Below is a summary of last month’s commentaries from BlackSummit’s sister company, Fundamental Analytics. The following describes the highlights of those commentaries, which showcase the factors affecting the energy, agricultural, and other commodities that power and feed the world.

Corn Futures Remain Stable, South American Troubles

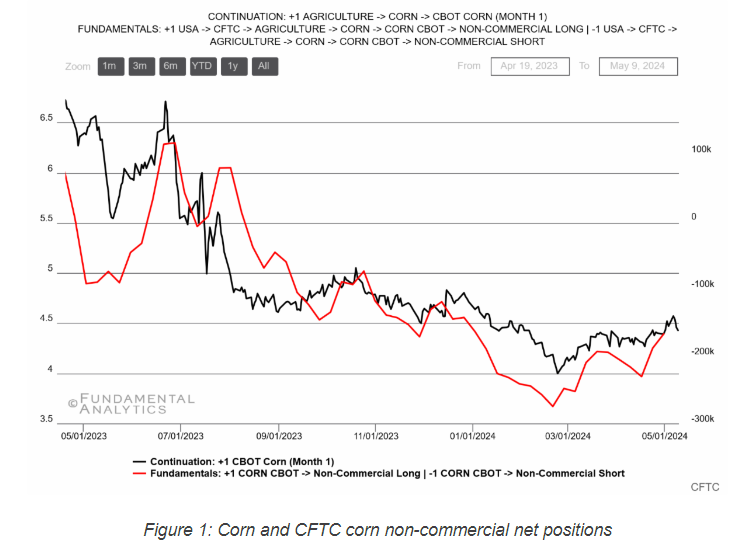

Corn futures remained roughly stable the past month, while US corn exports to China continued to suffer. China has, in recent years, looked to Brazil as its main external supplier but increased domestic production prospects could limit the need for external suppliers in the medium future, negatively impacting Brazil and Argentina. Meanwhile, the USDA lowered 2023/2024 ending corn stock volumes for US supplies due to expected higher usage for ethanol, feed, and residual use. Traders will now focus on planting and weather patterns in the US as they will be a major determinant in future corn market movements.

The world’s largest exporter of corn, Brazil, is dealing with adverse weather conditions and increased competition from Chinese producers as it looks to capitalize on the Chinese market. According to USDA estimates, Brazil’s expected corn output held at 4.482 billion bushels and Argentina’s production fell by only a million metric tons due to drought. Total corn exports for the month increased by 532,075 tons, a 9.4% increase as compared to March data.

Natural Gas Oversupply Drives Prices Down

Natural gas futures fell due to forecasts for lower demand and a higher-than-expected increase in US natural gas inventories. By the end of April, LNG storage in the US had increased by 21%, creating concerns that that there is a longtime oversupply of the commodity. By April 19th, US utilities added 92 billion cubic feet (bcf) of gas into storage representing the largest increase in 6 months and well above the 87 bcf that was expected. The abundant nature of natural gas and the increasing inventory of the commodity may point towards a continued reduction in prices.

More Energy Commentaries from Fundamental Analytics:

- WTI Crude Oil Futures Slip Amid Surging US Inventories and Demand Concerns

- Energy Prices Struggle to Find Momentum

- Natural Gas, the Calm Energy Source

- Fear Reaches New Level

More Agricultural Commentaries from Fundamental Analytics:

- Global Grain Market Report: Navigating Supply Risks and Global Dynamics

- Global Grain Market Report: A Detailed Look at Wheat, Corn, and Soybean Markets

- Walking Down the Spreads Line

Other Commodities Commentaries from Fundamental Analytics: