The essence of this commentary is twofold: First, to explain how and why the rising levels of financial lubrication are expected to generate and support a rally in equities and to a lesser extent in bonds. Second, to discuss how those elevated lubrication levels may become the source of a market downfall which in combination with endemic problems in the EU, China, and Japan could become the cornerstone of the next crisis in two-three years, which crisis may surpass in depth and length the one of 2008. Maybe at that time the words of Cardinal Consalvi (who later ended up being the ultimate ruler of Rome) spoken at the Vienna Peace Conference in 1814 will echo again in our ears: “The demon is not far from us, and the gates of hell are always open”.

But first let’s define financial lubrication as the total of M2 money supply in the US, UK, and EU (currency + checking accounts + shares of money market mutual funds) plus the pledged collateral (which is re-hypothecated a few times in those countries) that is used for credit and money creation.

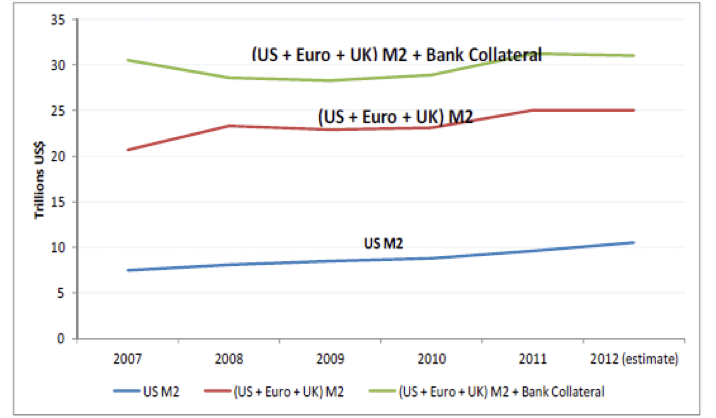

The graph below (as reported in an August 2013 IMF Paper by Manmohan Singh) shows that before Lehman Brothers’ collapse total financial lubrication was more than $30 trillion and about one third came from the use and re-hypothecation of collateral.

The financial crisis had a triple effect: First, it reduced the value of collateral; second it shrunk the re-hypothecation chain; and third, forced the central banks to proceed with unprecedented measures of quantitative easing (QE) in order to monetize the “good collateral” issued by respective governments.

The absorption of “good collateral” through QEs has affected the mix between money supply and collateral in the financial lubrication, and has reduced the velocity of collateral. As collateral velocity is being reduced, so does the velocity of money. Those reductions in velocities affect credit and money creation. Collateral shortage lowers the repo rate. The EU’s good collateral rate has dropped below zero, while in the US is still positive. This has implications for currencies too.

After Lehman the loss in collateral amounted to about $5 trillion (difference between the green and red lines below), a significant amount by any standard. It’s interesting to note that despite the QEs (the increase in US M2 in the blue line below) has not replaced the lost collateral, since the Fed buys that good collateral. It is primarily base money rather than collateral that has lifted total financial lubrication to about $30 trillion. Currently, base money makes up about 81% of total financial lubrication, while the proper mix would be 67-70% base money and 30-33% collateral. This imbalance contributes to lower velocity of both money and collateral (especially when excess reserves are sitting idle with the central banks).

Therefore, if pledged collateral could increase, not only the mix will change, but also credit in the real economy will be extended and velocities will start rising. Welcome to the shifting sands of collateral swaps accompanied by an expansion of the re-hypothecation chain (where the same collateral is pledged a few times for lines of credit and money supply, i.e. the very thing which along with the derivatives brought down the house five years ago).

As we reported on September 24th (link) the Fed started effective tapering by lending “good collateral” to primary dealers, hedge funds, and other market makers. The swap agreements increase the collateral base, re-balance the mix between money and collateral, allow credit to be issued and money to flow, and thus creating a liquidity and portfolio effect. The monetization of the borrowed “good collateral” via pledges and re-pledges of that same “good collateral” becomes the basis of generating fungible money that uplifts financial assets. Those effects are hoped to increase real hard collateral and money velocity while becoming sources of capital and wealth creation that possibly could fill some collateral holes (warnings about those holes have been issued by the Treasury’s Borrowing Advisory Committee a.k.a. TBAC).

At current rates of QEs the Fed may end up monetizing all Treasury duration in 4-5 years. If that happens there will be very little collateral left to support a system of liabilities created (especially through the shadow banking system) which are estimated between $55-85 trillion. Therefore, the effective tapering not only is it an effort to stimulate credit, increase money supply, change the mix between money and collateral and uplift velocities and asset values, but it also has a subliminal but very important goal: to re-ignite the “moneyness” of private assets held by the shadow banking system and convert them into “good collateral” that can be used for repos, swaps, credit and money creation, and through that process fill the holes and recapitalize the banks.

The financial crisis forced governments to issue record levels amounts of debt which the central banks monetized for asset encumbrance purposes. In the quotes found below (from the ultimate global banking authority) we have everything, from the dangers of re-hypothecations, to the risks of bail-ins (where depositors funds are used to recapitalize the banks), and from the need for stress tests and collateral haircuts to the subliminal need to awake private assets and thus generate collateral. Finally those quotes are not short in exposing derivatives as one of the main causes of the last crisis.

