The authoritarians Spartans invaded the democratic Athens in the spring of 431 BCE. The Athenians evacuated their estates – as Themistocles had taught them half a century earlier – crowding into the walled city and watching smoke rise on their horizons as the Spartans were burning down their country estates. When Themistocles implemented that strategy, the victory at Salamis came quickly and uplifted their spirits. This time was different. The tragic Pericles had chosen confrontation rather than suasion. These are two totally different strategies of growth. The latter respects constraints. The former denies their existence. This time – unlike Salamis – no triumph was in sight. Pericles’ funeral oration failed to uplift the city’s morale. The following year the authoritarians Spartans returned along with an ally that no one could have foreseen. A plague. A plague that struck Athens and took Pericles’ life a year later in 429 BCE. The world has not been the same (see conclusion) ever since.

We are sailing in uncharted waters. We were found unprepared and the impotent response to the virus could have long, but hopefully not dramatic consequences. The inability to formulate a competent strategy made up of surgical tactics that would detect the virus, contain its spread, and address the imminent need for supplies and a vaccine, have imposed measures whose costs on institutions (how we do things), liberties, and the economy could be dire.

In a series of commentaries, we will discuss the unfolding crisis in terms of its possible effects on markets and the economy and consequently the possible ramifications regarding statecraft and the world democratic order, or disorder, that may emerge. This time could truly be different.

Our series is made up of four parts, namely:

- Part I: Assessment of the economic and financial impact

- Part II: The possibility of stagflationary forces emerging due to developments in the oil sector along with the potential impact that recent counter-cyclical measures could have

- Part III: The need for a statecraft policy that will contain malcontent efforts to undermine the world order

- Part IV: The danger that the current crisis can awaken financial monsters from the past which combined with malcontent efforts and unwise policy could undermine the dollar and global financial stability.

Here we go then, with Part I: Forward Looking Economic & Financial Assessment

- We expect global output to fall by around 2.6% in 2020.

- We further expect US GDP to fall by close to 18% in Q2 (on an annualized basis) and overall, by about 3.5% in 2020.

- We would not be surprised if next month’s unemployment numbers indicate that about 8.7 million people lost their jobs and the unemployment rate jumps to 9.4%.

- As the crisis deepens the numbers may get worse, especially when we take into account the magnification effects of lower consumer and capital spending.

- EU expectations are worse than the US, especially given the dysfunctions of the EU along with its shaky banking sector. The latter will go through major tremors when NPLs start rising again at a time when capital ratios will be deteriorating.

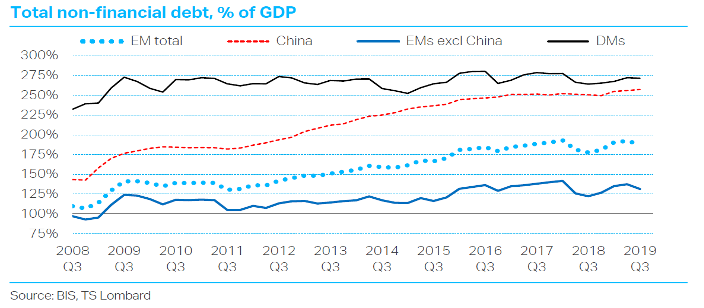

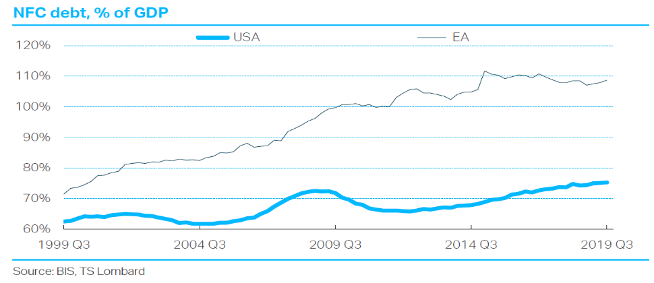

- Debt levels for companies and nations will force downgrades (Fitch already downgraded the UK economy) which in turn may shake up the fixed income markets. National debts for developed markets (DM), China (where the Great Wall of Steroids keeps growing) as well as emerging markets (EM) are at an all-time high, as shown below.

- As national deficits and debt explodes, the status quo in currency markets may shake.

- Emerging markets (ex China) – and especially those which are commodity and exports dependent – are in for a major shock.

