We live in an era of financial repression where savings are penalized due to low interest rates. The latter is the outcome of the financial crisis. This in turn was caused by collateralizing questionable assets, derivatives’ volume explosion, securitizing heterogeneous IOUs, and over-extension of credit. There are two arguments in this commentary: First, is the argument that since interest rates represent the price of the commodity called money, any effort to push down that price is the equivalent of currency debasement. Second, is the argument that as history teaches us those societies that have reverted to currency debasement, eventually ended up paying a very high price.

It may be prudent to examine both of those arguments under the historical lenses of the Roman Empire. The Romans minted coins of gold and silver. In the beginning the process was pure in the sense that coins had gold or silver purity as high as 95%. However, in the process of trying to satisfy vested interests, they were tempted to blend gold or silver coins with additional cheaper metals, such as copper. Hence, the state found it politically expedient to expand the money supply by cheapening the denarius and mixing the silver with other cheaper metals. This was essentially as they thought, “money for nothing”.

Nero started the debasement process in 68 A.D., and during Trajan’s rule the denarius lost about 5% of its purity (A.D. 107), which allowed the emperor to spend more money. Needless to say that such action represents hidden taxation. As demands on the state increased, succeeding emperors found that debasement can also get them what they wanted, i.e. pleasing the constituent bases (who were seeking to extract rents at the expense of everyone else), advancing the emperors’ dreams of overstretching the empire, and also have more money available! It was pure magic.

If an aspiring emperor wanted to ascend in power, all he had to do was to promise more money. A machine had been put in place where emperors were assassinated so that the ambitious one could start reigning and issuing cheaper currency. In just one year (A.D. 193), the Roman Empire experienced the rule of five emperors! At the end of that year Severus started his rule, and during his tenure the denarius dropped to 40% purity. Gibbon’s who wrote the classic work on the decline of the Roman Empire said about Severus “posterity justly considered him as the principal author of the decline of the Roman Empire”.

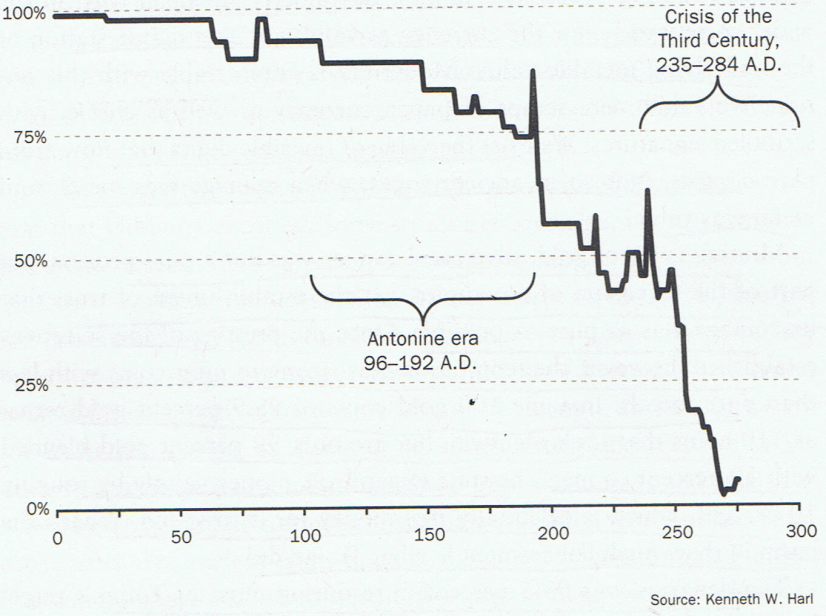

The graph below represents the cheapening of the Roman currency during that aspiring period where “money for nothing” policies cheapened standards, and succeeded in establishing a Diocletian order of things (Diocletian ruled from 285-306 A.D.) where state ownership of the means of production destroyed incentives, misallocated capital, over-taxed the public, drained resources, and eventually brought the end of the empire.

It is astonishing to see what such policies of giving in to vested interests via the cheapening of the currency route can do to an empire. The disintegration of the empire was facilitated by a weak currency which paved the road to lost cohesiveness and determination. It was not the barbaric invaders that defeated the Roman army, but rather internal forces that destroyed what the empire stood for.

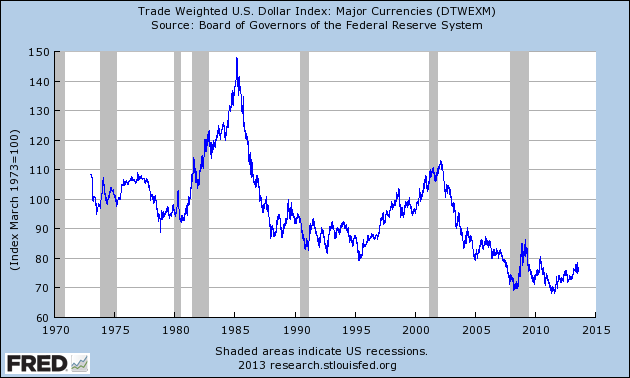

From that perspective the strength of the currency becomes the cornerstone of capital attraction that feeds investments, growth, employment, and a vibrant middle class. The graph below clearly identifies the periods where the strength of the USD coincided with a relative prosperous period (1980-1986, and 1995-2000) in the most recent past.

It is not a coincident that in both periods the USD was standing tall relative to other currencies. However, the policies followed since the beginning of this century – and especially since the financial crisis erupted – are policies that depress the strength of the currency and overstretch the American republic with policies that are essentially unfunded. Without embracing the fiat currency, I could only say that we need a chairperson in the Fed that can restore some dignity to the USD (its cheapening brought the world on the edge of disaster) and stop this madness of financial repression.