The period from the mid 1980s to the middle of 2007 is known as the period of great moderation, when inflation was low and stable, unemployment also was low, utilized capacity pretty high, productivity growth rate very healthy, interest rates stable and declining, asset classes were enjoying significant returns, globalization was going full speed and everything seemed to be rosy (if some of those things were bought on over-extension of credit, that’s another story we have touched on elsewhere).

A wealth of information has hit markets in the past couple of weeks, revolving around the immediate future of this “recovery” in the United States economy. The gun shot to start the race came from the mouth of none other than Ben Bernanke and his forecast of “unusual uncertainty” regarding the prospects of the American economy. Market perception, analysts, and TV pundits have been relaying Mr. Bernanke’s quotes excessively since the Chairman’s testimony. Since then, we’ve had data that shows manufacturing productivity declining, revisions that lowered the second quarter’s growth record, private savings and deleveraging increasing, incomes stagnating or falling, and the dollar falling against major currencies including its lowest point in 15 years against the Japanese yen.

The U.S. economy is facing pressure from a multitude of directions. Unemployment has locked out millions of people and scared additional workers into either drawing down consumption or deleveraging, which leads to reduced corporate profitability, the deflating of assets, reduced investment, excess capacity, falling share prices which wreaks havoc on pensions, downward pressure on wages, and layoffs which starts the cycle back up again. We need not forget that deleveraging, reduced consumption, and poor corporate profitability reduces government receipts and increases the threat of rising interest rates. It doesn’t help when monetary policy has little if any wiggle room and fiscal tools are out of the question with mid-term elections coming soon.

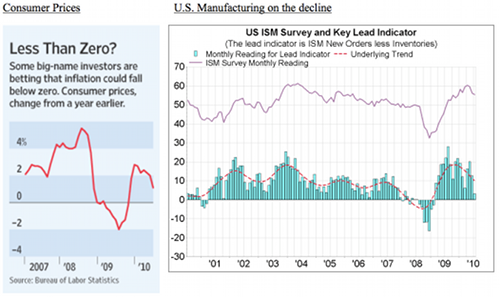

The two graphs below show some troubling signals. The one on the left shows that the fear of declining prices (deflation) may be registering with investors and may turn out to be the ultimate outcome of the deleveraging cycle as we have written several months ago in our newsletters. The second graph portrays the signals from the purchasing managers, who have been less aggressive in their orders in the last few months, and hence the decline in the ISM numbers. Both of those graphs (among others) hint to the possibility that the Great Recession may be knocking at the door again.

That’s just on the domestic side of things.

Overseas we’re witnessing stronger bonds between emerging markets. From 2000-2008 inter-emerging market trade rose 18% while their share of trade with the U.S. has declined; emerging market countries are expected to grow over 6% for both 2010 and 2011 and continue to rely more on their peers than the advanced world, relatively speaking. This further eats into corporate profitability, tax receipts, and demand for the U.S. dollar. The dollar liquidity policy (or current-account deficit policy as some describe it) of the last 15 years, in which the U.S. became the greatest consumer, financed new investments and growth opportunities for a great slice of the world economy. But these emerging markets in that time frame pulled closer to each other in addition to the United States, in effect diversifying their exposure to different economies and hedging ties. In essence, they are trying to make sure that in regard to their own economies, the U.S. is not too big to fail, withholding a crucial piece of leverage that the U.S. could use: the belief that other countries need us to be who we’ve been the past 15 or so years.

Those economies that are heavily exposed to the U.S. are aware of their weaknesses and are moving away from dollars, most notably China. For the past three months China has been a net seller of U.S. assets, and the countries of Russia and Japan have also been cited for dumping dollar denominated assets. China is diversifying a greater share of its reserves towards the Japanese yen. But aside from that, threats of a slowdown in China bears enormous consequences on what will happen to their holdings of dollars and U.S. assets. As recently as Monday, Chinese officials complained that liquidity for the hoard of dollars they hold is running dry in the medium and long terms. As more and more information comes in about a Chinese slowdown (we will publish our own thoughts soon to be followed by a full newsletter on that very issue) pressure on the dollar and U.S. financing mounts while here at home we’re struggling with paying our own debts. Anything severe in China will negatively impact us in the States, separate the U.S. from the rest of the world economy to a greater degree, and we could see negative effects for global growth and a possible double global dip.

These domestic and external threats to the viability of the U.S. economy put the country in a unique situation, one where nothing can be ruled as an impossible occurrence. Risk is everywhere (just don’t tell those who hold big positions in Treasuries). Failing to take seriously all possibilities may have disastrous consequences.

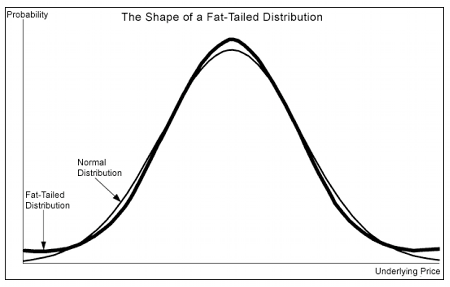

In a distribution of outcomes where the tail becomes fatter (see graph below), investors will be trapped if they are caught at that fat tail. In situations like this liquidity is one thing, but even more important is to be holding assets that represent no one else’s liability. A portfolio full of assets that represent someone else’s liabilities are like the turkeys that are being fed for Thanksgiving.

In the grand scheme of things we would not be sursprised if the following sequence of events takes place: Chinese financial tremors resonate throughout the global economy to the extent that we experience another round of recessions (possibly severe), hard assets becoming the ultimate safe haven, currency crises erupt, emerging economies emerge as leading the global economy of of its troubles and a new financial regime starts taking shape and form.

As always please enjoy the ride!