First of all, allow us to start with some clarifications/definitions:

Heraclitus Fallacy: The belief that history imposes no constraints. Failing to comprehend the past not only signifies ignorance, but is also idiotic.

Parmenides Fallacy: Comparing the present with the past rather than with the future state of affairs. Failing to remember the future could turn out to be fatal.

The current economic environment is abnormal, as we have discussed previously. The negative yielding bonds are a symptom of a system that has the crown jewels of unsustainable debts, derivative instruments that undermine stability, a shrinking middle classes, and declining productivity. The result has been a zero-sum global economy.

Under these circumstances, societies are pressured and conflicts arise. Over the last few weeks the clashes originally seen in Hong Kong, which began this past summer, have spread to a number of countries: Chile, Lebanon, Spain, Pakistan, Iraq, and others. As conflicts (including trade) rise and concessions are offered to calm down the masses (or to stop a 40-day strike like in the case of GM after), governments feel the heat, especially under the pressures of slowing economies. Of course, we cannot forget the Paris yellow jackets, the massive protests against Brexit as well as the demonstrations around the world calling for action against the climate change.

At the same time, as the monetary base is converted into money supply, price pressures may also start rising, especially at a time when everyone is pushing and praying for higher inflation (in the convoluted thinking of secular stagnation advocates higher inflation is thought to stimulate growth!). Hence, we would not be surprised if over the next 18 months, inflation indeed starts rising which in turn can turn the complacency that brought us negative rates and unsustainable debts on its head.

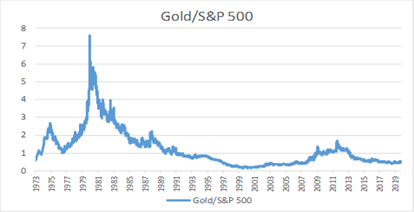

Today, under nominal and not real terms (i.e. without taking into account the effects of inflation over the course of the last several decades) gold is just under $1500/oz and the S&P 500 is close to 3,000 points, so an ounce of gold would buy roughly 0.5 a unit of the index. Over the last 45 years (i.e. since the collapse of the Bretton Woods Agreement), that figure has ranged from more than 7.5 in 1980 to less than 0.2 in 1999 (see graph below). Exuberance, facilitated by bubbles and monetary manipulations, has the tendency to cheapen the value of real money (gold), while inflating the value of paper assets. During times of crises, paper assets deflate and real assets that have intrinsic value appreciate.

Therefore, we would humbly offer the suggestion that complacency about inflation and the rising conflicts around the world could surprise the markets with some unexpected news in the future. If it turns out not to be an aberration, it will hit hard fixed assets, and force central banks to take action, both of which could badly damage equity markets.

Against this, our suggestion is that real assets carrying intrinsic value should play a role in every investor’s portfolio, and so should hedging using commodity futures.