We just want to erase from our memories the happenings of last fall, when the markets were dropping nervously while searching for signs of life. The swap lines announced by the Fed last November infused hope and allowed the ECB to start the cheapening of collateral standards in the EU, which in turn postponed the inevitable for the EU-wide banking sector. We now read about new collateralization schemes that will be known as PCS (Prime Collateralized Securities). The latter will be nothing but bundles of debt (from mortgage to credit card) that will be sliced up, accepted as “safe” collateral and allowed to be traded, so that profits can built up the miserable picture of the EU’s banking sector. The Secretary General of the European Financial Services Round Table (which has a vested interest since it is one of the two groups that organize the scheme) described ECB’s support for the program, stating that will add quality to the credit mechanism.

With all due respect, we humbly disagree. It may add liquidity, but it makes the system even more unstable and the eventual collapse even more catastrophic, especially when we take into account the amount that will be involved (over one trillion Euros). It reminds us of an addiction that trades short term euphoria for long-term death. It seems that catharsis stemming from a strategic disintegration is undesirable. The chaos that may result is the natural effect when trading triumphs over capital formation, and when risk is only seen as a Manichean enterprise.

Of course that does not mean that given the market climate one should not take advantage of market opportunities. Since last December we are on the record that for the foreseeable future the markets may do well while precious metals may take a pause. At the same time we are of the opinion that there are equities and pipelines that offer – in the current circumstances – better risk-reward propositions than fixed income options.

The latest supervisory stress test of US banks (assuming severe scenarios of recession, 13% unemployment rate, and a 21% drop in house values, among others), show that only four banks could not pass the severe scenarios and were unable to meet the capital requirements. However, while tier 1 capital has increased on average by 80.71% between 2009 and 2012, and the RWA (risk-weighted assets) has also increased by 92.59% during the same period, we do not think that the US banking sector is out of the woods yet, given the unknown amount of toxic assets still in the books. Banks’ ability to finance lending will be limited due to those toxic instruments still in the books. Strategic disintegration in the US banking sector is needed in terms of breaking up the big players, an action that will be cathartic and uplifting in terms of transparency, liquidity, and financial stability. The country needs to prepare for the consequences of unfunded liabilities and the consequences of the incoming students’ debt crisis.

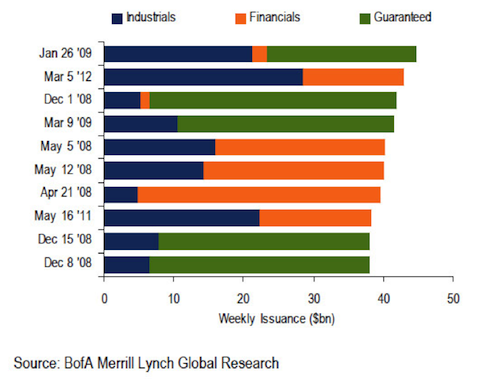

The dynamics of the US debt market shines a positive outlook, as the figure below shows. The graph portrays a picture of high supply volume sustained by high demand and tightening spreads. The offer on March 5th was the highest since 2009.

Thus, on one hand the graph above affirms the optimistic view about the foreseeable future, but on the other hand – that of the need for strategic disintegration that will involve a catharsis from debt and “assets” that are nothing but third-party liabilities – it makes the long-term picture darker. The micro balance sheets of corporations depend on the macro ones, and when the time comes in the medium to long-term the macro-fundamentals will shake up and possibly devastate even relatively speaking strong balance sheets.

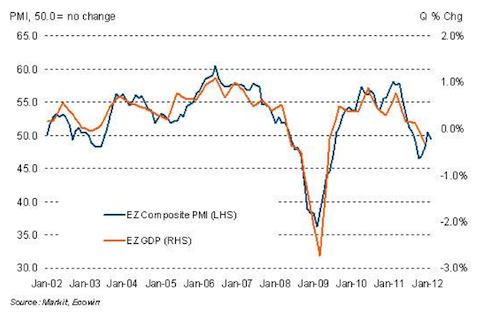

In the EU, the amount of debt that is being accumulated – especially in the banking sector – cannot be serviced. The ECB’s program of bank leverage buyouts is not viable since it is based on borrowed funds and cannot build up the needed firewalls. The EU banking sector is saturated with debt and the marginal productivity of every ECB loan produces less and less of a protection. These diminishing returns in terms of protection cannot produce organic growth and the EU stagnation will worsen given the absence of vital investments. The result of the above will be a capital flight away from the EU and a further decline due to deteriorating savings. If we add the unfunded liabilities in relatively speaking strong countries like Germany, then the picture becomes even bleaker. The latest PMI picture for the Euro zone, as shown below foretells the story of a declining Euro zone that awaits the margin call. When the latter comes it may sound like the four horsemen of the Apocalypse.

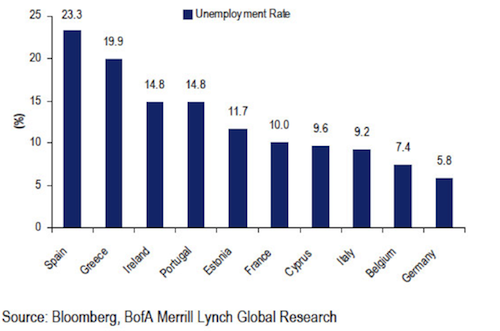

The Euro retains temporarily some strength due to three facts: First, the Fed’s swap lines; secondly, the covering of shorts; and thirdly due to the fact that foreigners are not required to fund EU trade deficits due to the EU’s current account balance. However, unless the Euro depreciates significantly in the next 12-18 months, then it may suffer from the same fate as those countries that held on to the gold standard during the Great Depression. The EU is not ready to cushion against sovereign defaults and the trajectory of its economies is not that optimistic, given the unemployment picture as depicted below.

ECB’s policies may allow banks to profit from carry trading (when they pay only 1% to the ECB for the loans while investing in higher-yielding securities), however its actions do not benefit the member-states (at least in the US the Fed turns over the profits to the Treasury) whose fiscal situation cannot improve given their macro and growth dynamics. Greece’s “resolution” will result in greater pains unless its hydrocarbons prospects are exploited without any kind of delays and problems. The troika’s insistence on regulating private sector wages there is at least questionable if not counter-productive. Contagion fears are heating up in the EU and it is only a matter of time until they are released.