In 1935 the famous Dutch historian Johan Huizinga published a book with the title In the Shadows of Tomorrow. By then bleak clouds had gathered over Europe. The forces that led to WWII were already at play since Versailles in 1919. A peculiar international payment system was emerging that was a non-system, marked by the distinct absence of an international reserve which is supposed to be based (at least partially) either on assets with intrinsic value (such as precious metals, in the pre WWI era), or on fiat currencies tied to such an asset (the Bretton Woods, post 1944 era), or on pure but trustworthy fiat as long as the leader has moral authority to direct such a system (post 1971 era where the foundations were established by non-other than the great late Paul Volcker).

Our fear is that the era that Paul Volcker established with his unique foresights is coming to an end and barbaric instincts are at play. Huizinga chose an intriguing phrase to characterize that era: “a world possessed.” If we are right in our assessment, then one of the greatest needs in the forthcoming era is the need to establish a new monetary and trading system, especially as tensions with China are rising (rightfully so). The truth of the matter is that the design of the Bretton Woods system started in early 1942. We plan on expanding on this in a series of 2-3 forthcoming commentaries.

When the FOMC minutes were released last Wednesday, with great surprise we read that the Fed contemplated the capping of interest rates, and naturally the question that jumped into our minds was: “Will gas prices be next?”

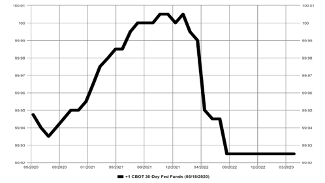

About two weeks ago, we observed that in the futures market the prices of Treasury Bills (TBs) crossed the threshold level of 100, implying negative interest rates. Here is the pertinent graph:

Both the European Central Bank (ECB) and the Japanese Central Bank (BoJ) have instituted negative rates for years now. The rationale is that they will stimulate growth. With all due respect, the growth rate in both countries is below dismal. In addition, the reasoning is that it will encourage lending. Again, with all due respect, prosperity bought on credit most of the times backfires because it lacks the productivity gains that make growth real and which in turn advance the standards of living. Furthermore, the reasoning says that consumer and business spending will be boosted. Again, with all due respect, we are still looking for that evidence.

The futures market provides some invaluable services, such as it indicates expectations and thus can serve as a leading indicator. In addition, the futures market allows hedging of risks, and as insurance contracts are employed, efficiencies increase, and capital misallocation is reduced. Therefore, because the futures market indicated the possibility that rates could turn negative in the first half of 2021, this does not mean that they will. However, the pressure is on for this to happen, and if that were to happen then greater market distortions will be taking place.

When central banks institutionalize negative rates, they penalize financial institutions which are at the epicenter of credit creation and financial stability. By penalizing the holding of cash, they push for capital misallocation, advance unnecessary risk-taking, while also contributing to a credit contraction (given that lending is not that profitable anymore). Negative rates could push asset prices (including real estate) artificially higher which would lead to greater corrections and losses.

There is little doubt that the greatest beneficiary of negative rates is the leviathan bottomless appetite of governments to spend money they don’t have, and unnecessarily mortgage the future of generations to come. But then, as Scott Minerd of Guggenheim recently observed, “we are all government-sponsored enterprises now,” implying that the whole investment-grade corporate bond market is now too big to fail, and even the high yield bond market benefits from such a policy framework.

We are of the opinion that the tightening of spreads will continue for the foreseeable future, the 10-year yield will be pushed even lower (possibly between 27-35 bps by year’s end) and TBs may indeed see negative territory. The Fed and Treasury-sponsored imputed liquidity, as unnatural as it may be, uplifts bond prices and encourages bond issuance (records keep breaking). The Fed’s primary and secondary put/implied insurance may be lowering credit risks but in our humble opinion is no recipe for curing capital and asset impairments.

As we wrote in an email to our clients last Sunday “When capital impairment – due to losses/negative earnings – impair a company’s assets and that phenomenon takes place on an economy-wide basis, then credit contracts and credit contraction is usually associated with extended recessions. We truly hope that this will not be taking place, but we need to consider that we live in abnormal times where an exogenous shock could mutate and create an economic contraction with depression-like stats which in turn can metamorphosize into a financial contraction – despite central banks abundant liquidity – due to capital and asset impairment.”

Happy fixed income hunting!