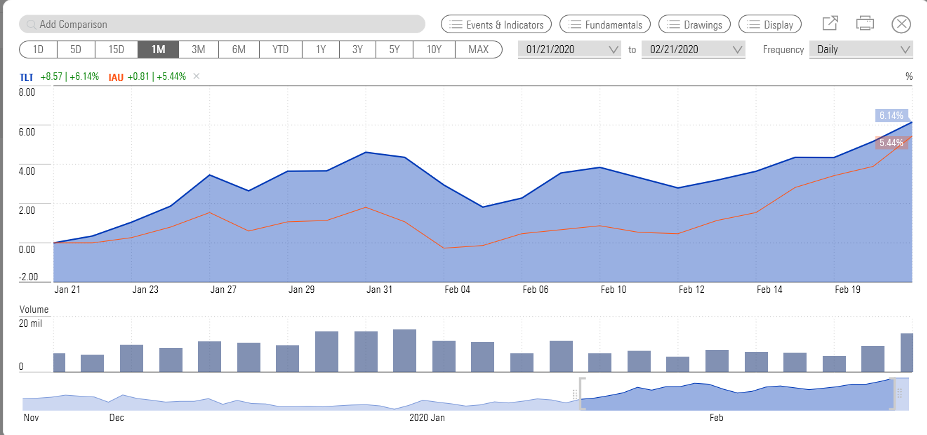

The Coronavirus is spreading beyond China and that shook the markets both last Friday and even more so yesterday to the point that equity indexes are down for the year. On the other hand, long-term Treasuries and gold continue performing very well. Both of them are up close to 6% in the last month.

We consider both good hedges against the rising risks of a pandemic that could affect sales as well as production lines. The Coronavirus also has the potential of amplifying the decoupling between the West and China, and could shake up China’s trajectory especially if thousands of firms start facing liquidity issues (news reports show that thousands of Chinese small and medium size companies cannot meet payroll and face huge challenges meeting loan requirements).

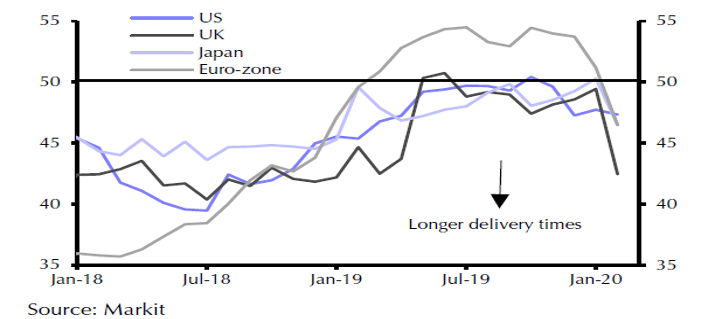

If a pandemic takes place, then, in the short term, complex supply chains will be affected in a more significant way than it has so far. There have been already reports of component shortages caused by factory closures in China. The biggest effects can be seen in emerging Asia, but recently reported PMIs reflect the lengthening in suppliers’ delivery time, as shown below.

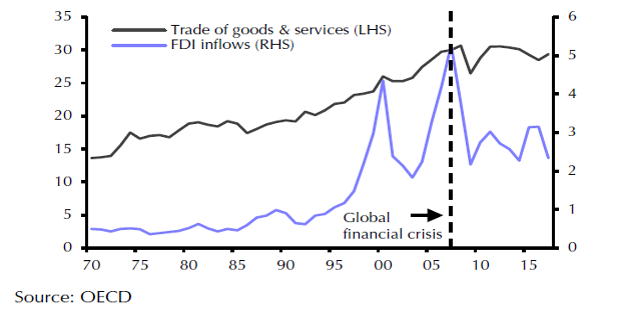

If the situation deteriorates, then the crisis could accelerate the process of de-globalization (in terms of world trade and FDIs) which as the figure below shows already reflects the pressures that are building in the last few years.

The virus’s spread is reaching a point where it will drag on growth. Chinese GDP growth in Q1 might be less than 2% and some estimates have it below zero. US growth estimates have slipped from 2.0 to 1.3%. The tumble in Treasury yields, along with the rise in gold prices and the drop in oil prices, reflect the downgrading of expectations. The exponential spread of the virus along with its potential profound uncertainty (which in turn feeds bad information) has the possibility of creating social and economic upheaval. Of course, in a few months’ time, when this will be over, the global economy will bounce back, assuming that proper measures are taken, mildly infected persons are marginally infectious, and that health care systems adequately address the issue in emerging economies.

We are of the opinion that the Coronavirus will become a pandemic on a smaller scale than how a pandemic is traditionally defined. However, given the geopolitical tensions, the transformation of political dynamics (where we may be observing the death of traditional parties), the environmental concerns, the technological developments, the possibly deglobalization trend along with the Chinese decoupling, as well as the demands for quality and fairness, we are of the opinion that firms will soon be thinking their logistical operations, possibly opting for shorter distances that will imply a whole new world of transportation dynamics.

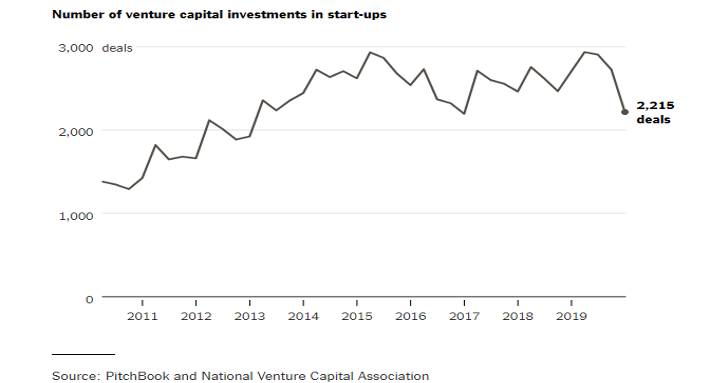

To that we should add that the virus coincides not only with the changes outlined above but also with a potential structural shift in the outlook and expectations of new startups including of course unicorns. Since last year the number of venture capital investments in startups has been declining (see figure below), while several of them are in the process of significant layoffs.

In conclusion, we opt to state that we do not believe that the pullback and the structural shifts observed will lead to a bust or a bear market in the short term. However the exercise of caution is warranted given the rising risks and the possibility of major disruptions if assumptions made prove to be invalid or if disruptions in production and demand turn out to be more severe than anticipated.