The Fed’s hint that they may taper the purchases of financial assets ignited a fear in the markets last week. We have long been advocates of sound money while questioning the viability of a financial system that is based purely on fiat currency. Until the markets settle to a process of normalizing interest rates, volatility is anticipated to continue. Our estimate is that US markets will enjoy good and positive returns in the next few months, as we explain below. We have been on the record that the US has good chances to start taking off effective 2014. The turmoil is creating some buying opportunities in sectors such as construction. We anticipate transportation and cyclical sectors to present also attractive entry points. Given the above, we consider the financial turmoil to last only for a few weeks and things to continue on an upward trajectory for the foreseeable future. We also consider the Chinese credit crunch of the last several days to be temporary and not to be the beginning of a major turmoil (yet) in Asia and the world. However, we are concerned about emerging markets and the outflow of funds from developing economies that is anticipated to take place in the next several months.

The normalization process of interest rates can be seen in the following graph which shows us the yield on 10-year Treasury notes. As the graph below shows we have observed a 40% increase in that yield since early May of this year. The corresponding decline in the bond prices reflects losses in the bond portfolios. While temporarily we may see a reversal of this trend in the next few weeks, we would not be surprised if the upward trend continues until it reaches 2.85%. As interest rates rise, the markets irrationally assumed that the profit margins will be squeezed, and thus the stock market declines that we experienced in the last few days. We are of the opinion that the reversal of this wrong assumption will take place within the next few months and equity markets will continue their upward trend, at least for the US.

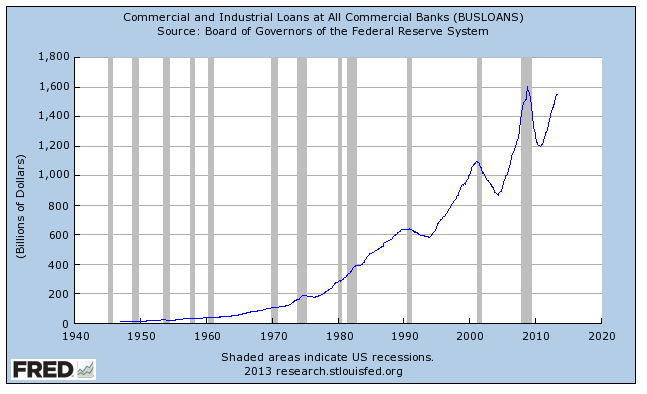

While the cost of capital may rise, our expectation is that its increase will be less than the revenue increases, given the higher future spending based partially on higher levels of borrowing. The figure below shows the significant increase in commercial and industrial loans this year. That increase in combination with the mortgage refinancing, the rise in mortgage financing and the rush to lock in low rates will contribute to a higher money multiplier, which as we have indicated before is one of the keys for higher growth.

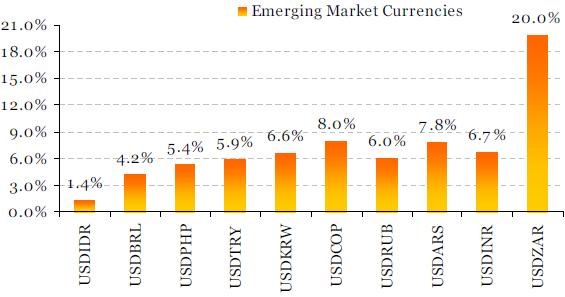

The liquidity in the US will be enhanced by one more source, namely the inflow of financial capital from emerging markets. The combination of quantitative easing (QE) and low yields in developed markets (such as the US), gave boost to the hunt for higher yields, which led many investors to invest in emerging markets. However, there are three forces at work currently that stimulate an outflow from emerging markets back to developed markets, and especially the US. Those forces are: the process of normalizing yields and growth expectations; the geopolitical turmoil from Brazil to India and from Turkey to S. Africa (to name just a few countries where political turmoil exists); and the current account deficits that several of those countries suffer from (indicating an over-extension of spending over savings). Indicative of those trends is the fact that those emerging markets’ currencies have been losing ground against the US dollar since the beginning of the year, as the graph below shows.

Someone then may ask: “If US still has a positive outlook while the emerging markets’ outlook is not that rosy, what is going on in China?” The best description that I could give of the Chinese market nowadays is that it resembles a holographic shadow universe in which activity exists in a two-dimensional form. The amazing thing about this two-dimensional holographic universe is that – like in holographic pictures – when you move your head the images change too. Hence, as the Fed changes its tune, interbank interest rates in China skyrocket and the Chinese currency strengthens. Here are two graphs that clearly show us the Chinese credit crunch of the last several days.

The Chinese economy is over-extended and they cannot escape the fact that credit over-extension leads to bubbles that always burst, when borrowers cannot make the payments. As the graph above shows, the Chinese credit-to-GDP ratio ballooned to 180% from 120% just four years ago. This credit over-extension has increased money market and financial trading in the shadow trusts of the Chinese economy and in off-balance sheet transactions (including instruments of questionable liquidity and value, known as WMPs). Those shadow trusts assumed that liquidity will always be there to support their activities. When the Chinese central bank (PBoC) decided to control credit, interbank rates skyrocketed to 28% last Thursday while yields on one-month corporate bonds rose to over 10%, bringing havoc into the repo market given the timing mismatch between assets and liabilities. This in combination with lower local expected growth as well as lower expected capital inflows shook the markets, at a time when demand for cash is seasonally high.

Is that cause of concern that a meltdown is imminent in that Great Wall of steroids? We do not think so. The PBoC has plenty of tools at its disposal (from lowering the reserve requirements, to offloading reserves via open market operations, etc.) to make the credit crunch look like a bad dream (it’s also a power play in the new transitional political reality and leadership). Actually, Chinese markets may present a buying opportunity (to be held only for a short period of time) in the next few weeks.

How then should we conclude this commentary? Allow me to use another analogy from the cosmological world. Our universe could be described as a de Sitter universe with a cosmological constant, which pushes the galaxies away at faster velocities. In a similar manner for the next 24-30 months the effects of all those QEs will be felt in the form of expansion and “growth”. The problem is that we live in an anti-de Sitter universe which has a negative cosmological constant and which could implode when the effects of monetary illusion pass away.