For this week’s commentary, we have chosen to look at three important indicators which could shape up the markets’ trajectory in 2018. We will start with the US which continues to be the locomotive of the markets’ direction. We are of the opinion that capital investments will be pivotal for US growth and subsequently for earnings expectations in 2018.

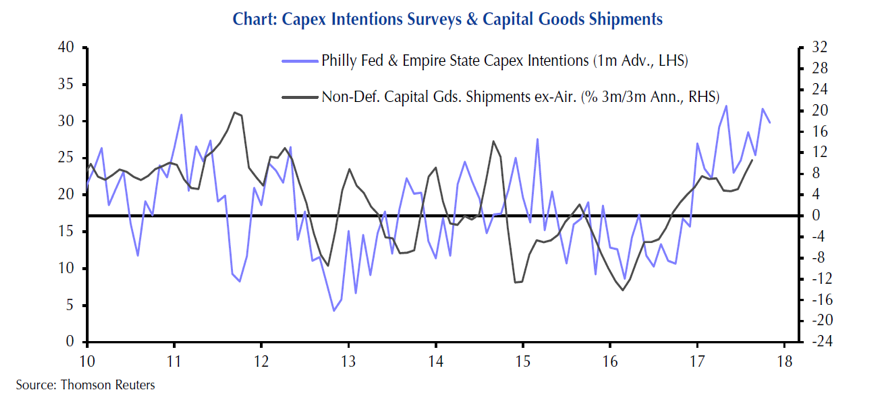

Based on the latest data related to business investment (see graph below), we observe that the 2.2% increase in durable good orders points to a stronger fourth quarter that could set the pace for an equally strong first half of 2018. Without a doubt, the strong transportation orders gave a major boost to the strong showing. However, even if we exclude those orders we could easily see that industrial activity is expanding at a healthy rate, especially if we take into account investment spending in IT, electronics, and fabricated metals. Moreover, non-defense spending increased at a pace indicating an annual growth rate that exceeds 10%.

Based on the above information, we could say that as things are shaping up now, 2018 may see an annual US growth rate ranging between 2.7% and 2.9% percent.

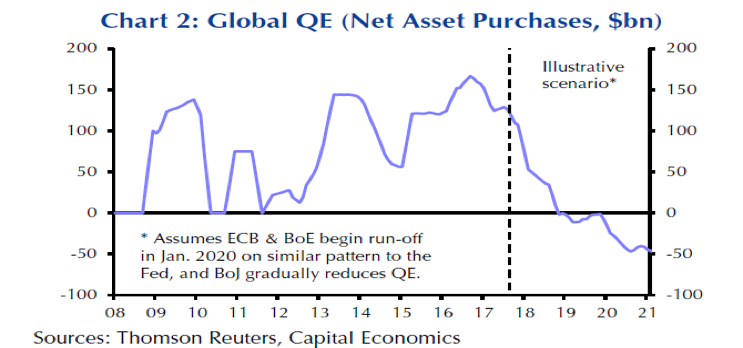

One concern that has been widely discussed by analysts is the effect that the contraction of central banks’ balance sheets will have on the economies and on the markets. Our point is that even if the Fed starts shrinking its balance sheet soon, global monetary conditions will remain loose given the QE policies that the ECB and the Bank of Japan are projected to follow for the next 18 months.

As the chart below shows, the QE programs of the world’s major central banks will stay positive throughout 2018, indicating a loose and accommodative global monetary policy. Given the integration of global markets, that means that the aggregate QE balance will stay in positive territory, boosting spending and keeping rates low.

Moreover, and based on the official announcements of the major central banks, it has become obvious that the pace at which they will be shrinking their balance sheets will be much slower than the pace at which they expanded them, providing cushions for market turmoil. Therefore, we may conclude – for now – that the reversal of QEs would not become a source of major market interruptions.

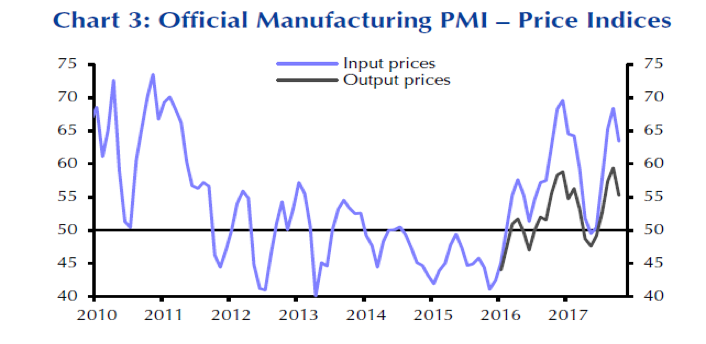

We will close the discussion about key indicators by looking at the PMI for China. Based on the latest information released on October 30th – and as shown below – we would expect that the growth momentum in China will slow down in 2018. A combination of an environmental crackdown and softer domestic demand could become the main reasons for the expected slowdown. When the manufacturing PMI is combined with the non-manufacturing PMI, then the projected expected decline becomes stronger.

Sources: CEIC, Markit, Capital Economics

In conclusion, we could say that the key economic indicators discussed above suggest that global economic growth will remain healthy in 2018 and hence we expect – ceteris paribus – for earnings and market prospects to remain on the positive side. Of course, such a preliminary conclusion needs to take into account that the stable disequilibrium we have achieved through fiat money operations is very susceptible to sudden changes that could occur due to global debt unsustainability and/or due to geopolitical developments.