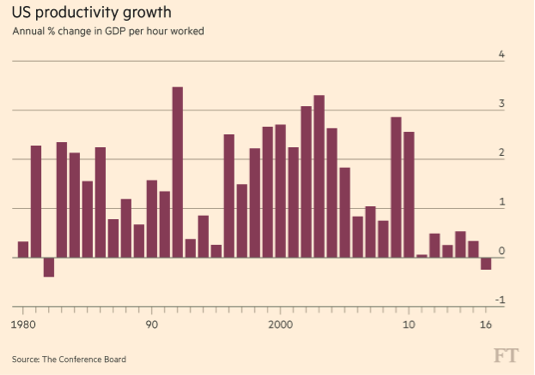

Productivity growth in the US will decline for the first time in over thirty years, raising the obvious question: How about all those magnificent innovations that constantly change our lives and transform our world from the internet of things to the latest smart phone in our pockets and the new gadget in our homes?

Without any doubt the innovations that took place between 1880 and 1970s brought a metamorphosis in the way that business and ordinary life was conducted. The corresponding increase in productivity created new pools of assets, which became sources of capital and which in turn enabled the economy to extract value out of those new capital sources. As value was extracted credit started flowing in the economy and the sharing of that credit advanced its velocity and raised incomes across the board.

However, the dilemma that we are now facing is whether the same can be told for the innovations of the last quarter century. Are we in a phase where productivity stagnation will be the economy’s permanent feature? One possible explanation is that innovations enable some of the economy’s crucial sectors to use less of the resources needed for production, which when combined with capital mobility and globalization advance income segmentation.

The graphs below portray the slowdown in productivity growth in the US, the EU, and China.

The slowdown in productivity since 2010 in all three regions is remarkable. These dramatic decreases of productivity growth are symptoms of a greater cause. When we think of this slowdown in the context of over-leveraged nations, corporations, and in some cases consumers then we can comprehend that an economic derailment (caused by defaults, credit freezes, a geoeconomic or geopolitical event, a financial shock or something totally unexpected) could have serious consequences.

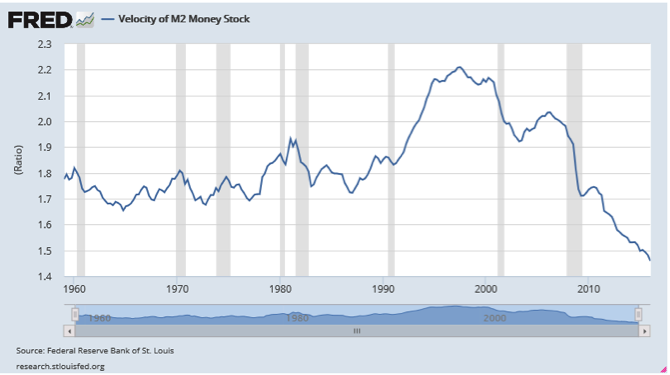

The significant slowdown in the productivity growth rate translates into an inability to create and share wealth through jobs and income growth. As wealth creation fizzles out, the velocity of money, credit, and assets goes into a stage of atrophy. The dramatic measures by the central banks may have succeeded in rescuing bankrupt financial institutions and avoiding another Great Depression for the time being; however, they can do nothing to revitalize the velocity of money, assets, and credit.

As the graph below shows, the velocity of money (the rate at which money changes hands) has experienced a dramatic decline. An equal decrease could be observed in the velocity of collateral.

We are of the opinion that these trends are indicative of an economic and financial system which is unable to breathe and is on life support, expecting a new crisis that will turn things upside down and hopefully generate new lines and ways of thinking how wealth is created. The prosperity of any nation, corporation, or family does not depend upon its ability to consume or create debt instruments but rather on its ability to create and spread wealth.

The mountains of debt and unfunded liabilities created by collateralizing inflated and sometimes-questionable paper/financial assets are crying out that we are running out of space and time. The lack of investment spending, the deflationary threats, the unconventional monetary policies and so many other symptoms or policy responses indicate that policy makers may opt out by using fiscal spending which in turn will be monetized via helicopter money.

Investors will do well to start looking into asset classes that possess four characteristics they act as a shelter in inflationary pressures by retaining their value, provide a cash stream of income, have intrinsic value, and they can hedge the risks of a major crisis.