As readers of our publications, presentations, and commentaries could confirm, for quite some time now we have been talking about the dangers of over-collateralization, especially of collateralizing paper-assets a.k.a. financial instruments of various forms.

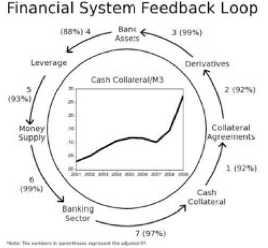

Moreover, as the schematic we published in our May newsletter demonstrated,

– also presented below – the collateralization/hypothecation of financial instruments enhanced banks’ balance sheets, contributed to the over-extension of credit, and ultimately led to the collapse of the financial markets.

Now, a working paper from the IMF comes to confirm the above hypothesis. Drs. Singh and Aitken of the IMF, published a paper titled The (sizable) Role of Rehypothecation in the Shadow Banking System. According to the paper, the lack of regulation and the absence of any cap, especially in the British financial system, allowed investment banks and hedge funds (among others) to hypothecate and rehypothecate clients’ assets multiple times which when used with their own proprietary assets, allowed them to extract trillions of dollars in credit. Thus, the over-extension of leverage, the explosion of credit, the easy loans, and the prosperity bought on credit has been incredible. No anchors, no restraints, over-used collateral, and with “guarantees,” which themselves were bubbles. They were bubbles since the financial instruments presented as “guarantees” were themselves by-products of bubbles and asset-priced inflationary trends. In essence, one bubble fed another in a cyclical, feedback phenomenon. The ground was fertile and was producing “prosperity” as long as the system was accommodating those schemes.

However, the global banking system is like a tower. The number of floors that can be built depend on several factors, among which the foundation is one of the most important. The foundation in this case is the asset-collateral used to extract credit. When the value of the assets used is high and the asset itself is sound, then the foundation is strong. On the other hand, if we manipulate and inflate the value of the asset, then temporarily we can – at least on paper – build more floors and extend the height of the tower. The problem is that as we keep building on a shaky foundation, the whole building is in jeopardy. This is what was happening from the late 1990s to 2007. We built a huge tower based on thin foundation and when the earthquake came, the top floors collapsed.

At the same time the ground engineers estimated the damages and demanded restraints. Currently some restraints are in place, thus the ground is not as fertile for credit cultivation and extension as it used to be. Hence, the collapse in securitization, loans, and money supply (see previous commentaries). The engineers are demanding not just restraint, but also good foundations a.k.a. hard real assets. Therefore, we reiterate our belief that in situations like these, the best place to be is not paper assets, but rather in hard assets such as metals, especially gold.

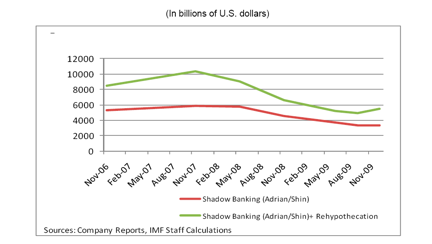

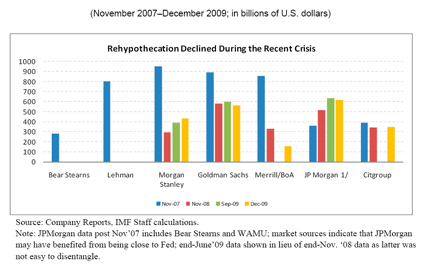

The figures below show clearly the extent of collateralization/rehypothecation prior to and after 2007. The restraints placed have limited the extent of this scheme, and thus the current infertility of the ground.

What is amazing in the above two graphs is the level of credit extension that those players achieved. As the figures show, over 10 trillion dollars in credit was extended via this over-collateralization process.

In closing this commentary, allow us to state that we believe that the engineers – despite the current measures – have not achieved structural stability of the tower. Even worse, the figures portray further buildup efforts. We are of the opinion, that without firm foundations we are extending the height of the tower. How long can such a building last without firm foundations? How long can the recycling of worthless paper – credited as assets in the foundation of the system – last? The view is wonderful from the penthouse. The problem is that the tower is unstable. We better preserve the tower and sacrifice some floors.

Ode to hard assets!