his Metamorphosis. The difference is that the hero is no longer Gregor Samsa but rather Verdi’s Violetta (in the La Traviata) whose self-sacrifice is ignored and who is transformed into Roger Waters’ (Pink Floyd co-founder) hero Mr. Pink. Pink in his inner experience of rage and depression isolates himself in order to contemplate all the traumas he has experienced.

Those traumas, in turn, have become bricks of a wall that isolates him from reality and from humanity. In his delusion, Pink is transformed into a fanatic who is hunting down immigrants and refugees seeking freedom and a better tomorrow.

How does this transformation end? Pink imprisons himself into a totalitarian hell where he commits atrocities while living in a nightmare. He pleads for the nightmare to end and his isolation is transformed into a courtroom. His atrocities become the witnesses and the Judge sentences Pink to tear down the wall.