Below is a summary of last month’s commentaries from BlackSummit’s sister company, Fundamental Analytics. The following describes the highlights of those commentaries, which showcase the factors affecting the energy, agricultural, and other commodities that power and feed the world.

Wheat Production Troubles

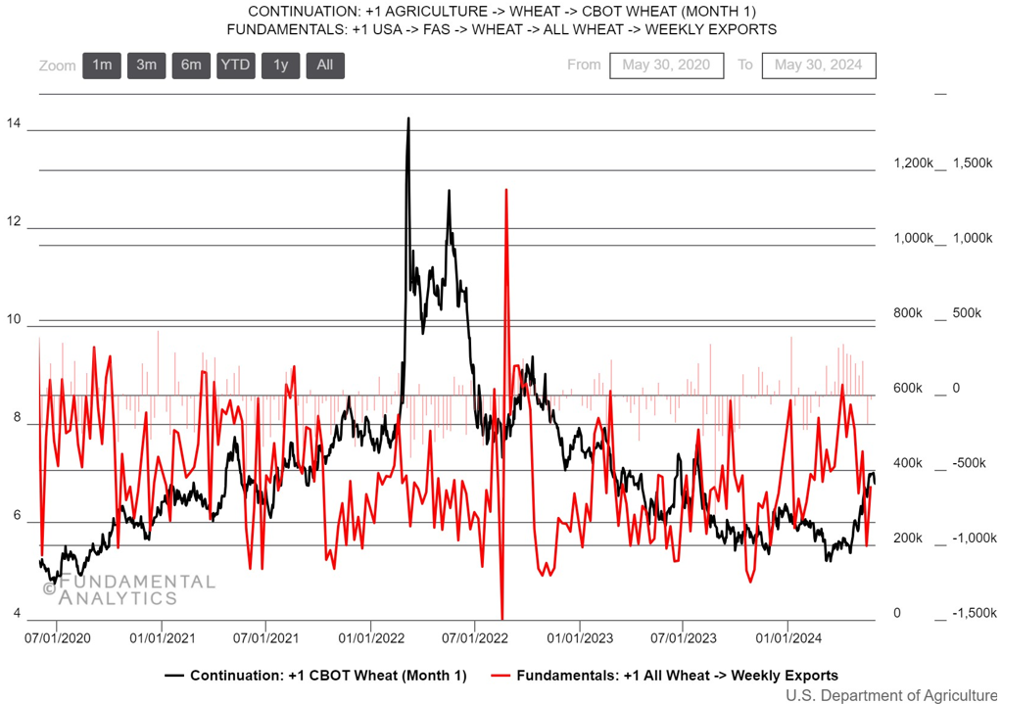

Over the past month, global wheat production has been hampered by adverse weather events specifically in Russia and Brazil but positive weather forecasts in Russia and harvest estimates in the US caused wheat futures to fall to $6.70 as of May 31st. Meanwhile, benchmark wheat prices in the final week of May reached $7.20 a bushel, the highest since July, driven by drought and spring frosts in Russia. Looking ahead the weather looks to improve with rain expected in the dry regions of Russia while the American Midwest is set to have favorable conditions for finishing planting. Furthermore, U.S. wheat accumulated exports have risen by 403k as compared to 2023, signaling strong demand dynamics possibly supporting a short-term bullish movement.

In Russia, over 900,000 hectares of wheat were lost due to drought and frost conditions, equating to 1% of total domestic sowed wheat acreage. Heavy flooding in Brazil’s southern state of Rio Grande do Sul severely impacted wheat production. Based on the impact of weather events, the WASDE projected a slight decline in global wheat supply by 2.2 million tons for 2024/2025, while global consumption is expected to rise by 2 million tons in the same time frame, potentially pushing prices up if production fails to rise.

