It was June 20th ,1920 and the eight-year old boy by the name of Abraham Zimmerman experienced the lynching and hanging of three black men in Duluth, Minnesota. Postcards of the hanging were sold as souvenirs. Forty-five years later in 1965, Bob Dylan (Abraham’s son) having heard the story from his father, recorded the song “Desolation Row”, whose opening line is: “There are selling postcards of the hanging…”

On November 22nd, 1963 three very well-known people died: President Kennedy, Aldous Huxley, and C.S. Lewis. Three distinct personalities representing three different worldviews. In a wonderful book titled “Between Heaven and Hell,” Peter Kreeft has them meeting in purgatory and debating among themselves those worldviews. There have been days recently when I think that the market is in purgatory, and in the purgatory, strange things may be happening. Purgatory and death usually go together. I remember reading another wonderful book years ago, titled “A Grace Disguised” by Gerald Sittser and still vividly remembering the paragraph expressing his torrent of emotion when he described that in a flash of a few seconds he lost his wife, one of his children, and his mother. “Three generations gone in an instant,” as Sittser put it.

Our lives go through stages of darkness, loss, and pain. We need perspective for a lavish hope to be born and be sustained. In the last twenty years, the world has experienced the tragedies of terrorist attacks, the financial and debt crises that started in 2007, and now the Covid-19 crisis. Surely, we need perspective when we endeavor into the arena of managing assets and structuring portfolios.

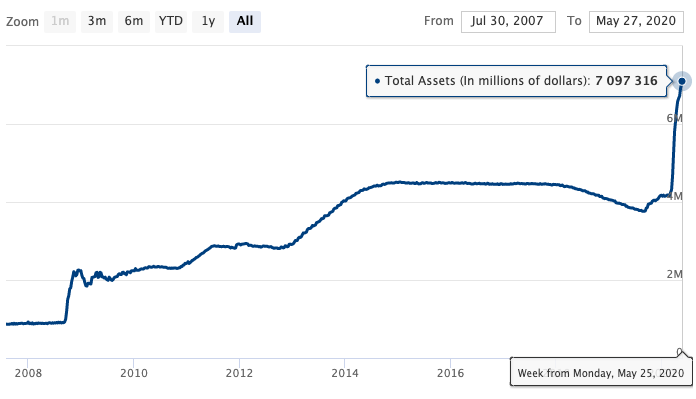

What we could state with certainty is that there has been an institutional structural change in the world economy with central banks around the world overplaying their hands, providing support via quantitative easing (QE) and a variety of monetary tools, and increasing their balance sheets into the stratosphere. To a large extent they seem to be “the only game in town.” The first graph below shows us what has been happening to the Fed’s balance sheet since 2007. It has increased almost 10 times, out of thin air, making us wonder if we live in a hall of mirrors whose mission is to advance moral hazard trading, because of the convoluted structure of the financial system which is separated from the real economy and which is based on fiat paper whose purpose is – through collateralization, securitization, and rehypothecation – to sustain the ever increasing amounts of debt.

