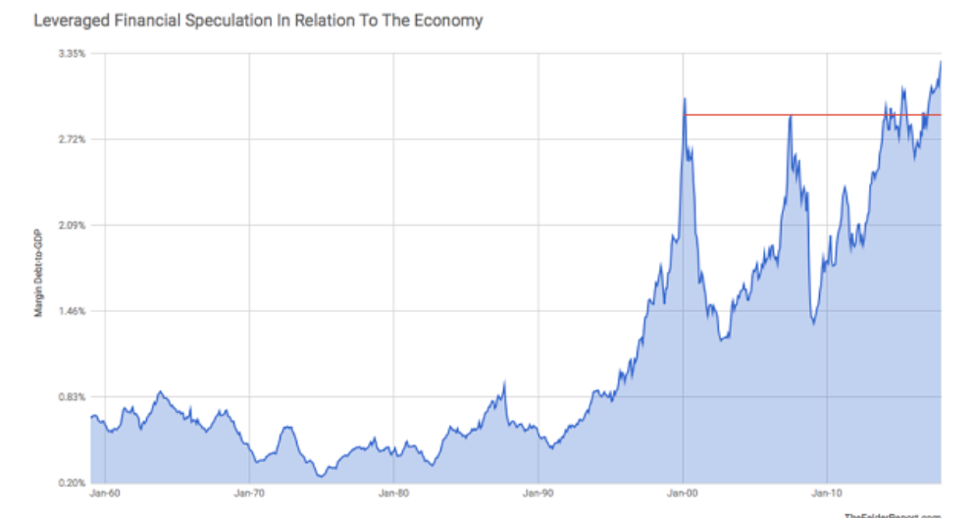

This year’s market gyrations should be viewed under the microscope of leverage. When we do that as the first figure shows below, then we can possibly start comprehending that in an environment of rising volatility, political instability, and geopolitical tensions, even a fairly valued market (which is not exactly the case) is susceptible to a significant drop, given that leveraged speculation seems to be at an all-time high.

According to the Felder Report – where the graph was published – there is a strong negative correlation between margin debt and forward earnings, especially when the Fed is in a mode of raising rates. Data show us that in similar circumstances in the past the market experience major corrections.

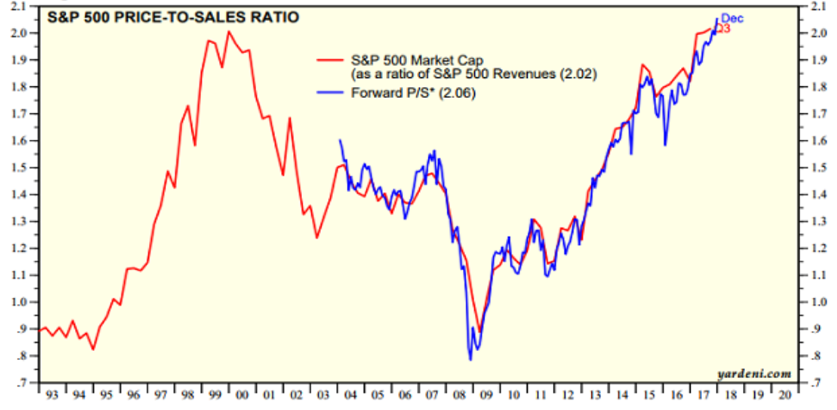

Furthermore, when we consider the total market cap relative to GDP (taking e.g. as a metric the Wilshire 5000 or the S&P 500 Price-to-Sales Ratio, as shown below), we discover that the market is more than fairly valued.

While the earnings reports are coming in and for the most part not only show good profits but also profits that beat expectations, we have to take into account that those profits are a bit exaggerated due to the tax legislation and due to suppressed rates. However, the effects of both of those will decrease over time, and therefore we won’t be surprised if earnings reports in the near future exhibit growth declines. At that point, and depending on how flux the economic and political environment is at that time, we would not be surprised if the equity markets turn decisively to the negative, especially when we take into account the complexities of algorithmic trading (experienced also earlier this year).

Speaking of the latter, the estimate is that as of earlier this year more than 80% of trading is done through algorithmic trading. The problem is that when such trading dominates the market, then systemic risks rise which in turn spread across most asset classes, especially ones that have high correlation. Melt-ups and melt-downs driven by computers introduce market disruptions and in a period when overleverage dominates, then a correction could turn into a bear market. If the latter prevails, then the danger is that algorithms may not be buying the dip because a negative feedback loop may have developed.

What is then expected from the rescuer of last resort a.k.a. the Fed? Probably some QE injections, as it happened when the market dipped in early February which may have contributed to the market’s recovery. However, our opinion is that a Fed put is not always guaranteed, especially with three new incoming Fed board members.

Therefore, we are inclined to stay on a conservative course, add uncorrelated assets, anchor more the portfolios, go a bit more defensive and if the market dips we could have some ammunition to deploy.