It has become common belief and even market strategy the dogma “don’t fight the Fed”. Once the Fed decided to follow an expansionary accommodative policy (at the onset of the 2008 financial crisis), the market has been on an upswing that defies fundamentals and, according to some analysts, the laws of market gravity. If that were the main fertilizer in market’s vineyard in the last dozen years, then we should also cite the exponential growth of China (which is itself the fruit of central authorities’ – fiscal and monetary – accommodative strategies) that has uplifted international trade, as well as the stratospheric explosion of technology that has been leading us into a new era, that is yet to be defined. As the last element in this mix of fertilizers, we cannot neglect the fact that we are also in a period of energy transition (like when we moved from solids – such as coal – to liquids i.e. petroleum, more than 130 years ago) which will alter in the interim the way we do business and move (e.g. electric vehicles). We are transitioning from the era of liquids to the era of gases, before things are revolutionized by the wide adoption of renewable energy sources.

However, we cannot neglect the fact that from a historical standpoint when market fertilizers coincide with an era of energy transition (especially since the early 1800s), the geopolitical environment becomes transformative itself. In the ancient world, the Delian League recognized Athens’s undisputed leadership in the Greek Alliance that the city-state of Athens had put together. However, such Alliance and leadership needed monetization, and such monetization did not take place until the League’s treasury moved from Delos to Athens in 454 BC. The influx of funds allowed Athens to support the military umbrella for its allies, advance the day’s science as well as the arts and architecture (the Parthenon was built between 447 and 438 BC), and consolidated Athens’s international authority. In the 20th century the Bretton Woods Agreement in July 1944 consolidated the American international authority, the epitome of which was the adoption of the dollar as the international reserve currency. The US cannot afford any kind of challenge to the latter, and that’s the only way to fortify its leadership which has produced decades of growth and prosperity around the world.

In the short-term we might be trading, but in the medium to long-term we ought to be investors who view things holistically and not monolithically. Investors probabilistically understand the central banks’ moves and decipher its messages, however they also comprehend the geopolitical challenges that autocratic states present to the democratic way of life, while also probabilistically measuring carefully the impact that technology and the undercurrent energy transition would have in a portfolio that seeks growth and income opportunities.

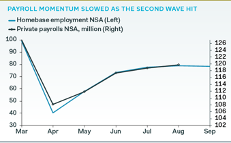

When we review the latest data in the midst of the pandemic, we see a pause in the recovery’s momentum, as shown by the figures below. The first one reveals that the employment growth in the US is stagnant; the second one is an indicative bleak picture of labor force participation rate in three major EU countries; while the third one shows us a contraction in Japanese Capex.

In our quest for understanding, we can only acknowledge our ignorance of the telos (and not only). The accumulated “knowledge and understanding” can only point to a state of elevated risks which we hope would not become a state of complete uncertainty. As Montaigne would point out in his Essays: “We have only by long study confirmed and verified the natural ignorance we were in before.” Montaigne taught us the distinctions among dogmatists, absolute skeptics, and epichists. The dogmatists believe that they have the absolute knowledge and are the conquerors of the truth. The absolute skeptics deny us the possibility of discovering the truth. The epichists teach us that it is equally unwarranted to proclaim that one has attained the full knowledge and understanding of things or that it is impossible to finally reach the truth and understanding of the unraveling world. In the cosmos of the market we choose to be epichists, a.k.a. Pyrrhonists, with a studious passion of avoiding fictional inventions, beneficial untruths, and harmful truths, of which the market will become abundant in the unfolding era.