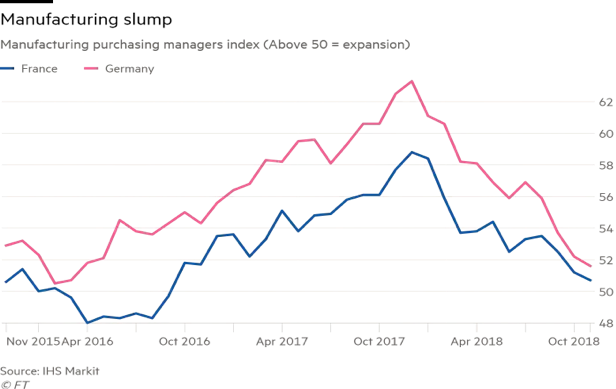

Economic indicators such as the Purchasing Managers Index (PMI), Consumer Confidence Index, and the price of oil could be thought as signals of future economic activity. Last year the Eurozone experienced a revival of growth that lifted up expectations and resembled an exuberance seen the day after Thanksgiving in the States (a.k.a. Black Friday). However, the most recent PMI coming from the EU is not that encouraging as shown below, possibly suggesting that the Black Friday mood may be turning into a Good Friday state of mind given the hurdles that the EU is facing from Brexit, to Italy, to the stability of Greek banks, the non-performing loans throughout the region, and the sluggishness of economic growth.

The weak PMI showing is to a large extent a reflection of the trade tensions that that have been building up over the last year. Such poor showing is also reflected in the reading of demand growth which also shows signs of weaknesses. The slowdown in consumer demand together with the manufacturing weakness contribute to the overall pressures on growth and consequently affect the oil dynamics.

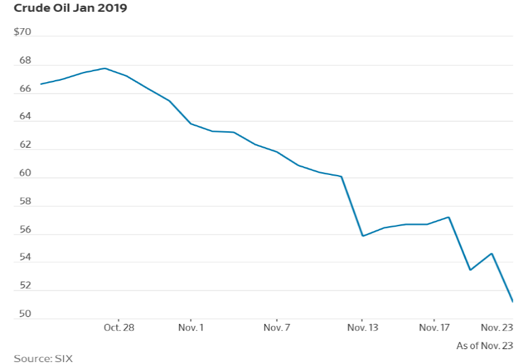

Oil (whether we are talking about WTI – the US benchmark – or Brent) has been in bear territory since it started dropping 6-7 weeks ago. Oil futures contracts for January delivery exemplify the downward trend as shown below.

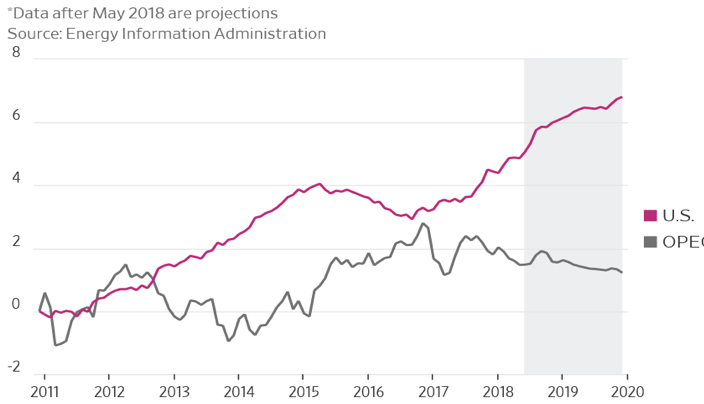

However, demand factors are not as important as supply factors in driving down oil prices. Oil production has been increasing fast and the oversupply of oil (especially in the US) has been the main factor driving oil prices lower (including Brent oil which is the international benchmark, see below).

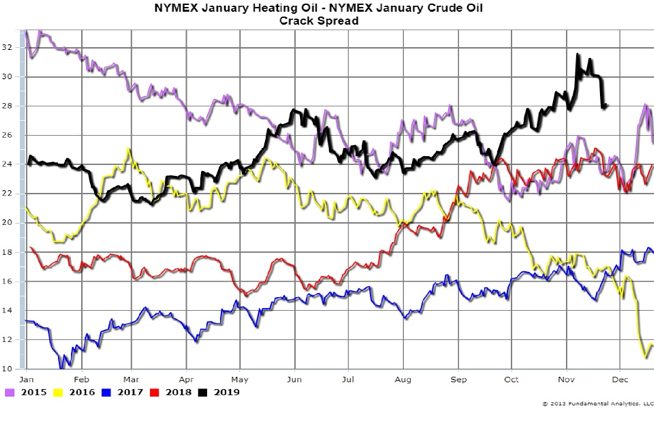

The oil price decline has created opportunities to trade spreads between heating oil and gasoline or between heating and crude oil. The former has not declined as much as the latter, and hence the difference/spread (a.k.a. Crack Spread) between the two has created a significantly profitable landscape for such trades, as shown below. (Feel free to contact our affiliate entity Fundamental Analytics www.fundamentalanalytics.com if interested to discuss similar issues).

In conclusion we would say that the forces that shape up the growth trajectory and formulate expectations (both of which are critical factors in the direction of equity and debt markets) seem to be in a volatile mood nowadays; however, for the foreseeable future we cannot see a crisis emerging. On the contrary, we see the volatile environment as an opportunity to strengthen positions and rebalance portfolios.