The Bank of International Settlements (BIS, a.k.a. the central bank of central banks) in its May, 2013 report regarding the re-hypothecation of collateral wrote:

“There is evidence of increasing bank reliance on collateralised market funding, particularly in Europe…Asset encumbrance is also rising on account of initial margin requirements of central and bilateral counterparties to cover derivatives exposures and other aspects of regulatory reform.

The demand for high-quality assets (HQA) that can be used as collateral will increase…Current estimates suggest that the combined impact of liquidity regulation and OTC derivatives reforms could generate additional collateral demand to the tune of $4 trillion.

Private sector adjustments can mitigate shortages of HQA. Such adjustments include broader eligibility criteria for collateral assets in private transactions, more efficient entity-level collateral management and increased collateral reuse and collateral transformation.

Yet while lessening any collateral shortage, such endogenous responses will come at the cost of greater interconnectedness in the financial system, for example in the form of more securities lending or collateral transformation services. They may also increase concentration, if these responses rely on the services of only a small number of intermediaries, and will add to financial system opacity, including via shadow banking activities, and increase operational, funding and rollover risks.

Greater encumbrance of bank balance sheets can adversely affect the residual claims of unsecured creditors during bank resolution, increase risks to deposit insurance schemes and reduce the effectiveness of policies aimed at bail-in. Given limited disclosures on encumbered assets, the ability of markets to accurately price unsecured debt can also be impaired…In cases where encumbrance could become a material concern, banks should be asked to perform regular stress tests that evaluate encumbrance levels under adverse market conditions…Concerns over procyclical demand for collateral assets lend support to efforts targeting strict standards for collateral valuation practices and through-the cycle haircuts.”

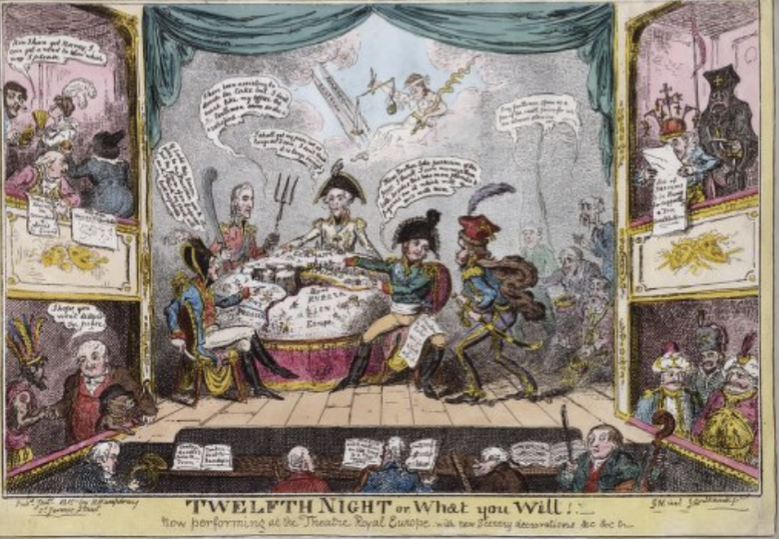

The picture of rising collateral demand and of the efforts made to slice it up and fill pertinent holes may seem as an effort of conquerors to occupy shifting sands, and remind me of that great cartoon related to the Vienna 1814 Peace Conference following Napoleon’s defeat.

“Now performing at the Theatre Royal Europe, with new Scenery decorations”

Here is what the digital library at Brown University reports regarding the cartoon above:

“Napoleon now in exile, the royals convene to recover their land lost during the Napoleonic wars. In this detailed satire, the crowned heads of Europe gather at the “Theatre Royal Europe” to watch the division of a large “Twelfth Night” cake on the stage. The cake is divided between the Russian Tsar, the King of Prussia, the Emperor of Austria and Castelreagh (holding a large fork and knife). At the right of the stage, various figures hold their crowns in their hands and meekly beg for a small piece of the continent. The figure of Justice appears above the stage; her scales are broken, her blindfold has been shifted, and her sword is crooked. Among the figures watching from the balconies, Louis XVIII looks forward to his coronation, and the representative of Italy looks forward to hanging those who supported a free constitution under Napoleon. At the left of the image, John Bull shakes hands with a Native American, cautioning, “I hope you won’t disturb the peace.” The orchestra in the pit in front of the stage has various sheets of music on the stands before them. Among these are “Yankee doodle’s come to town, Yankee Doodle dandy,” and “Avarice and Ambition, an Old Song to a New Tune.”

Here is what the characters are saying in the cartoon above:

Fredrick William: “If I add this Saxon piece to my Prussian One & put the figure of an Emperor on it, I think my share will look respectable.”

“Now I have got Norway, I can get a wind to blow which way I please.”

Castlereagh: “I have been assisting to devise the Cake but I don’t much like my Office the Gentlemen seem so dissatisfied.”

Emperor of Austria: “I shall get my piece cut as large as I can, I don’t think it is large enough.”

Tsar Alexander: “Here Brother, take possession of this piece I think I can manage them both besides this has more plumbs and figures on it which will mix with mine.”

Disenfranchised royals: “Pray Gentlemen, spare us a few of the small pieces for we are almost starving.”

In the modern theater of collateral usage and re-usage where primary players try to divide peacefully the remnants of collateral do not be concerned if eavesdropping accusations surface. It’s all part of the game.