Crude Oil Volatility

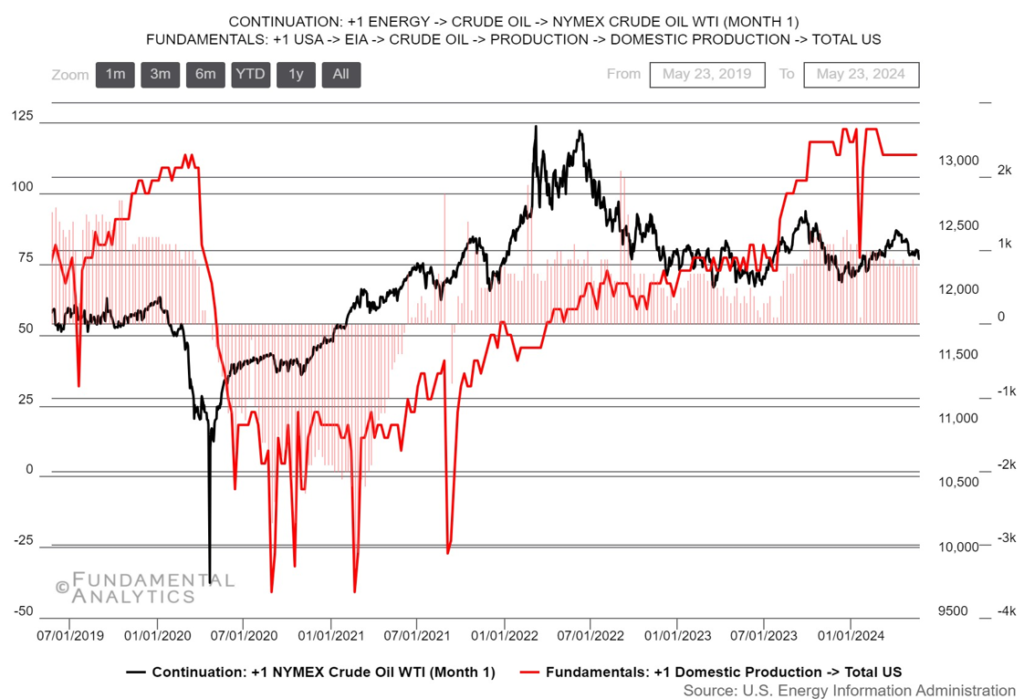

WTI crude futures experienced volatility, with a 1.1% gain to settle at $77.7 per barrel on May 31st, but faced a 3% weekly loss due to concerns over elevated interest rates that negatively impacted the U.S. economy’s outlook and energy demand. The unexpected uptick in US crude inventories, reaching their highest levels since July, added pressure. Nonetheless, US gasoline demand surged to its highest level since November, offering some support to oil prices ahead of the summer driving season. OPEC+ recently announced a deal to ease their voluntary output cuts in the Q4 2024 and extend group-wide production quotas in 2025, causing oil prices to slump.

Meanwhile, crude oil production averaged roughly 13.1 million barrels per day, raising concerns over oil oversupply especially since the EIA, in mid-May, lowered its estimates for global oil and liquid fuels consumption from the previous week. Overall, the EIA projects consumption to rise to 102.84 million bpd, less than the 105 million bpd previously projected. OPEC’s April report showed that member countries had exceeded their production cap by 586k bpd but demand projections remained strong for 2024 and 2025.

More Energy Commentaries from Fundamental Analytics:

- Why Did the Price of Natural Gas Go Up?

- Energy Prices Pressured Downward

- Crude Oil Regains Amid Inventory Drop and Hope for Rate Cuts

- Energy Stockpiles Surge: Fed Rate Cut and China’s Growth

- Natural Gas Edges Toward Shortages?

More Agricultural Commentaries from Fundamental Analytics:

- Agriculture Futures Lowered Amid Uncertainty

- Weather Woes and Market Bets: Fund Managers Go Long on US Wheat, Corn, and Soybeans

- China Accelerates Toward Genetically Modified Crops

Other Commentaries from Fundamental Analytics: