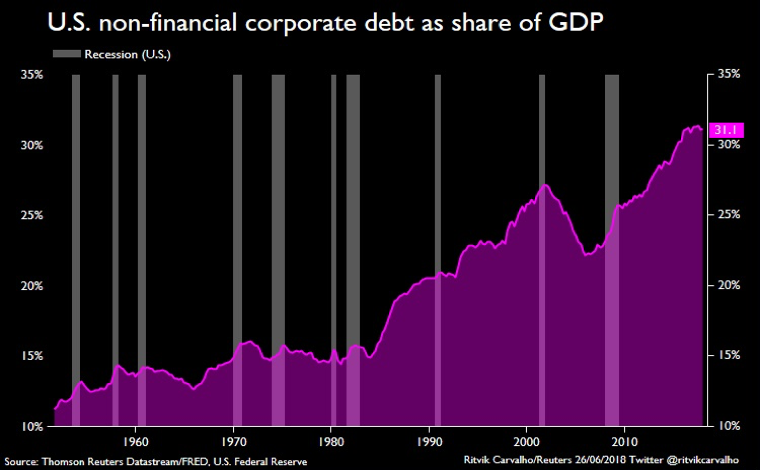

With little doubt, emerging markets have entered into bear territory with the Chinese index down more than 20% since January. This is happening at a time when central banks are unwinding their QE-induced liquidity and while corporate leverage stands at an all-time high relative to GDP, as the figure below shows.

Higher rates in the midst of record levels in leverage imply higher costs and consequently lower earnings. The natural effect of this is for the present value of future earnings to be lower, implying that stock prices could fluctuate between losses and meager gains.

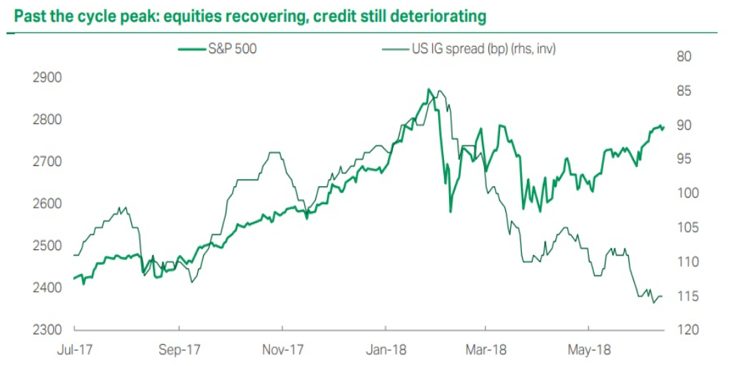

Investment-grade bonds have been experiencing capital outflows for the last 6 weeks, while high-yield bonds have been suffering capital outflows for the last 30 weeks. What seems to be troubling is that corporate credit markets have started deteriorating, in the sense of widening spreads between them and Treasuries. The trouble that may be brewing could be seen in the investment-grade (IG) corporate bonds. The IG corporate bond index has lost almost 3.5% this year and this might be their worst year since 1996. Higher rates, unwinding of central banks’ balance sheets, and rising corporate yields could mean further trouble for emerging markets (especially China) as well as European markets. Widening credit spreads may signal the reversal of the credit cycle and this is usually followed by equity market losses.

The graph below shows the S&P 500 since last July and the deteriorating credit market between IG bonds and Treasuries.

Source: TS Lombard

While the equities have mostly recovered (supported by leverage, buybacks and M&A activity) the spreads have deteriorated (inverted right-hand axis). Corporate debt is rising faster than net earnings and the market is sustained by the leverage. However, the reversal of the credit cycle could bring the upswing to a halt or even reverse it to a downturn. If such reversal occurs at a time of escalating trade disputes, then economic growth may come to a standstill which could further deteriorate credit spreads, incomes, spending and earnings (in such a case it will be the credit cycle that will lead the business cycle).

Given the above, we believe that the likelihood of strong equity returns is limited for the remainder of the year and if that were to be true we would rather opt for a safer asset allocation.