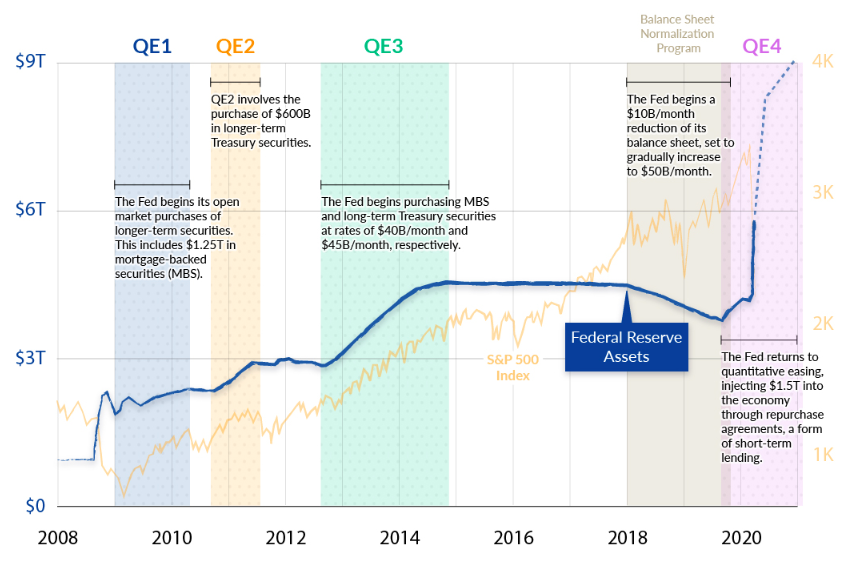

Moving now unto our second image below, we can see the different QE phases and their co-movement with the S&P 500. Yes, expectations of therapies and of a vaccine give hope for economic recovery, but if it weren’t for the Fed to provide ample liquidity, the hope of staying in the purgatory would have been an illusion.

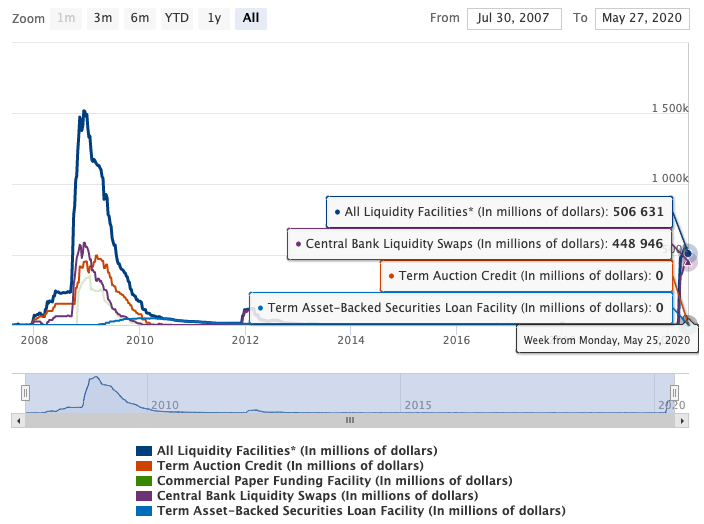

Many analysts are trying to gain perspective into the divergence between a grim economic reality with depression-like statistics and the upward trajectory of the equity markets. The single most important factor is the creation of the Fed’s programs/facilities (on top of the QE that is being used to purchase Treasuries and agency securities) which keeps the market in purgatory. However, when we dig deeper to see how those facilities are being deployed, we observe that – as shown below – only a small fraction has actually been deployed, implying that the Fed relies for now on moral suasion, hoping that its word of having the market’s back, will sustain the situation.

However, our biggest concern is not so much with the shrinking of the Fed’s balance sheet (representing now 45% of GDP), but rather with the survival of small and medium size companies (SMEs). Those SMEs may be eligible for the Main Street Lending Facility (MLF) – which has not been activated yet – however, their debt tolerance level may be an impediment, and there lies the risk of another downturn.

The over-indebtedness – despite repressed rates – reduces the marginal efficiency of investments (ROIC), implying lower valuations. We consider this a rather unique abnormality reflected also in the price of gold which, despite the market rally, has remained over $1700. Speaking of the gold market, we also observed in the past few weeks another abnormality. Specifically, the spread between gold and gold futures usually ranges between $2-8. However, in the last few weeks, there have been days when the spread exceeded $70, leading to a substantial drop in the volume of gold futures trading. Major players in that market (such as HSBC) have stopped trading in the futures market (where they usually sell puts to hedge their positions). The abnormality in the gold futures market may not be an aberration and, if that were to be the case, then we would expect higher gold prices that reflect rising fears in search of self-fulfillment.

In closing, it is our humble opinion that the market abnormalities supported by central bank actions and overpriced optimism for a swift recovery, will impose a restraint on spending, capex, hiring, and possibly on the faith in forward-looking market pricing. The nature of the current recession produced a very short-lived bear market that was shallow. We may not touch the market lows, but in our opinion a new bull market requires its starting lineup to be from lower valuations once the effects of the downturn are fully priced in.

Ophelia, she’s ‘neath the window for her I feel so afraid

On her twenty-second birthday she already is an old maid

To her, death is quite romantic she wears an iron vest

Her profession’s her religion, her sin is her lifelessness

And though her eyes are fixed upon Noah’s great rainbow

She spends her time peeking into Desolation Row.