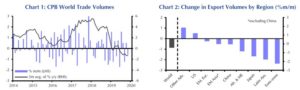

The latest figures on global trade portray a picture of contraction. Have we entered into a period of deglobalization? The figures tell us a story of the longest period of contraction since the crisis more than ten years ago. Six consecutive months of year-on-year contraction does not necessarily reflect a healthy picture. Even more troubling might be the fact that almost all major regions reported trading volume declines.

The following two graphs reflect the trends discussed above.

Source: Capital Economics

Having said that, we also need to point out that leading indicators (such as the PMIs discussed below, capacity utilization of air and cargo freight) point out to a possible recovery starting later this year, albeit from a low level. The signing of the Phase One trade deal between the US and China won’t contribute significantly to the potential recovery due to the fact that tariffs remain unchanged, as well as due to the fact that China will shift its imports rather than import more.

Rather than adopting the theme of deglobalization, we opt for the concept of global transformation, maybe as important as the pre-Civil War period in the US. The Civil War was a global event with global consequences. America was re-founded again at a time when Germany and Japan gained centralized power. The moral consequences of Lincoln’s emancipation were enormous. Lincoln’s actions established the foundations of what America became, the global power of today. And that would not have happened if it was not for borrowing from his law partner (Billy Herndon) books and especially borrowing, reading and understanding Walter Whitman’s poetry, who inspired him to draft his famous speech “House Divided” which in turn probably made him president.

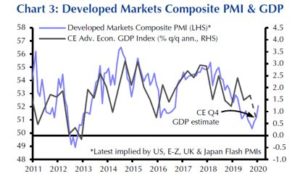

Now, back to the PMIs: Latest figures released for January offer signs of global stabilization. Forward-looking indicators (including those for Germany) point to some gradual improvement. As the figure shown below indicates, advanced economies appear to be at a turning point. Admittedly, some of the indexes had fallen very far and some are still near recession levels, but the improvements suggest that developed markets may soon be turning the corner.

Source: Capital Economics

Before we close with a small portion of Lincoln’s lecture on “Discoveries and Inventions” (pretty fitting in the AI age of global transformation), allow me to share with you that recent market developments apart from the coronavirus (from dropping rates, to market valuations, and from expected earnings announcement to the copper/gold-yield correlation) have led us to think that a mini correction (with the necessary profit taking) might be in the works over the course of the next few weeks (we all observe what is happening in the markets today), so some caution and hedging might not be a bad idea.

As the age of global transformation unfolds, it might be prudent to recall Lincoln’s reading of Walt Whitman’s poetry that inspired him to a Homeric-like lecture:

“All creation is a mine, and every man, a miner.

The whole earth, and all within it, upon it, and round about it,

including himself in his physical, moral, and intellectual nature, and his susceptibilities, are the infinitely various leads from which, man,

from the first, was to dig out his destiny.

In the beginning, the mine was unopened, and the miner stood naked, and knowledgeless upon it…”