- China will also experience a dramatic decrease in its Q1 GDP, with the negative effects slowing in Q2 and Q3. Given the measures taken (infrastructure spending, monetary) as well as the inability to accurately assess the reliability of data, we believe that the Chinese economy is in recession which will be magnified by the slowdown in global trade.

- Equity market wealth losses will further impact consumption and spending patterns and may inflict fear into consumer tastes and preferences.

- A repricing of risk is underway. Central banks actions (unlike 2008-’09) may cause inflation (see forthcoming Part II) and may not be as effective especially as stopgap/Puts for equity valuations, and hence we may be facing a structural equity shift into lower multiples and/or valuations.

- As banks’ stress test were thrown out of the window and reserve requirements were abolished, the forthcoming bankruptcies and loan losses will make some financial institutions more fragile, and hence the rising financial stress index. If fragility keeps rising, a credit crunch cannot be excluded.

- For the time being, the Fed’s decision to backstop any illiquidity in the bond market– will offset deflationary pressures but eventually may contribute to inflation (see forthcoming Part II).

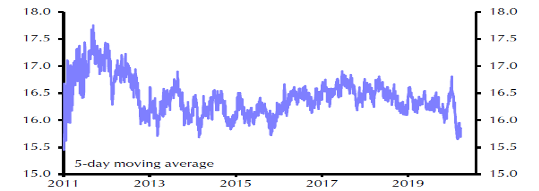

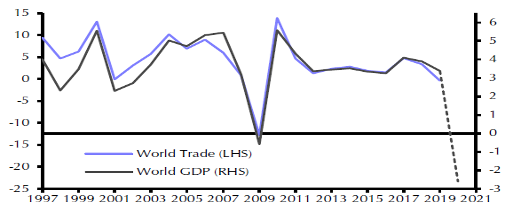

- The effects of the crisis, and the measures taken against it, will also have an enormous negative effect on global trade. In some simulations, the latter could drop by as much as 25%. Data show that Asian exports have already dropped between 11-15%. In the 2008-’09 crisis, global GDP dropped by less than 1%. In the current crisis global GDP is anticipated to drop by 2.5%. The first graph below may be indicative of the supply chain dislocation while the second one presents the potential impact of the crisis on global trade.

Average Container Shipping Speeds (Knots)

World Trade & GDP (%y/y)

Source: Refinitiv, IATA, Markit, Capital Economics

- We do not believe that the markets have hit bottom yet. On March 12th we wrote to our clients (when the S&P 500 stood at 2480) that we expected another 10% drop in equities (hence expecting capitulation around 2200). The hemorrhage temporarily stopped at 2,237 and since then it has jumped back to 2,541. Since March 12th, we have reassessed corporate earnings, economic growth, global trade, oil dynamics, capex, consumer sentiment and spending, business confidence, Fed and government responses, and we believe that corporate earnings could drop between 26-30% (from about $160 to about $117/share). Assuming a multiple of about 16, we believe that the bottom for the S&P 500 could be found around 1870, implying that from the current level we could see a fall between 14-26%.

- The reasons that made us reach such a conclusion is the forward-looking earnings recession, the forthcoming weak economic data, the forthcoming collapse in oil prices (Part II of this series), and the policies applied. As earnings expectations drop, analysts will start downgrading their forecasts. In addition, valuations have more predictive power over long time periods. An event-driven recession (Covid-19) that shakes up balance sheets cannot be accurately reflected into forward looking P/E ratios and markets tend to overreact; therefore, we expect that that they will test the recent low of 2,237. Furthermore, we cannot exclude a Japanification-style recovery of anemic growth and capped bond yields. The weight of corporate and national debts could also afflict productivity growth

The greatest of the Athenians failed in his judgment call. Furthermore, he failed to distinguish between vital and peripheral interests. The abstraction of strategy needs to be balanced by the tactical moves and the emotions of the strategists. The heat of emotional tactics require only an instant to melt abstractions drawn from years of cool reflection. Decades devoid of reflection may undermine the prospects of generations to come. Pericles left behind monuments to speak of those great times, but did not leave behind him a functional democratic state. It took the world over two millennia to see democracy again becoming a model of governing a functional state. The authoritarians took over, democracy died all because of the tragic judgement calls of a leader who chose to act on impulses rather than on reason. Athens and the world were never the same.