As we noted in our last commentary (http://stage.blacksummitfg.com/3181), we anticipate some volatility during the next few weeks, but we also expect it to subside and for the market to find its upswing trend during the last 10-14 weeks of the year. We are of the opinion that all those discussions about the Fed’s anticipated move to be without substantial base because the historical record shows that incremental and discounted Fed moves do not move the markets significantly.

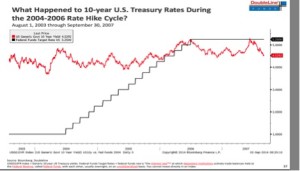

As the graph below shows, during the last cycle of interest rate increases, the Ten-year Treasury rates remained relatively stable, and we expect the same thing to take place during this round of rate normalization (even if we believe that the Fed will not move in a systematic rate normalization this time around, i.e. we do not expect the 2004-’06 pattern to be repeated as in a textbook case).

Besides anticipated earnings that could meet or exceed market expectations, we hold the opinion that the excess net debt of corporate America will become a driver of the markets’ upswing cycle that could outlast the last quarter of this year.

Non-financial companies are holding an enormous amount of cash (close to $2.2 trillion) as the graph below shows.

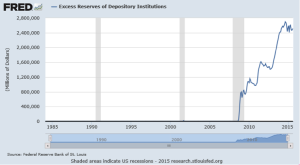

In addition financial institutions are holding enormous amounts of excess reserves with the Fed to the tune of more than $2.5 trillion, as the figure below shows.

All this cash has been used to buy back shares, which has contributed significantly to the market upswing. Moreover, all this cash could serve as a cushion in future gyrations, especially ones generated overseas. The excess reserves are in a stage of deployment when rates start their normalization cycle, which should boost the credit and spending cycles, provide another – at least temporarily – boost to the markets, while also sparking capital investments and R&D, which in turn would finance the next innovation cycle.

The fact that the net debt position (debt minus cash) of the US corporate world as a fraction of the equity is almost at a record low level (debt/equity ratio stands at around 30% currently as shown below), and could become the basis of a market force that advances P/E ratios and justify higher valuations.

Without neglecting the turmoil that could emanate from emerging markets (especially China) we believe that the last quarter of the year could erase losses and help the market finish on a positive note for the year.