The Byzantine Emperor Leo III (who inaugurated the Isaurian dynasty of emperors in the Byzantine Empire) was a true reformer. Around 725 AD, he sensed that the empire was endangered from within by lawlessness (the infamous twenty prior years of anarchy), corruption, and iconodules. Consequently, he took drastic measures to avoid the cultural, political, social, economic, and religious degradation of the empire.

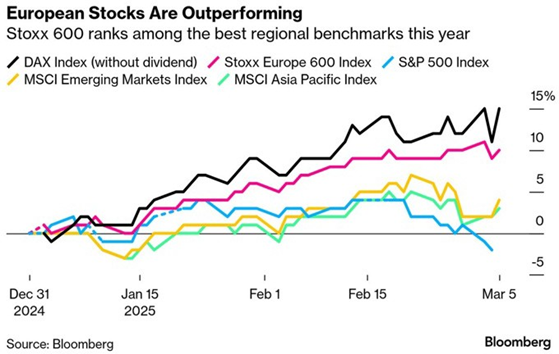

As those lines are being drafted, the global market has been attempting a reversal of the US markets’ exceptionalism (which we have been witnessing for close to 15 years), as can be seen in the graph below. The S&P 500 is down for the year (the Magnificent Seven have declined much more), while overseas markets (both European and Asian) have been performing much better.

Leo’s reforms were not without controversy and brought significant volatility. The markets in the last few weeks have been witnessing rising volatility (time for options?), while low volatility stocks (SPLV) have been outperforming the S&P 500 (VOO), as can be seen below.

What are the causes, and where is the refuge from the current and possibly rising turmoil? We are bombarded with analysis and predictions, and we all have heard and read that the policy on tariffs carries a lot of the blame, and certainly, this is the case. Fears of inflationary pressures (due to tariffs and rising deficits) are rightly blamed, too, for the turmoil. Massive firings in the public sector instill fears of rising unemployment, while the misfirings of DOGE carry the sense of a not-well-thought-out (but much needed) reform plan. Rising concerns about actions that may not fall exactly within the legal and institutional parameters under which the US has been functioning enhance the previous fears, while the attempted foreign policy reversal (at least on the Ukrainian front) leaves a lot to be desired and adds oil to the fire.

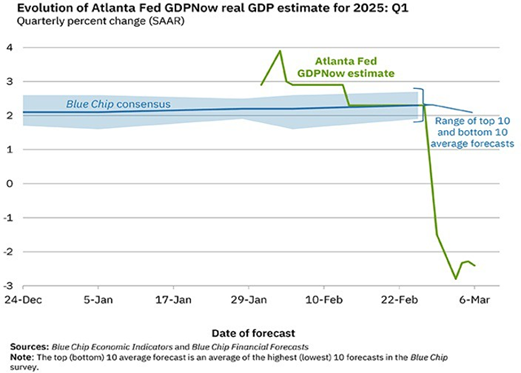

The policy uncertainty gives testament to the concerns that growth may be slowing down. However, if it were just a temporary slowdown, we could consider it an aberration to the exceptional growth of the last five years. Discussions of recession started circulating in economic circles and the latest revisions of growth prospects published by the Atlanta Federal Reserve Bank are concerning indeed, as can be seen below (most probably the dramatically revised growth projections from +2%+ to -2%+ are overblown due to weather conditions and the importation of gold, however the reality remains regarding the economic indicators: the economy is slowing down).

Leo III excelled in his tasks and assignments, even if emperor Justinian II (who owed the throne to Leo III) sent him to command a military expedition, expecting him to never survive it (no good deed goes unpunished indeed!). A master of diplomacy and war, Leo III successfully opposed enemies and preserved the empire until he was crowned emperor on March 25, 717. For a full year (August 717- August 718), he masterfully defended Constantinople and the expansionism of his external enemies, while after preserving the empire and consolidating his authority – by putting down internal rebellions – he mastered alliances that allowed the empire’s influence in the Caucasus. Leo’s system of social, institutional, legal, and military reforms set the foundations for the empire’s preservation for the next 700 years.

In the wake of declining business and consumer confidence/sentiment, as well as declining economic activity, the calculations of the tariffs’ impact are not encouraging: GDP could be hit by 1.3%, and inflation could rise by 0.8%, both of which are seeds for stagflation. The declining yield of the 10-year Treasury (first graph below), while being celebrated as an achievement if it is viewed in combination with a declining USD (second figure below), might be sending a contraction signal for the next 12-16 months.

The fundamental questions regarding valuations remain: How is it possible that a few tech firms’ combined valuation (especially those involved in AI) exceeds the valuation of all European stocks? How could seven stocks hold one-third of the whole S&P 500 index?

How could the valuation of US equities represent 70% of the global equities valuation? What does the downward revision of earnings tell us about the market’s trajectory? Could a more conservative allocation to Treasury Bills (given the recent gains of Treasury Notes (IEF) and Treasury Bonds (TLT), along with international exposure (EZU) and precious metals (IAU) be part of the allocation strategy?

It is obvious that a global paradigm shift is being attempted in the institutional/legal, economic, and geopolitical order. Alliances are possibly being abandoned, and misalignments may be surfacing on the horizon at a time when the world’s hyperpower is viewed not as a benevolent power but rather as a rent-seeking landlord, unconcerned if malevolent powers start underwriting the world order. Abandoning the foundations that have sustained security, peace, prosperity, and development since the end of World War II may gift malevolent powers the tools to shape the world order in their image, an outcome that will backfire for the US too. Does something have to give in? Leo III made the strategic mistake of leaving out of his reforms the western territories, a decision that not only cost the Byzantine empire those western territories but also ultimately planted the seeds of canceling some of his crucial domestic reforms on the eastern front. It took another 800 years for another reformer to nail his 99 theses and start the revitalization of the West.