The coronavirus has been credited with causing recent market volatility. In a single day last week, the gains made in January were wiped out, while this week the market gains erased all of last week losses. Could it be that the market is searching for direction and the coronavirus is an excuse? In one simple sentence: we retain skepticism and we believe that market fundamentals affirm such skepticism.

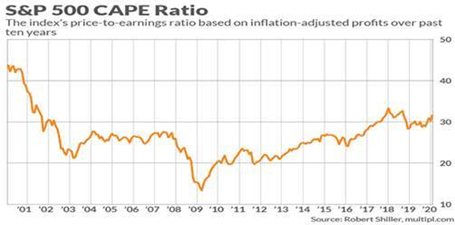

When we look at the traditional Cyclically Adjusted Price Earnings Ratio (CAPE) – as shown below – we can clearly see that it stands above 30, implying an overvalued market.

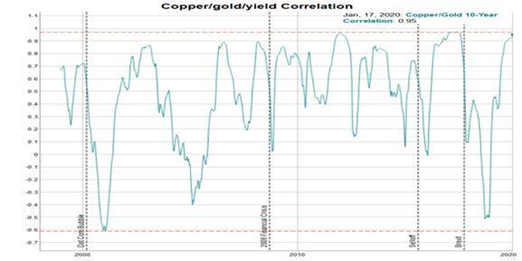

The next indicator may not a traditional one, but seems to be quite reliable. It deals with the correlation between the copper/gold ratio and the yield on the 10-year Treasury. Historically, as it can be seen below when it reaches current levels, a selloff/correction takes place.

The next indicator may not a traditional one, but seems to be quite reliable. It deals with the correlation between the copper/gold ratio and the yield on the 10-year Treasury. Historically, as it can be seen below when it reaches current levels, a selloff/correction takes place.

More troubling is the Price-to-Sales (PS) ratio, which is about 15-20% above the historical average level of the last 20 years.

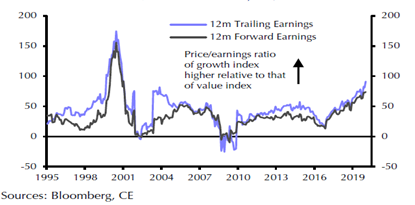

The divergence between growth and value indices is quite problematic under the circumstances described above. The reality is that such divergence only once before has been so high and that was the time of the dot com bubble, as shown below.

The divergence between growth and value indices is quite problematic under the circumstances described above. The reality is that such divergence only once before has been so high and that was the time of the dot com bubble, as shown below.

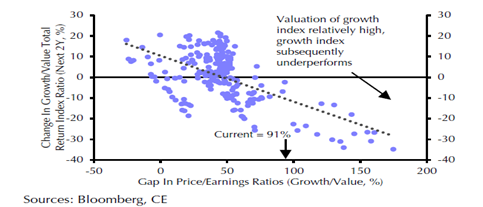

From a historical perspective, when the gap between the two indices becomes so large, the growth stocks are the ones that suffer the most in the subsequent 2-3 years, as the figure below shows.

From a historical perspective, when the gap between the two indices becomes so large, the growth stocks are the ones that suffer the most in the subsequent 2-3 years, as the figure below shows.

In the search of direction, we opt for the case that precaution is useful, especially when economic circumstances do not imply a bear market (at least not yet). Given the pressures from Asia to Europe and the valuations we see, we would not be surprised if profit taking is exercised which will allow buying at lower valuations to make better sense.

In the search of direction, we opt for the case that precaution is useful, especially when economic circumstances do not imply a bear market (at least not yet). Given the pressures from Asia to Europe and the valuations we see, we would not be surprised if profit taking is exercised which will allow buying at lower valuations to make better sense.